Global Peritoneal Dialysis Market Overview

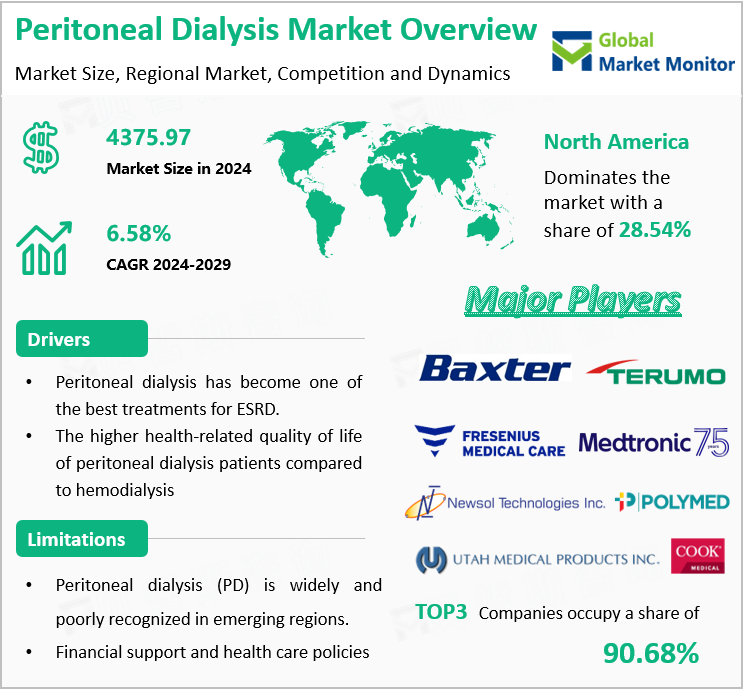

According to Global Market Monitor, the global peritoneal dialysis market will be $4375.97 million in 2024 with a CAGR of 6.58% from 2024 to 2029.

The global median prevalence of chronic kidney disease is 9.5%, and there are large disparities in medical resources between regions and countries at different levels of development. In most countries, chronic kidney disease is considered a health priority, and around 80% of countries worldwide offer chronic peritoneal dialysis, while patients in some regions do not have access to peritoneal dialysis. Improving economic conditions and the high incidence of various chronic diseases such as diabetes and hypertension continue to drive the expansion of the global peritoneal dialysis market.

