Global In-Building Wireless Market Overview

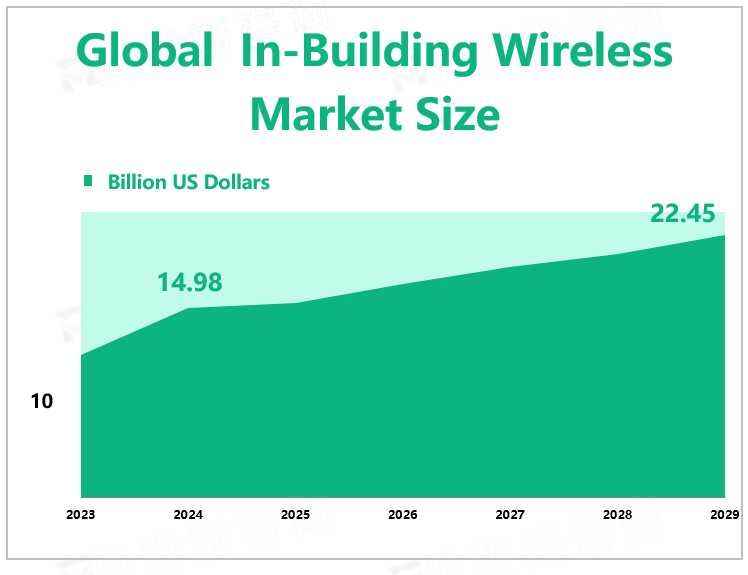

According to Global Market Monitor, the global in-building wireless market size is $14.98 billion in 2024 and is expected to grow to $22.45 billion by 2029.

Market News

In June 2024, Hewlett Packard Enterprise Development LP launched HPE Aruba Networking Enterprise Private 5G, designed to simplify and accelerate the management and deployment of 5G private networks. The solution provides high levels of reliable wireless coverage in vast campus and industrial environments and opens up new use cases for dedicated cellular networks that have not been explored before.

In May 2024, ZTE Corporation announced a partnership with Thailand's top mobile operator Advanced Info Service PLC for the commercial deployment of its latest generation wireless products. It aims to use Advanced technology to assist Advanced Info Service PLC in developing green, ultra-simplified, and intelligent telecommunications networks.

In May 2024, Boldyn Networks announced the acquisition of Apogee Telecom, Inc. This strategic acquisition combines the established reputation and expertise of Apogee Telecom, Inc. with Boldyn's global experience and comprehensive wireless and fiber solutions, enhancing Boldyn Networks' connectivity offerings in the expanding education market.

In-Building Wireless Drivers

Fixed wireless access (FWA) is the portion of a cellular network that serves fixed locations such as office buildings and private residences. 5G FWA is the first type of 5G service deployed because it is a compelling alternative to fiber optic and other cable-based Internet access formats for "last mile" connections. There is no need to lay time-consuming and expensive wiring, and the necessary 5G equipment (routers, bridges, and access points) can be installed quickly.

It is expected that 5G FWA connections will more than triple, reaching more than 180 million by the end of 2026, accounting for a quarter of all cellular network data traffic. As a global trend, the expansion of 5G FWA means that more families in more places will be able to take advantage of the secure, high-performance Internet access provided by 5G.

In-Building Wireless Market Restraints

Compared with wired networks, wireless networks have lower security. Wireless networks are susceptible to interference from nearby wireless networks and other fading conditions. Due to the jitter and delay of connection setup time and poor service quality, wired networks generally maintain faster Internet speeds and are more secure.

In-building wireless sales companies are mainly from North America and Europe and the industry concentrate rate is not high. The top three companies are AT&T, Huawei, and Ericson with a market share of 33% in 2024.

AT&T is a provider of telecommunications, media, entertainment, and technology services for consumers, content creators, distributors, and advertisers.Huawei is a global supplier of information and communication technology (ICT) infrastructure and smart devices. The company provides telecom operators with a series of products, services, and business solutions.

|

Company Name |

AT&T |

|

Website |

Website www.att.com |

|

Established Time |

1877 |

|

Sales Region |

Worldwide |

We provide more professional and intelligent market reports to complement your business decisions.