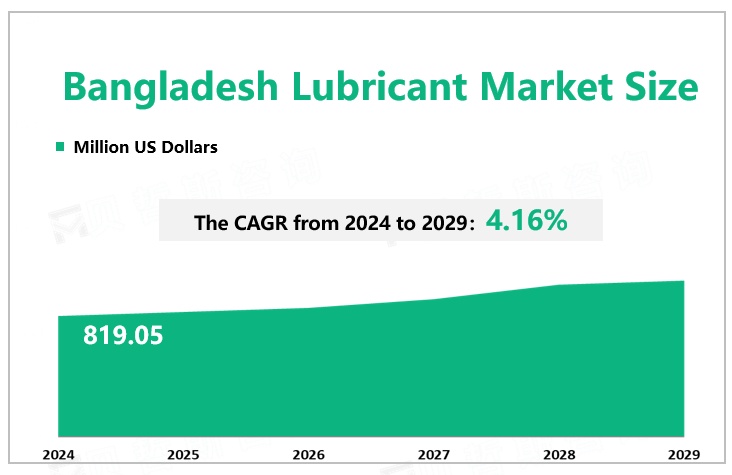

Bangladesh Lubricant Market Overview

According to Global Market Monitor, the Bangladeshlubricant market size will be $819.05 million in 2024 with a CAGR of 4.16% from 2024 to 2029.

Opportunities

Bangladesh is one of the most densely populated countries in the world and has great market development potential. Due to the relatively weak infrastructure technology in Bangladesh, domestic industrial equipment and equipment are very backward, lack large machinery, and low configuration. Since Bangladesh participated in the joint construction of the “Belt and Road”, several related projects have been implemented. Such as Bangladesh's power system upgrade and expansion projects. In addition, with the friendly relations between the two countries, more investments have been made in lubricants. For example, SINOPEC lubricants began to market in Bangladesh and set up distributors. A large number of cooperation projects between China and Bangladesh have continued. Landing and flowering, some projects have successfully applied SINOPEC lubricant products. To some extent, the situation of foreign investment has been resolved. In recent years, Bangladesh has steadily made great achievements in the economic field. Despite various factors driving the rapid economic development of Bangladesh, the “Belt and Road” initiative is an important reason for promoting rapid economic development. It will also continue to promote the development of the region.

In 2023, Lubrizol entered into a distribution agreement with IMCD Group aimed at expanding Lubrizol's additives business in Bangladesh's booming lubricants and fuel additives market. The partnership will enable Lubrizol to strengthen its presence in South Asia, where there is a growing demand for high-performance finished lubricants and lubricants, particularly in Bangladesh.

Development of the Shipbuilding Industry

Shipbuilding is a growing industry in Bangladesh with great potential. The local river network in Bangladesh is dense, the terrain is low, the inland navigation is developed, and the demand for ships is huge. At the same time, Bangladesh and India have resolved the demarcation disputes in the Bay of Bengal, and marine development will become a new hot spot. Due to the increase in export transactions secured by shipbuilding companies and the availability of cheap labor in the country, the continued growth of the shipbuilding industry will also be an important driving factor for the development of this market.

Limitations

For crude oil extraction, in addition to resource constraints. Technology development is also a very important limiting factor. Compared with domestic enterprises, foreign-funded enterprises occupy a larger market share. And more dependent on foreign companies. As for the lubricants market, foreign companies are also concentrated in Bangladesh, which has certain restrictions on the development of local companies.

|

By Type |

Engine Oil |

|

Automotive Oil |

|

|

Transmission and Hydraulic Fluid |

|

|

Metalworking Fluid |

|

|

General Industrial Oil |

|

|

Power Generation oil |

|

|

Heavy Equipment Oil |

|

|

Grease |

|

|

Gear Oil |

|

|

Aviation and Marine Oil |

|

|

Transformer Oil |

|

|

The automotive oil segment held the largest market share. |

|

|

By Application |

Industrial |

|

Marine |

|

|

Automotive |

|

|

The automotive segment occupies the biggest share. |

We provide more professional and intelligent market reports to complement your business decisions.