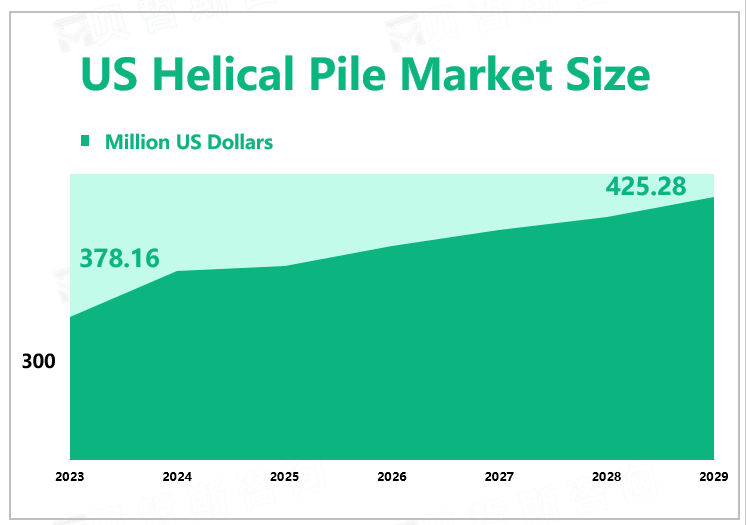

US Helical Pile Market Overview

According to Global Market Monitor, the US helical pile market size was $378.16 million in 2023 and is expected to grow to $425.28 million by 2029.

Market Drivers

The United States helical pile market is mainly driven by the rapid growth of the construction industry. Due to its better drainage capacity, load carrying capacity, minimal site disturbance, instant load capacity, and quick installation, the screw pile is the most popular in urban construction. In addition, the continued growth of commercial construction in the US such as commercial kitchens, healthcare, business parks, institutions, and entertainment has led to the use of helical piles in infrastructure, which is also responsible for the growth of the helical piles market.

In recent years, composite technology has been developed and patented for use in small screw piles. Composites offer significant advantages over steel in small screw pile manufacture and installed performance. Helical pile design is based on standard structural and geotechnical principles. Screw pile designers typically use their design software which has been developed through field testing of differing compression pile and tension anchor configurations in various soil profiles. Corrosion is addressed based on extended field trials, combined with worldwide databases on steel in ground corrosion. These will drive the growth of the United States helical pile market.

The Development of Infrastructure Drives the Growth of Helical Pile.

Globally, the rating of the US infrastructure sector has been declining for the past two decades. According to the World Economic Forum's Global Competitiveness Report, the United States ranked 13th globally in infrastructure in 2019, up from 5th in 2002 and down eight places in 17 years. The report of the American Society of Civil Engineers pointed out that the total gap in infrastructure investment in the United States has reached trillions of dollars, and if it is not made up, the United States will lose 10 trillion dollars of GDP by 2039.

The government’s huge investment in infrastructure and utilities has also increased the demand for helicopter piles. Due to the aging of the US infrastructure and the unreasonable design of interstate highways, the US government launched the “Infrastructure Week” nationwide in 2017 to pave the way for the launch of the trillion-dollar infrastructure investment plan. During the "Infrastructure Week" event, US President Trump called for public and private sector funds to improve infrastructure such as roads, bridges, railways, inland waterways, and ports. The support of these government funds has driven the development of the petroleum pile market.

In March 2021, the White House website released Biden's "Infrastructure Plan", investing $2 trillion for eight years, including key support for new energy power generation, energy storage, new energy vehicles, power grids, and plans to build 500,000 electric vehicle charging piles before 2030. The rise in innovative construction such as solar farms, agricultural construction, and modular construction has also led to the popularity of helical piles due to their quick installation ability and building up structure. The United States has been developing new energy sources due to the demand for renewable energy.

|

By Type |

Solid Square Shaft |

|

Round Shaft Pipe |

|

|

Square & Round Shaft Combo Pile |

|

|

Grouted Square Shaft |

|

|

Round shaft pipe contributes the largest market share. |

|

|

By Application |

Oil and Gas |

|

Construction (Residential and Commercial) |

|

|

Road Construction |

|

|

Bridge Building |

|

|

Others |

|

|

The construction (residential and commercial) occupies the biggest share. |

For more industry information, please refer to our latest released "2023 Global Helical Gearmotors Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".

We provide more professional and intelligent market reports to complement your business decisions.