Global Fuel Card Market Overview

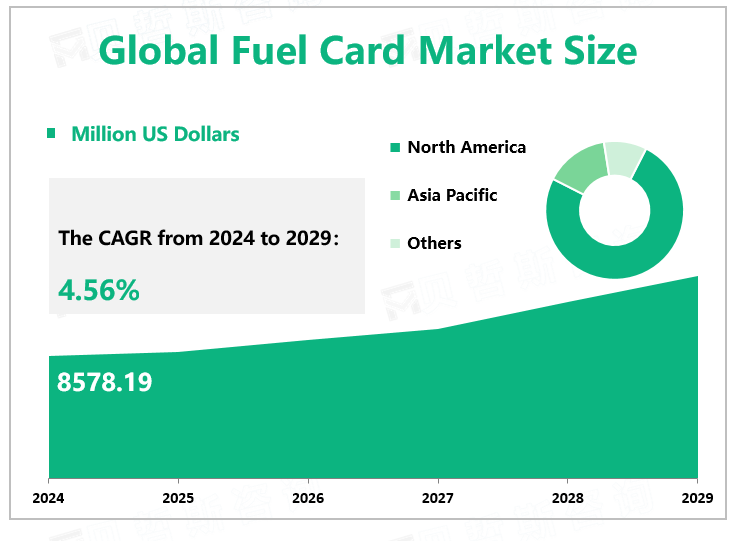

According to Global Market Monitor, the global fuel card market size will reach $8578.19 million in 2024 with a CAGR of 4.56% from 2024 to 2029.

Fuel card is used as a payment card most commonly for gasoline, diesel, and other fuels at gas stations. Fuel cards or gas cards, can help consumers’ businesses realize significant fuel savings and used to pay for vehicle maintenance and expenses.

Market Drivers

A significant advantage of fuel cards is the network of filling stations owned by many fuel card suppliers. Large fleet operators typically operate many vehicles and often carry out logistics activities overseas. Many fuel card providers have partnerships with large gas stations that provide fleet operators with extensive and convenient refueling networks, even across continents. Some suppliers even offer discounts, loyalty rewards, or negotiated fuel prices to customers, which can help save fleets money. These advantages have attracted many downstream users, which will also stimulate the demand of downstream users.

Due to carbon-neutral agreements and emission reduction policies, many countries have proposed to reduce the production, sales, and use of traditional fuel vehicles, the EU agreement will stop the sale of new CO2 emission vehicles in 2035, and new energy such as electric vehicles will become the mainstream of the future automotive industry. As the electric vehicle market continues to expand, some fuel card providers are including electric vehicles in their service. The rapidly growing electric vehicle market provides new opportunities for the fuel card industry. Accelerating cooperation with charging station suppliers and forming a convenient charging network will help enterprises seize the market in advance.

Market Segmentation

Based on type, the fuel card market is segmented into branded fuel cards, general fuel cards, and commercial fuel cards, with the general fuel card segment accounting for the largest market share in 2023.

According to the application, the fuel card market is divided into vehicle service, fuel filling, toll, etc., and the fuel filling segment occupies the largest market share. Refueling cards enable business owners and users to control and manage refueling and maintenance services.

Due to its well-developed transport infrastructure, Europe occupies a large market share. In addition, the increasing adoption of refueling cards to effectively monitor and optimize fuel consumption is further contributing to the growth of the refueling card market in this region. North America is a major market for refueling cards, as consumers in the region are increasingly turning to digital transaction solutions such as mobile wallets, prepaid cards, and contactless payments. The United States holds a major share in the region and dominates the market, followed by Canada. The proliferation of smartphone applications for digital transactions is expected to further drive the growth of the market.

|

By Type |

Branded |

|

Universal |

|

|

Merchant |

|

|

By Application |

Fuel Refill |

|

Parking |

|

|

Vehicle Service |

|

|

Toll Charge |

|

|

Others |

We provide more professional and intelligent market reports to complement your business decisions.