Jewelry insurance, usually referred to as

"valuable item insurance" in property insurance, is an insurance

product specifically designed for valuable items such as jewelry, to protect

the value of jewelry and property safety. For jewelry enthusiasts and

collectors, jewelry is often an important investment and precious asset, so

protecting the safety and value of jewelry has become their top priority.

Product classification introduction

|

Classified by insurance liability

|

-

Property

insurance: mainly protects against

risks that may cause jewelry property damage, such as fire, theft, and

natural disasters.

-

Liability

insurance: mainly guarantees the

compensation liability of jewelry companies in the event of personal injury

or property damage to third parties, such as customer falls and injuries in

the business premises, product quality issues leading to customer claims,

etc.

-

Credit

insurance:mainly protects jewelry

companies from losses incurred due to customer default or bankruptcy.

-

Transportation

insurance: mainly protects jewelry

from various problems that may occur during transportation.

|

|

Classified by underwriting methods

|

-

Fixed value

insurance: At the time of purchase,

the insurer and the insured have already determined the insured value and

stated it on the insurance policy. The advantage of this method is that the

procedures are simple, but the disadvantage is that when an insurance

accident occurs if the actual value of the insured subject matter is higher

than the insured amount, the insured may not receive full compensation.

-

Uncertain value

insurance: When applying for

insurance, the insurer does not pre-determine the insurance value, only

stating the insurance amount as the maximum compensation limit. The advantage

of this approach is that the insured amount is not limited by the insured

value, and the insured can receive full compensation; The disadvantage is

that the procedures are relatively complex and the insurance value needs to

be determined after the occurrence of an insurance accident.

|

Source: www.globalmarketmonitor.com

Overview of Market Development and Analysis of Market Development in Major Regions

In recent years, with the prosperity of the jewelry market, the demand for jewelry insurance from consumers has also increased. In addition, due to the high value of jewelry and its susceptibility to risks such as theft and damage, jewelry insurance has become an important tool for jewelry holders to ensure the safety of their assets. This has driven steady growth in the global jewelry insurance market.

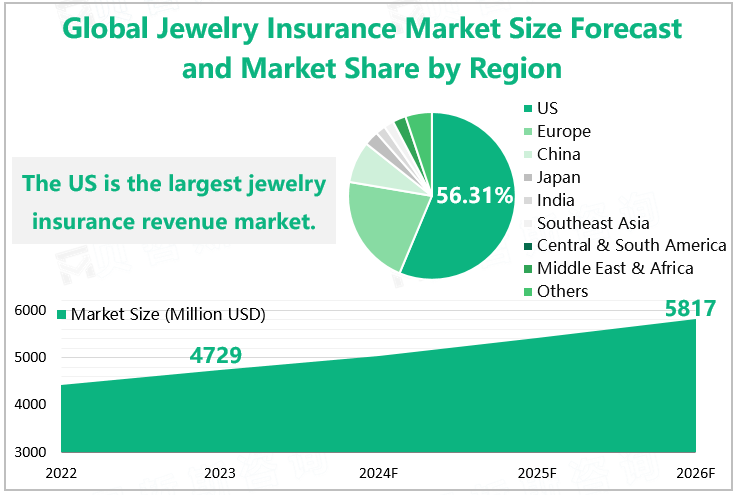

According to our research data, the global jewelry market size in 2023 was $4729 million. In the coming years, with the development of technology, the jewelry insurance market is expected to improve the transparency and efficiency of the insurance business through the application of new technological means such as blockchain and the Internet of Things, thereby promoting continuous market expansion. It is expected that the global jewelry insurance market will increase to $5817 million by 2026.

From a regional perspective, the global jewelry insurance market is mainly concentrated in developed regions such as North America and Europe. From a national perspective, the US is the largest revenue market for the global jewelry insurance market. According to our data, the size of the US jewelry insurance market in 2023 was $2663 million, with a market share of 56.31%. In addition, Asian countries such as China, Japan, and India are also important components of the global jewelry insurance market.

Global Jewelry Insurance Market Size Forecast and Market Share by Region

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "2023 Global Jewelry Insurance Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".