Global Almond Market Overview

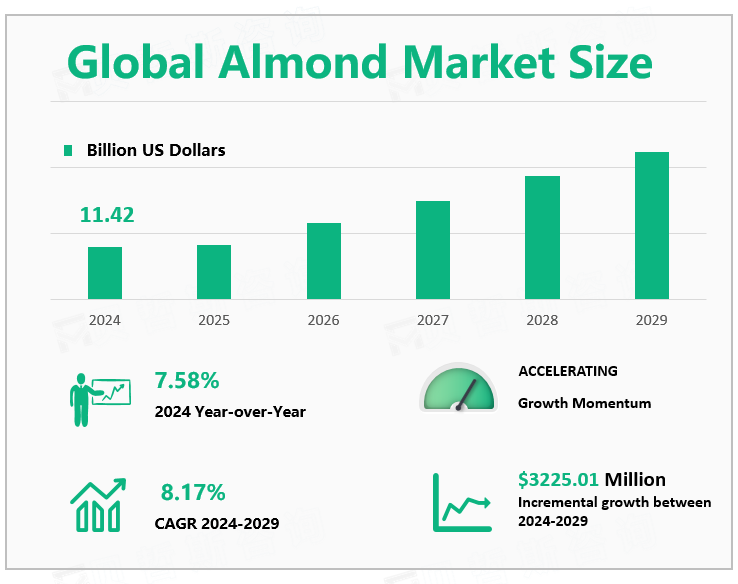

According to Global Market Monitor, the global almond market size will be $11.42 billion in 2024 with a CAGR of 8.17% from 2024 to 2029.

Almonds are rich in nutrients, especially rich in protein, fat, minerals, and vitamins, and have high nutritional value.

Market Drivers

With the developing world's preference for protein-rich diets, almonds are becoming less of a luxury and more of a necessity. The market for meat protein alternatives and nut milk is growing rapidly as more and more people seek meat and dairy alternatives for health, ethical, or environmental reasons. Almonds are also a key ingredient in many healthy snacks. There is a growing desire for healthier foods and snacks in response to increasingly prevalent lifestyle issues such as weight gain, high cholesterol, heart disease, obesity, and diabetes. In the U.S., almonds are the number one snacking nut, thanks largely to investments in nutrition research. The state of California invests about $1.6 million annually in research on the nutritional content and potential health benefits of almonds.

The US is One of the Leading Exporters of Almonds

Due to extensive production, consumption, and export, centered in California, the United States is a well-known global player in the field of almond production, and the United States is one of the largest exporters of almonds in the world, with an export share of more than 80%. The main export destinations are India, China, and the United Arab Emirates. In the United States, most almonds are used as an ingredient in manufactured goods, snacks, home baking, and food service outlets. The expanding consumer taste for international cuisine is supporting the market growth.

Application Fields

While almonds themselves are the most commonly used product, the flowers of the almond tree can also be eaten and used as a garnish. Most almonds are consumed as ingredients for manufactured products, including cereals and granola bars; the remainder are consumed as snacks, home-baked goods, and in food service establishments. Consumer tastes for international cuisines that use almonds continue to expand. In addition, nut flours are expanding as an alternative to regular wheat flour in the gluten-free market. The market for nondairy alternatives to almond milk is expanding, providing consumers with a low-fat, high-protein option. Almond milk has a light texture and nutty flavor, and it is a dairy-free and vegan alternative to cow's milk almond milk makes up the largest percentage of non-dairy products consumed in the United States. New branded products and new uses for almonds in cereals, ice cream, confectionery, and baked goods have been introduced. Almonds can be sold in their shells or in processed form, which involves shelling, dry roasting, blanching, slicing, and chopping to transform them into a paste (marzipan) or flavoring. Most almonds are hulled during processing, and the excess hulls (husks and hulls) are used for livestock feed and bedding. There is no doubt that the expansion of downstream almond product applications will drive the market demand for almonds.

|

By Type |

Shelled |

|

Inshell |

|

|

The shelled segment contributes the largest market share. |

|

|

By Application |

Direct Edible |

|

Food Processing |

|

|

Kitchen Ingredients |

|

|

Others |

|

|

The direct edible is the largest segment. |

We provide more professional and intelligent market reports to complement your business decisions.