High-net-worth household insurance refers to professional insurance services provided to families with higher net asset value. This type of family usually has higher income and wealth accumulation, so more comprehensive insurance protection is needed to ensure the quality of life and wealth security of family members.

Overview of Market Development

Against the backdrop of continuous development and changes in the global economy, the high-net-worth household insurance market is gradually emerging and becoming a major highlight in the financial sector. The rise of this market not only reflects the high net-worth population's emphasis on wealth protection and risk management but also reflects the insurance industry's efforts in continuous innovation and meeting customer needs.

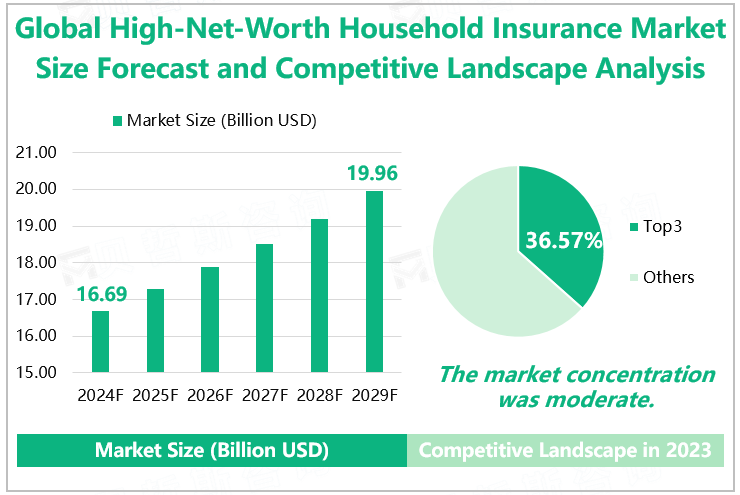

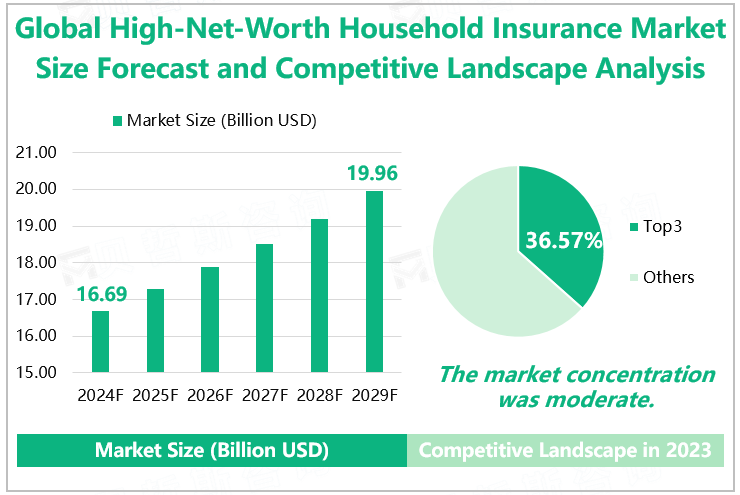

According to our research data, the global high-net-worth household insurance market is estimated to reach $16.69 billion in 2024, an increase of 3.96% compared to 2023. Looking ahead, with the continuous development of the global economy and the increasing number of high-net-worth individuals, the scale and potential of this market will continue to expand. It is expected that the market size will increase to $19.96 billion by 2029. Meanwhile, with the continuous progress of technology and innovation in the insurance industry, the high-net-worth household insurance market will also face more development opportunities and challenges.

Analysis of Market Competitive Landscape

From the perspective of market competition, the concentration of the global high-net-worth household insurance market is moderate. The data shows that in 2023, the total high-net-worth household insurance output value of the top 3 enterprises was $5.87 billion, with a total share of 36.57%. The top three companies were Chubb, Zurich, and Covéa. In 2023, these three companies accounted for 18.28%, 10.43%, and 7.86% of the global market share in high-net-worth household insurance output, respectively.

Global High-Net-Worth Household Insurance Market Size Forecast and Competitive Landscape Analysis

Source: www.globalmarketmonitor.com

Segmented Market Analysis

From the perspective of product types, high-net-worth household insurance can usually be divided into three categories based on the duration of insurance coverage: long-term insurance, medium-term insurance, and short-term insurance. Among them, short-term insurance dominates the market. According to data, the estimated size of the global short-term high-net-worth household insurance sub-market in 2024 is 11.368 billion US dollars, and the market share is expected to reach 68.10%.

From a regional perspective, the global high-net-worth household insurance market is mainly concentrated in countries and regions such as the US, Europe, China, and Japan. Among them, the US is the largest revenue-generating country. Data shows that the high-net-worth household insurance market in the US is expected to reach $6.75 billion in 2024, with an estimated market share of 40.45%.

Global High-Net-Worth Household Insurance Market Size and Market Share by

Region/Country Forecast in 2024

|

|

Market Size (Billion USD)

|

Market Share

|

|

Segmented by Type

|

|

Long-term

|

2.16

|

12.96%

|

|

Medium-term

|

3.16

|

18.94%

|

|

Short-term

|

11.37

|

68.10%

|

|

Segmented by Region/Country

|

|

US

|

6.75

|

40.45%

|

|

Europe

|

4.39

|

26.32%

|

|

China

|

1.58

|

9.48%

|

|

Japan

|

0.99

|

5.92%

|

|

India

|

0.34

|

1.99%

|

|

Southeast Asia

|

0.33

|

1.95%

|

|

Latin America

|

0.34

|

2.05%

|

|

Others

|

1.98

|

11.84%

|

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "Global and Europe High Net Worth Household Insurance Market Professional Survey Report 2019".