Ferritic stainless steel is a type of stainless steel mainly composed of chromium, a small amount of carbon, and other elements. It has a body centered cubic crystal structure, mainly composed of ferrite structure, and usually does not contain nickel. It has good thermal conductivity, small coefficient of expansion, excellent oxidation resistance, and stress corrosion resistance, and is often used to manufacture components that are resistant to atmospheric, water vapor, water, and oxidative acid corrosion.

Overview of Market Development

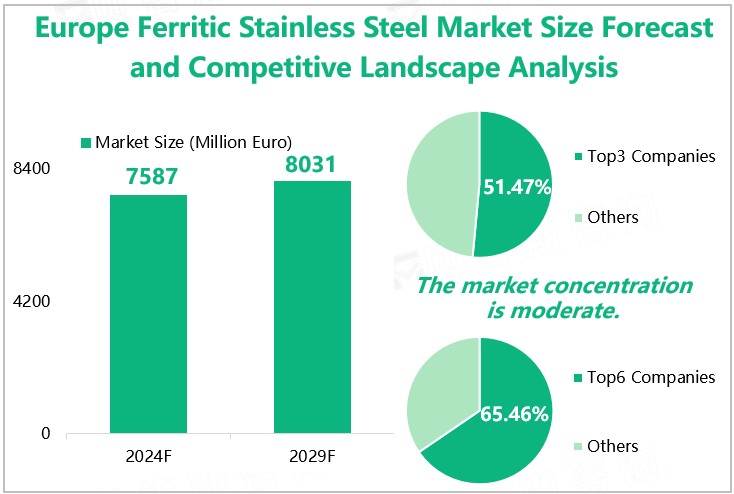

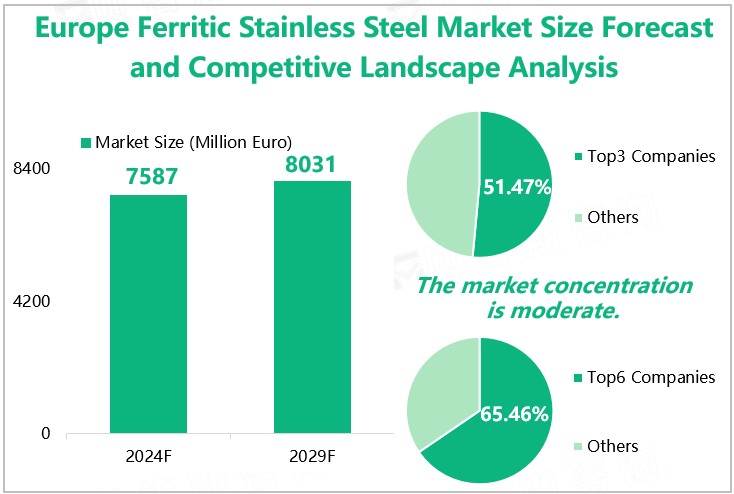

Europe is an important part of the global stainless steel market, and ferritic stainless steel, as one of its types, has a certain market share. According to our research data, the market size of ferritic stainless steel in Europe is expected to reach €7587 million in 2024, an increase of 6.32% compared to 2023.

From the perspective of market development prospects, it is expected that the European ferritic stainless steel market will be driven by the global stainless steel market growth trend and show certain growth potential. In addition, with the recovery of the European economy and the expansion of stainless steel applications, the market demand for ferritic stainless steel is expected to further increase. It is expected that by 2029, the size of the European ferrite market will continue to increase to €8031 million.

Analysis of Market Competition Pattern

From the perspective of market competition, the concentration of the European ferritic stainless steel market is moderate. Data shows that the total production of ferritic stainless steel by the top 3 companies in the industry in 2023 was 1.45 million tons, accounting for 51.47% of the total production in Europe; The total production for ferritic stainless steel of the top 6 enterprises was 1.85 million tons, accounting for 65.46% of the total production. The top three companies were Acerinox, Outokumpu, and APERAM. In 2023, these three companies accounted for 20.38%, 18.56%, and 12.53% of their ferritic stainless steel production in the European market, respectively.

Europe Ferritic Stainless Steel Market Size Forecast and Competitive Landscape Analysis

Source: www.globalmarketmonitor.com

Segmented Market Analysis

From the perspective of downstream application patterns, ferritic stainless steel is widely used in various fields such as construction, automotive, shipbuilding, and mechinery. Among them, the consumer goods and appliances sector is the largest downstream application market, with an estimated application share of 39.80% in 2024.

From the perspective of national development, Russia is the largest consumer market for ferritic stainless steel in Europe. Data shows that the consumption of ferritic stainless steel in Russia is expected to reach 520.7 tons in 2024, accounting for an estimated 17.53% of the total consumption in Europe; The German market is expected to rank second with a market share of 13.99%.

Europe Ferritic Stainless Steel Consumption and Proportion by Application and Country Forecast in 2024

|

|

Consumption (Tons)

|

Proportion

|

|

Segmented by Application

|

|

Construction

|

370.0

|

12.46%

|

|

Automotive

|

636.1

|

21.42%

|

|

Shipbuilding

|

204.8

|

6.90%

|

|

Machinery

|

445.3

|

14.99%

|

|

Consumer Goods and Appliances

|

1182.1

|

39.80%

|

|

Elevators and Escalators

|

93.2

|

3.14%

|

|

Others

|

38.6

|

1.30%

|

|

Segmented by Country

|

|

Germany

|

415.6

|

13.99%

|

|

France

|

142.8

|

4.81%

|

|

UK

|

105.5

|

3.55%

|

|

Italy

|

242.9

|

8.18%

|

|

Russia

|

520.7

|

17.53%

|

|

Spain

|

150.2

|

5.06%

|

|

Benelux

|

106.2

|

3.58%

|

|

Poland

|

170.6

|

5.74%

|

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "2023 Global Ferritic Stainless Steel Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".