Global Satellite Manufacturing and Launch Systems Market Overview

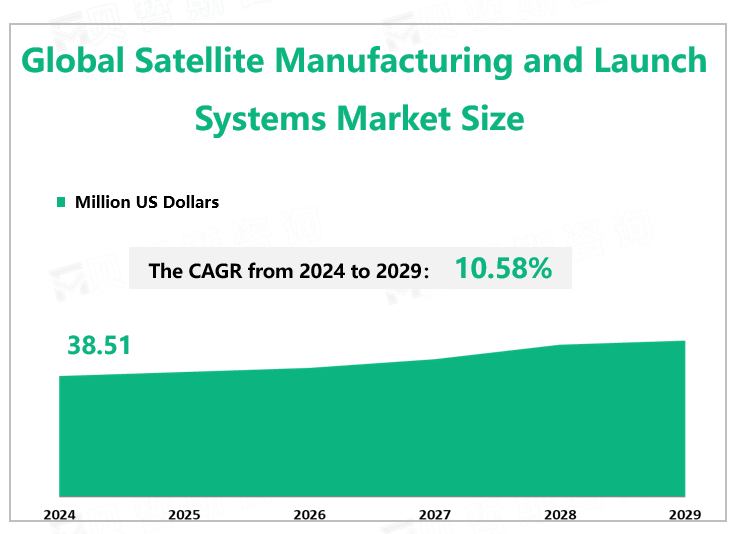

According to Global Market Monitor, the global satellite manufacturing and launch systems market will be $38.51 billion in 2024 with a CAGR of 10.58% from 2024 to 2029.

Market Trends

The satellite manufacturing and launch market is playing an important role, and the demand for miniaturized satellites is increasing. Miniaturization is the most cost-effective solution for cost reduction while ensuring a predefined level of delivery performance. The platform quality and cost of the satellite are proportional to the mass, power requirements, and volume of the payload. Therefore, any reduction will significantly affect the cost. Moreover, in addition to cost, microsatellites can function as indirectly contributing microbial satellites. Therefore, micro and development are expected to fundamentally change the dynamic global satellite manufacturing and launch market for the market.

With the development of satellite constellation and formation flying fleet technology, cluster satellite constellation has become the research focus and development trend of the satellite industry. In particular, constellations based on micro-satellites will become the main means of satellite communications, earth observation, and Internet of Things services. Small satellite constellation has the advantages of low cost, short period, high mobility, strong networking, and new technology, which greatly improves the operation capability of global system networking. The constellation has brought great changes to the structure of the space satellite system and promoted the integration of satellite communication, remote sensing, mobile data, and Internet technology. Satellite communication effectively promotes the rapid development of new-generation space technology. Especially after the emergence of a new satellite cluster communication architecture, the data transmission rate of satellite communication increases, transmission delay decreases, and coverage expands.

Types Segment

GEO satellites have many applications, including weather forecasting, satellite radio, and television. With the rapid development of the Internet, customers' demand for low-latency and high-speed broadband network services is increasing day by day. Compared to terrestrial communication networks, low-orbit satellite communications can achieve wide area coverage, making remote areas, aircraft, ships, and other terrestrial networks unable to cover, and these market drivers are currently stimulating the development of Low-Earth orbit satellites.

The growing demand for high-speed Internet connectivity, especially in rural and underserved areas, is driving the demand for broadband services for Low-Earth orbit satellites. As downstream applications expand, so does the need for Leo-based services. With low latency and high data rates, LEO satellites are the best choice for real-time data transfer applications such as video streaming, gaming, and remote working. There is a growing demand for remote sensing applications based on low Earth orbit satellites in many sectors, including forestry, agriculture, and energy. LEO satellites provide high-resolution images and real-time data on environmental and climatic conditions, enabling more effective decision-making.

|

By Type |

LEO |

|

GEO |

|

|

MEO |

|

|

Beyond GEO |

|

|

The GEO segment occupies the largest share. |

|

|

By Application |

Commercial Communications |

|

Earth Observation |

|

|

Navigation |

|

|

Military Surveillance |

|

|

Scientific |

|

|

Meteorology |

|

|

The military surveillance field dominates the market. |

We provide more professional and intelligent market reports to complement your business decisions.