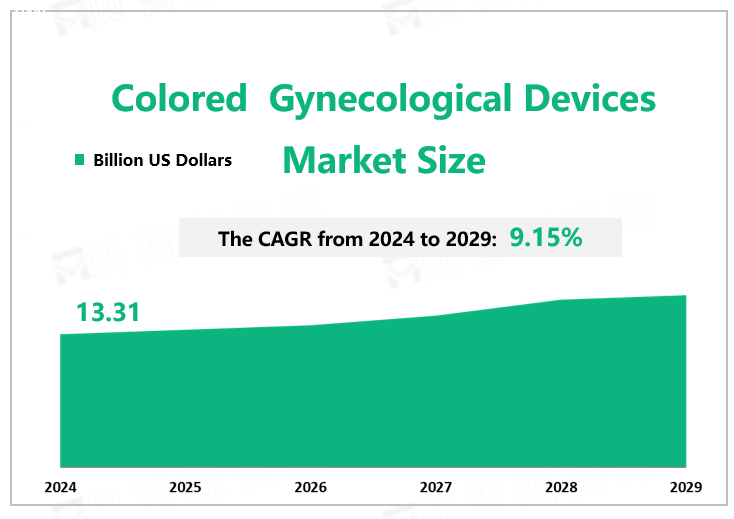

Global Gynecological Devices Market Overview

According to Global Market Monitor, the global gynecological devices market size will reach $13.31 billion in 2024 with a CAGR of 9.15% from 2024 to 2029.

Gynecology is a medical institution of a diagnosis and treatment subject, but also a branch of obstetrics and gynecology is the diagnosis and treatment of female gynecology as a professional department, divided into Western gynecology and traditional Chinese gynecology. The demand of the downstream industry for gynecological medical device applications and the improvement of gynecological medical device technology are driving the growth of the industry. In the future, the gynecological medical device market has broad prospects and investment potential.

The Rise in Patients with Gynecological Diseases has Increased the Market Demand.

Endometriosis, Polycystic Ovary Syndrome (PCOS), adenomyosis, and uterine fibroids are the most common conditions. According to an article published in the Frontiers Journal in 2021, PCOS population-based pool prevalence is around 5 to 9% globally. Hence, the growing prevalence of these conditions is leading to a rising number of regular check-ups and surgical procedures. For instance, as per the Office on Women's Health (OWH), in the U.S., around 500,000 women opt for hysterectomy, which is the second-most common surgery performed among females.According to the United Nations Population Facts, the need for modern contraceptives among women of reproductive age was around 90.1% and this is expected to remain constant till 2030. The rising prevalence of gynecological disorders coupled with rising surgical procedures is expected to foster the growth of the market.

Compared with the international market, China's gynecological medical device market still has huge room for growth. The medical device market size in developed countries has been comparable to the drug market size in the same period, while China's medical device market is only 1/5 of the drug market in the same period, and there will be broad room for growth in the future. Compared with developed countries, China's gynecological medical device industry started late, high-precision processing equipment, high-quality optical materials, and imaging equipment are mainly dependent on imports, and the industrial base is limited in its support capacity, affecting the development of domestic products.

However, with the high incidence of gynecological diseases and the rise of women's health awareness, people's demand for gynecological disease examination and treatment has increased, increasing the demand for gynecological medical devices in hospitals, and it has played a positive role in promoting the gynecological industry. The high prevalence of gynecological diseases such as ovarian, uterine, cervical, and vaginal cancers, as well as expanding awareness campaigns, government initiatives to support cutting-edge medical facilities and services, and advanced health insurance reimbursement schemes are the main factors driving the growth of gynecological diseases.

|

By Type |

Surgical Equipment |

|

Hand-held Instrument |

|

|

Surgical equipment occupies the largest market share. |

|

|

By Application |

Public hospital |

|

Private hospital |

|

|

Research institution |

|

|

Public hospitals occupy the largest market share. |

We provide more professional and intelligent market reports to complement your business decisions.