Global Refrigerant Market Overview

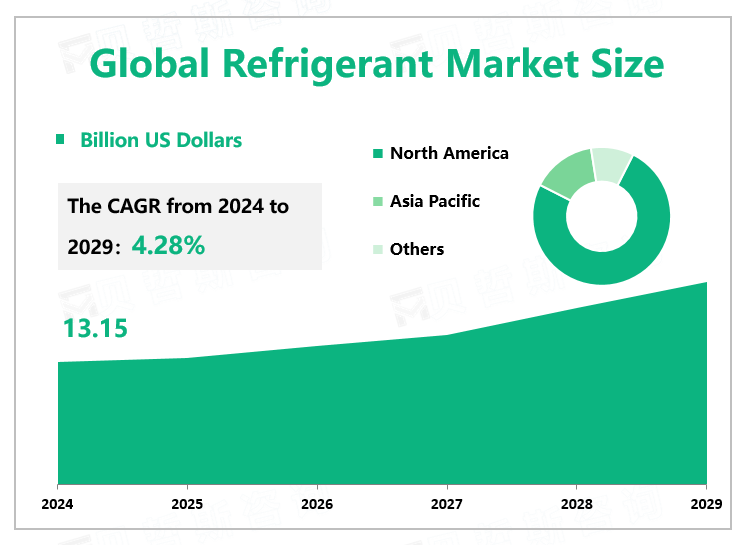

According to Global Market Monitor, the global refrigerant market size will reach $13.15 billion in 2024 with a CAGR of 4.28% from 2024 to 2029.

A refrigerant is a substance or mixture, usually a fluid, used in a heat pump and refrigeration cycle. In most cycles, it undergoes phase transitions from a liquid to a gas and back again. Fluorocarbons, especially chlorofluorocarbons, became commonplace in the 20th century, but they are being phased out because of their ozone depletion effects. Other common refrigerants used in various applications are ammonia, sulfur dioxide, and non-halogenated hydrocarbons such as propane.

Market Limitations

Due to the continuous discharge of CFCs and other chemical wastes from all over the world, they enter the atmosphere, form chlorine, and bromide ions, float around, and combine with oxygen ions. The oxygen ions in the atmosphere gradually decrease, causing the ozone layer to be destroyed. It will increase the amount of ultraviolet radiation reaching the earth by 5% to 10%, causing direct damage to humans, animals, and plants. At the same time, CFCs, HCFCs, and HFC refrigerants are considered greenhouse gases.

The US Environmental Protection Agency (EPA) has introduced regulations to phase out certain HFC refrigerants in many applications. Some regulations based on the SNAP policy have been formally implemented, and more regulations will be fully implemented in the next few years. Therefore, the US HVAC industry is continuing to study safety equipment using new refrigerants.

Regional Market Status

According to the International Energy Agency, the global stock of building air conditioners is expected to grow from 1.6 billion units in 2022 to 5.6 billion units by 2050, equivalent to 10 new air conditioners sold every second for the next 30 years. Asia Pacific accounted for the highest market share and growing construction activity also supported the demand for refrigerants. It is expected to grow significantly due to the increasing acceptance of energy-saving and environmentally friendly products in developed economies such as North America and Europe. In emerging markets such as Asia Pacific, the Middle East, and Africa, demand for home refrigeration is being driven by concerns about food waste, improved food quality, and rising disposable income, prompting the wealthier middle class to spend more on modern appliances.

China started a project of the construction of 200 airports in 2022, which is expected to be completed by the end of 2035, and the country's growing investment in construction activities is driving the demand for air conditioning, which in turn is likely to drive the refrigerant market during the forecast period. At the same time, there has been an increase in the consumption of frozen and processed foods due to multiple factors such as convenience, increasing disposable income, and busy lifestyles, which are driving the demand for refrigerants in the market. Due to the increasing usage of ready-to-eat packaged foods, many consumers are considering refrigeration equipment as a household necessity, which paves the way for the equipment to enter the market, which further strengthens the growth of the refrigeration market.

|

By Type |

HCFC |

|

HFC |

|

|

HFO |

|

|

Others |

|

|

The HFC segment contributes the largest market share. |

|

|

By Application |

Air Condition |

|

Chillers |

|

|

Refrigerator |

|

|

Others |

|

|

The air Condition segment occupies the biggest share. |

We provide more professional and intelligent market reports to complement your business decisions.