Polyketone, with a complex and diverse structure, is a type of polymer obtained through polymerization of ketone monomers. These types of compounds are widely present in nature, especially polyketide compounds produced by actinomycetes, which have important biological activities such as antibiotics, immunosuppressants, anti-cancer, and antiviral effects. They have broad application prospects in fields such as medicine, agriculture, and animal husbandry.

Overview of Market Development and Analysis of Segmented Markets

In recent years, the global production capacity and output of polyketone have maintained stable growth. With the continuous maturity of production technology, more and more enterprises are entering the field of polyketone production, promoting the expansion of market scale.

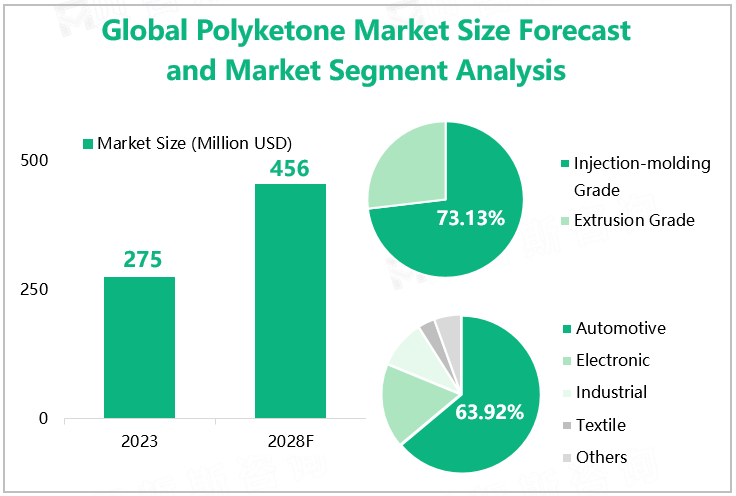

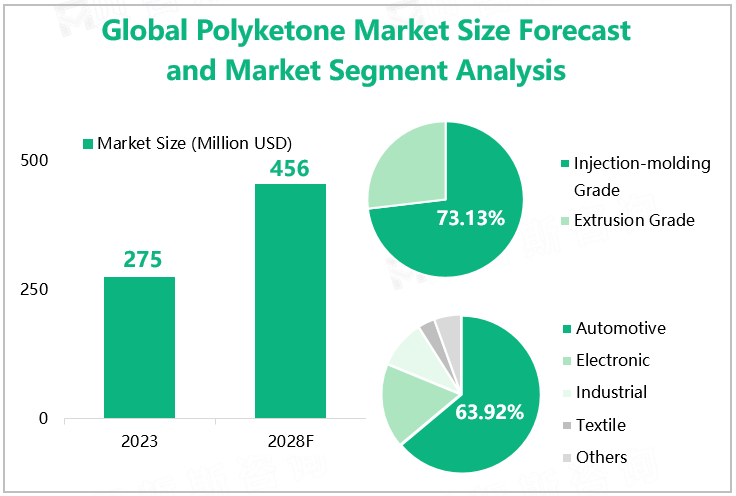

According to our research data, the global polyketone market size was $275 million in 2023 and is expected to increase to $456 million by 2028.

From the perspective of product types, according to different uses and quality standards, polyketones can usually be divided into two categories: injection molding grade and extrusion grade. Among them,

injection-molding-grade polyketones dominate the market. According to our data,

the global injection-molding-grade polyketone segment market size in 2023 was $201 million, with a market share of 73.13%.

From downstream applications, polyketones have a wide range of applications in aerospace, automotive, electronics, chemical, textile, and other fields due to their excellent heat resistance, chemical corrosion resistance, and good mechanical properties. Research has shown that among many application fields,

the automotive industry is the largest downstream application market, with an application share of 63.92% in 2023.

Global Polyketone Market Size Forecast and Market Segment Analysis

Source: www.globalmarketmonitor.com

Analysis of Market Development in Major Regions/Countries

From a regional perspective, the global polyketone market is mainly concentrated in North America, Europe, and Asia. Among them, Asia is the world's largest consumer market for polyketones, accounting for over 50% of the global market. From a national perspective, China is the world's largest consumer of polyketones. According to the data, the consumption of polyketones in the Chinese market reached 26.5k tons in 2023, accounting for 29.12% of the global total consumption. In addition, countries such as Japan, India, and South Korea are also important components of the Asian ketone market.

Global Polyketone Consumption and Proportion by Region/Country in 2023

|

Regions/Countries

|

Consumption (K Tons)

|

Proportion

|

|

North America

|

18.9

|

20.77%

|

|

Europe

|

20.9

|

22.97%

|

|

China

|

26.5

|

29.12%

|

|

Japan

|

3.6

|

3.96%

|

|

India

|

4.0

|

4.40%

|

|

South Korea

|

10.8

|

11.87%

|

|

South America

|

2.7

|

2.97%

|

Source: www.globalmarketmonitor.com

Market development trend analysis

Technological innovation:With the

continuous progress of production technology, the performance of polyketones

will be further improved, and their application fields will also be more

extensive. In the future, technological innovation will become a key factor

driving the development of the polyketone market.

Environmental policies:With the

increasing global environmental awareness, the impact of environmental policies

on the polyketone market will gradually become apparent. In the future, polyketone

products that meet environmental requirements will have greater market

competitiveness.

Industry chain integration:With the

intensification of market competition, industry chain integration will become

an important trend in the polyketone industry. Utilizing mergers and

acquisitions, optimizing resource allocation, etc., we aim to enhance the

overall competitiveness of the industry.

For more industry information, please refer to our latest released "2023 Global Polyketone Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".