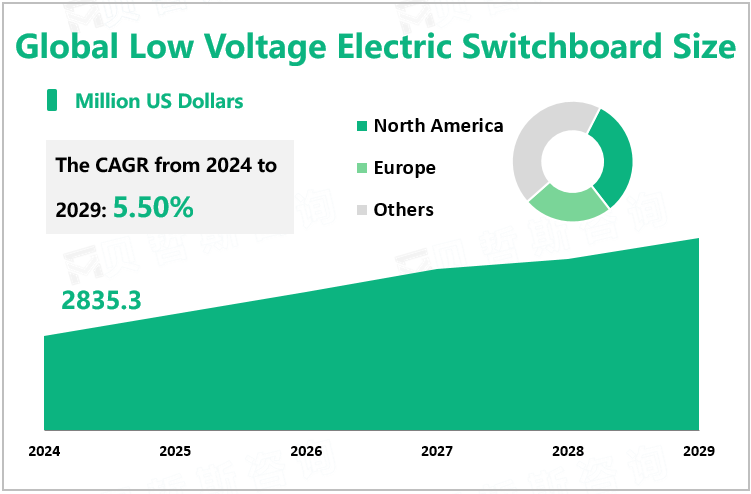

Global Low Voltage Electric Switchboard Market Overview

According to Global Market Monitor, the global low Voltage electric switchboard size will reach $2835.31 million in 2024 with a CAGR of 5.50% from 2024 to 2029. The low Voltage electric switchboard industry is primarily a highly competitive market and the market share of the top three companies in 2023 was 50.97%.

After a period of development, the industry is at a mature stage. With the continuous upgrading of products and the development of technology and economy, the market continues to expand.

Drivers

Commercial and industrial expansion drives expansion of power generation and distribution networks worldwide. It is shown that at least $21.4 trillion will be invested in electricity grids by 2050 to support the world’s net-zero emissions trajectory. The total investment comprises $4.1 trillion to sustain the existing grid and $17.3 trillion to expand the grid for new electricity consumption and production. Capital investment in global power grids jumped 5% in 2023 from the previous year to $310 billion. The US led the pack spending $87 billion, with significant portions for increasing grid resilience to threats such as storms, including by burying power lines.

Increased demand for smart homes and smart buildings. More and more people want to digitize their homes, equip them with voice control, or take additional security measures using IoT technology. The growth of the residential low voltage electric switchboard market is driven by advancements in smart home technology, growing demand for energy-saving solutions, and changing consumer preferences.

The Market in North America

Economic activity in North America is extremely diverse. The United States and Canada have developed modern economies. Mexico's modernization journey has been uneven, with chronic inflation and debt burdens hampering major development in power, transportation, and manufacturing. U.S. real GDP is expected to grow by 1.2% in 2024. Annual U.S. inflation slowed to 3.1% in November 2023 from 3.2% in October. Inflation is likely to fall below 2.5% in 2024. Forecasts for the U.S. economic outlook in 2024 are tied to several factors, including rising inflation, high interest rates, dissipated pandemic savings, rising consumer debt, and the return of mandatory student loan payments. Canada’s GDP is expected to grow by 0.9% in 2024. Canada's annual inflation rate is expected to fall to 2.5% in 2024. Consumer spending will experience below trend growth as Canadian households save more in the face of high mortgage debt. The need to build more homes will drive residential investment, while the opportunity to rapidly advance the clean energy transition will drive investment in structures, machinery, and equipment. Mexico's GDP is expected to grow by 3% in 2024. Mexico's central bank upgraded its economic growth forecast, citing strong demand for Mexico's exports, strong domestic consumption, and plans to increase government spending in 2024.

|

By Type |

Low-voltage |

|

Medium-voltage |

|

|

High-voltage |

|

|

By

Application |

Data

Centers |

|

Food

& Beverage |

|

|

Commercial |

|

|

Metals

& Mining |

Source: www.globalmarketmonitor.com

We provide more professional and intelligent market reports to complement your business decisions.