Sheet piling is a special profile with locking linkage technology, and the locking linkage device can be freely combined to form a continuous and tight steel structure for retaining soil and water. They are mainly used in fields such as construction, water conservancy, and railway engineering, serving as cofferdams and permanent supports.

Product Classification Introduction

According to the production process classification, sheet pilings can be divided into two types: cold-formed thin-walled sheet pilings and hot-rolled sheet pilings; According to their functional classification, sheet pilings can be divided into foundation piles, support piles, anti-slip piles, etc.

Overview of Market Development

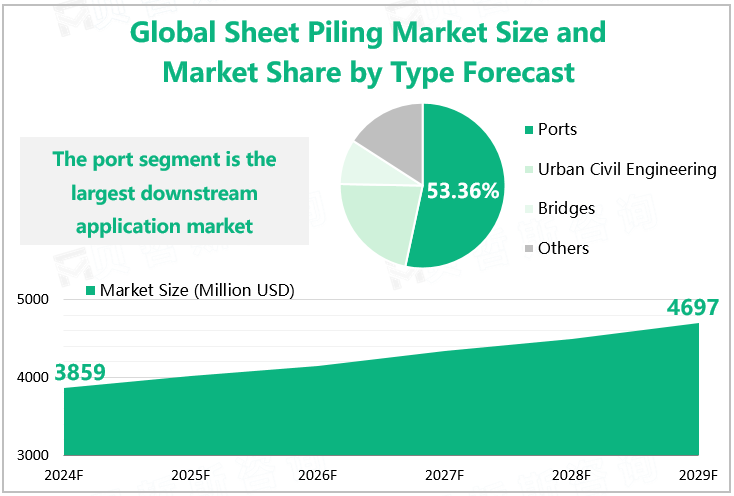

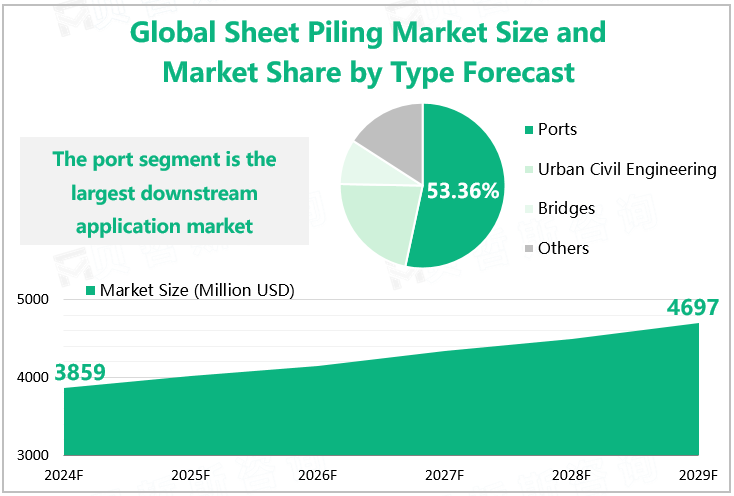

In recent years, the global sheet piling market has shown a steady growth trend. According to our research data, the estimated global sheet piling market size in 2024 is $3859 million, an increase of 4.25% compared to 2023. In the next few years, with the acceleration of urbanization worldwide, government investment in infrastructure construction and real estate developers' investment in real estate development will further increase, which will drive the market's demand for sheet pilings to continue to rise. It is expected that by 2029, the global sheet piling market size will continue to increase to $4697 million.

Analysis of Downstream Applications

From the perspective of downstream applications, sheet pilings are mainly used in ports, urban civil engineering, and bridge construction. Among them, the port segment is the largest downstream application market, with an estimated application share of 53.36% in 2024.

Global Sheet Piling Market Size and Market Share by Type Forecast

Source: www.globalmarketmonitor.com

Market Analysis of Major Regions/Countries

From a regional perspective, the global sheet piling market is concentrated in three major regions: North America, Europe, and Asia Pacific. Among them, the Asia Pacific region is the largest consumer market, accounting for nearly 40% of the global total consumption of sheet pilings. From a national perspective, Japan is the largest consumer country. Data shows that the estimated consumption of sheet pilings in Japan in 2024 is 1014.8k tons, accounting for an estimated 15.54% of the total consumption.

Global Sheet Piling Consumption and Proportion by Region/Country in 2024

|

Regions/Countries

|

Consumption (K Tons)

|

Proportion

|

|

US

|

1008.5

|

15.44%

|

|

Europe

|

1180.3

|

18.07%

|

|

China

|

661.6

|

10.13%

|

|

Japan

|

1014.8

|

15.54%

|

|

India

|

285.7

|

4.37%

|

|

Southeast Asia

|

472.0

|

7.23%

|

|

Others

|

1908.5

|

29.22%

|

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "2023 Global Sheet Piling Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".