Global Sodium Cyanide Market Overview

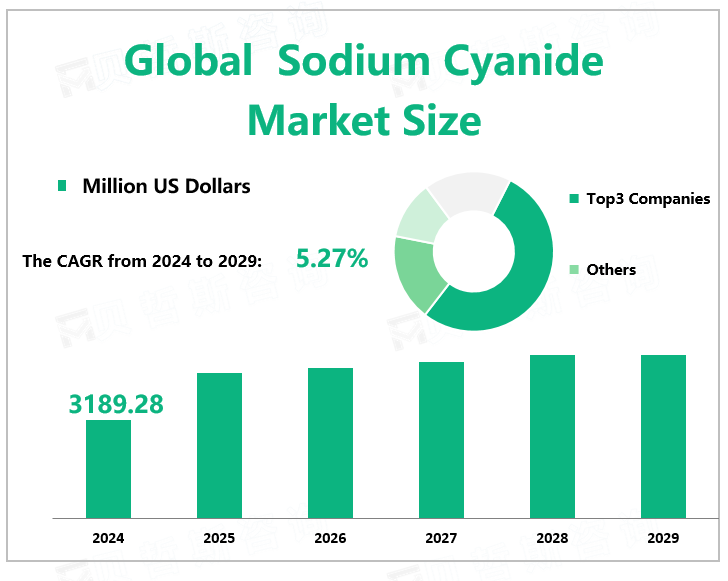

According to Global Market Monitor, the global sodium cyanide market size will reach $3189.28 million in 2024 with a CAGR of 5.27% from 2024 to 2029.Sodium cyanide is an inorganic compound with a high affinity for metals, leading to this salt's high toxicity. Its main application, in gold mining, also exploits its high reactivity toward metals. The sodium cyanide industry market will generally show an upward trend during the forecast period.

Application Fields

Sodium cyanide is widely used in medicine, dyes, minerals, pesticides, and other fields, and is an extremely important chemical raw material in the production process. Because sodium cyanide has the property of dissolving gold and silver, in the mining field, this substance is often used for the extraction of gold and silver and the selection of non-ferrous metal minerals. It is one of the most economically viable, easiest to process, and environmentally sustainable gold processing technologies. The increasing demand for sodium cyanide in the downstream market has promoted the sustainable development of the industry.

Market Competition

The market competition in the sodium cyanide industry is fierce, and the market share gap between large enterprises is small. Developing countries, with their advantages in resources and labor, have become important production bases, and new local entrants have increased. Sodium cyanide companies are constantly innovating their manufacturing processes to reduce costs and be more energy-efficient and environmentally friendly while optimizing packaging, transportation, and delivery options. In February 2024, Orica to expand mining chemicals business with cyanco acquisition, partly funded by equity raising.

Asia Pacific Leads the Sodium Cyanide Market.

The Asia-Pacific region dominates the global market. With strong demand from gold mining and the chemical industry, the demand for sodium cyanide is growing faster in the Asia Pacific region (mainly China). China is the largest gold producer, accounting for about 9% of the world's total gold production. The latest statistics released by the China Gold Association show that in 2023, China's raw gold production was 375.155 tons, with an increase of 0.84%, and the gold mineral is mainly caused by large gold enterprises (groups). According to statistics, in 2023, the output of mineral gold in mines of large gold enterprises (groups) in China will be 142.323 tons, accounting for 47.88% of the country's total scale. Among them, overseas mines of Zijin Mining, Shandong Gold, and Chifeng Gold enterprises achieved 60.378 tons of mineral gold production, an increase of 18.28%.

Although sodium cyanide has been widely used in the mining industry, its use has received increasing attention in recent years due to its adverse impact on the environment. Governments have introduced strict regulations to limit the use of sodium cyanide, and the International Code of Cyanide Management has specific restrictions on the use of sodium cyanide. Many parts of the world are under pressure to ban the use of sodium cyanide in gold recycling.

|

North America |

8.65% |

|

Europe |

15.32% |

|

Asia Pacific |

46.15% |

|

Latin America |

15.31% |

|

Middle East and Africa |

13.28% |

Table: Global Sodium Cyanide Market Share by Region in 2023

We provide more professional and intelligent market reports to complement your business decisions.