Phosphates are a special type of chemical substance and one of the ester derivatives of phosphoric acid. One or more hydroxyl groups in the phosphoric acid group of their molecular structure are replaced by organic groups, forming P-C bonds. According to the different numbers of substituted alkyl groups, phosphonates can be divided into three categories: phosphate monoesters (primary phosphate or alkyl phosphate), phosphate diesters (secondary phosphate), and phosphate triesters (tertiary phosphate). These compounds have wide applications in various fields, such as as phosphorus containing pesticides, nerve gas, synthetic lubricants, anionic surfactants, and flame retardant plasticizers.

Overview of Market Development

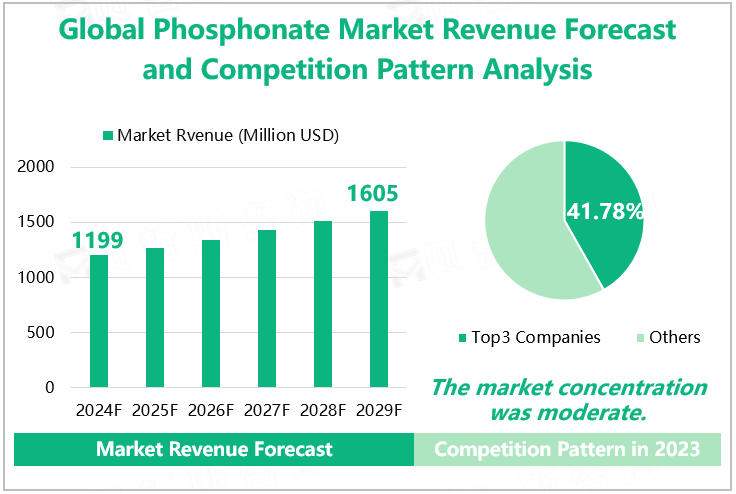

In recent years, the global market for phosphonates has shown a steady growth trend. According to our research data, the global market revenue for phosphonates is expected to reach $1199 million in 2024, an increase of 6.07% compared to 2023. In the next few years, with the continuous growth of downstream demand for phosphonates, the market is expected to continue to expand. It is expected that by 2029, the global market size of phosphonates will increase to $1605 million. The CAGR for 2024-2029 is estimated to be 6.01%.

Analysis of Market Competition Pattern

From the perspective of market competition, the concentration of the global phosphonate market is moderate. According to the data, the total revenue of the top 3 companies in the phosphonate market in 2023 was $470 million, with a total revenue share of 41.78%. The top three companies were Italmatch Chemicals, Qingshuiyuan Technology, and Shandong Taihe Water Treatment Technologies. In 2023, these three companies' revenue from the phosphonate market accounted for 14.63%, 13.63%, and 13.52% of the global market, respectively.

Global Phosphonate Market Revenue Forecast and Competition Pattern Analysis

Source: www.globalmarketmonitor.com

Segmented Market Analysis

From the perspective of downstream applications, phosphonates are mainly used in fields such as water treatment and cleaning agents. Among them, the water treatment field is the largest downstream application market. The data shows that the estimated consumption of phosphonates in the water treatment field in 2024 is 566.4k tons, accounting for 58.91% of the total consumption.

From a regional perspective, the global market for phosphonates is concentrated in three major regions: North America, Europe, and Asia Pacific. Among them, Europe is the largest consumer market. Data shows that the consumption of phosphonates in Europe is expected to reach 442.1k tons in 2024, accounting for an estimated 45.99% of the global total consumption.

Global Phosphonate Consumption and Proportion by Application and Region Forecast in 2024

|

|

Consumption (K Tons)

|

Proportion

|

|

Segmented by Application

|

|

Water Treatment

|

566.4

|

58.91%

|

|

Cleaning Agents

|

272.3

|

28.12%

|

|

Others

|

122.8

|

12.77%

|

|

Segmented by Region

|

|

North America

|

126.2

|

13.13%

|

|

Europe

|

442.1

|

45.99%

|

|

Asia Pacific

|

218.9

|

22.77%

|

|

South America

|

79.6

|

8.28%

|

|

Middle East & Africa

|

94.5

|

9.83%

|

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "2023 Global Phosphate Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".