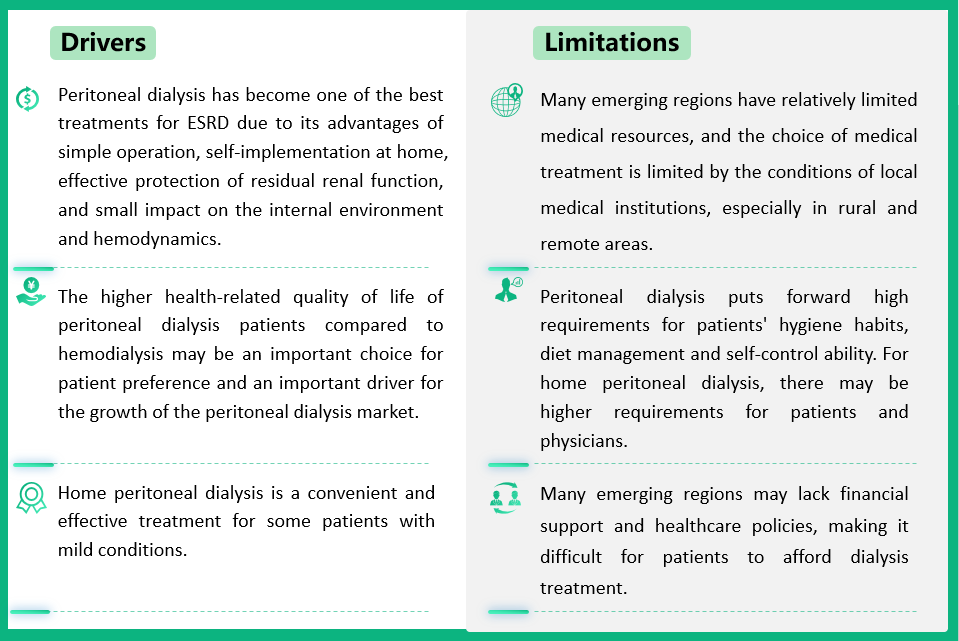

Market Drivers

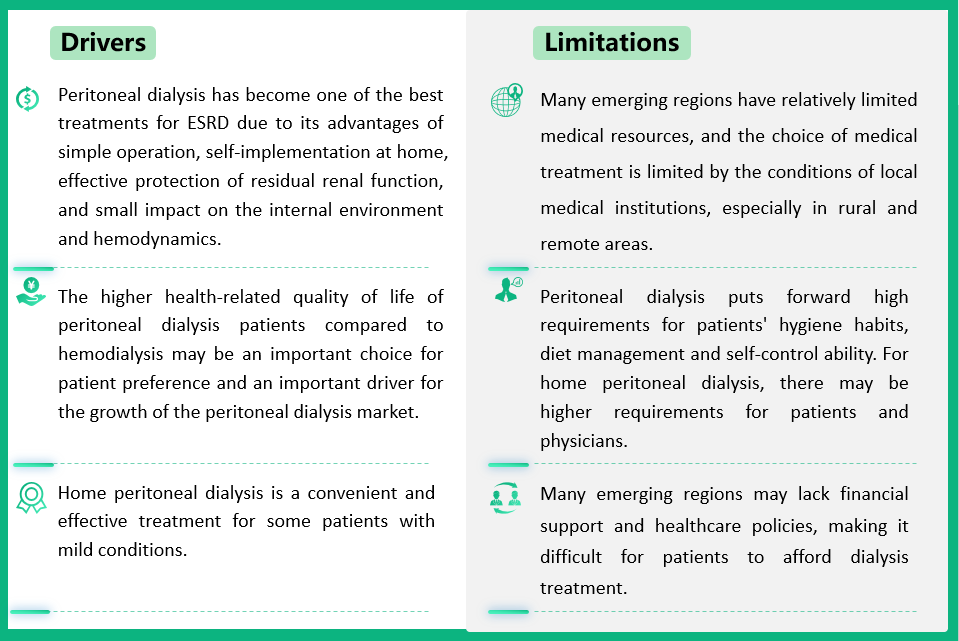

End Stage Renal Disease (ESRD) is the final stage of chronic kidney disease (CKD) when kidney function is severely impaired. Peritoneal dialysis has become one of the best treatments for ESRD due to its advantages of simple operation, self-implementation at home, effective protection of residual renal function, and small impact on the internal environment and hemodynamics. Especially for low blood pressure, unstable cardiovascular function, elderly patients, and diabetic nephropathy patients. Therefore, as the population of patients with chronic kidney disease continues to expand, the demand for peritoneal dialysis also grows. According to the National Institutes of Health's (NIH) Chronic Kidney Disease Epidemiology Dynamics (2022) statistics, more than 800 million people worldwide are affected by chronic kidney disease, which is particularly common in the elderly, people with diabetes, and people with high blood pressure. Moreover, according to clinical studies, patients with diabetes and hypertension are the high-risk groups of chronic kidney disease. Diabetes has become one of the main causes of chronic kidney disease. Therefore, with the aggravation of the aging trend of the global population, the incidence of chronic diseases such as diabetes and hypertension continues to rise, and the demand for peritoneal dialysis treatment continues to rise. Peritoneal dialysis has become the preferred dialysis method for diabetes and elderly patients.

In addition, the higher health-related quality of life (HRQOL) of peritoneal dialysis (PD) patients compared to hemodialysis (HD) may be an important choice for patient preference and an important driver for the growth of the peritoneal dialysis market. At the same time, the continuous progress and innovation of medical technology, the treatment effect of peritoneal dialysis, and the quality of life of patients have been significantly improved, and further promote the popularity and use of peritoneal dialysis (PD). For example, the formulation of peritoneal dialysates has been optimized, and dialysates using low glucose degradation products (GDPs) can reduce long-term peritoneal damage, thereby reducing the risk of peritonitis; Innovations in connection systems, such as the use of all-in-one Y-kits and pre-connected dialysate bags, can reduce the number of procedures and reduce the likelihood of infection; Catheter design improvements, such as the use of catheters with antibacterial coatings, can reduce bacterial adherence and thus reduce the risk of infection. These technological innovations and improvement measures have effectively controlled the complications of peritoneal dialysis, enabling patients to maintain PD treatment for a longer period, while also improving their quality of life.

In addition, home peritoneal dialysis is a convenient and effective treatment for some patients with mild conditions. As society ages and the number of patients with chronic kidney disease increases, the demand for peritoneal dialysis at home will also gradually increase. In the future, the popularity of home peritoneal dialysis will become one of the important trends in the development of the peritoneal dialysis industry.

Market Limitations

Peritoneal dialysis (PD) is widely and poorly recognized in emerging regions: In emerging regions, the awareness and popularity of peritoneal dialysis (PD) is far less than that of developed regions such as North America and Europe, which is caused by many factors.

Distribution of medical facilities and resources: North America has advanced medical facilities and a high level of medical services, which provides the foundation for the widespread adoption of hemodialysis (HD). In contrast, many emerging regions have relatively limited medical resources, and the choice of medical treatment is limited by the conditions of local medical institutions, especially in rural and remote areas, which limits the popularization and development of peritoneal dialysis.

Preference of doctors and patients: Since hemodialysis is performed in a medical facility, doctors can directly supervise and manage the treatment process, and patients trust this method more. However, peritoneal dialysis puts forward high requirements for patients' hygiene habits, diet management, and self-control ability. In addition, for home peritoneal dialysis, there may be higher requirements for patients and physicians, such as pre-treatment education and training, patient manipulation, and self-management. In addition, hemodialysis technology is mature, equipment and technical support are relatively complete, and peritoneal dialysis has relatively little investment in marketing and education, resulting in its popularity being less than hemodialysis.

Financial support and health care policies: In North America, governments and insurance companies provide financial support for dialysis treatment, reducing the financial burden on patients. Many emerging regions may lack similar financial support and healthcare policies, making it difficult for patients to afford dialysis treatment.

Overall, the penetration of peritoneal dialysis in emerging regions is lower than in North America, mainly due to a combination of resources, technology, economics, education, policy, and environment. To increase the popularity of peritoneal dialysis in emerging regions, it is necessary to start from these aspects, strengthen the construction of medical infrastructure, improve public and patient awareness, improve economic support and medical insurance policies, strengthen education and training, and formulate policies and regulations conducive to the development of peritoneal dialysis.

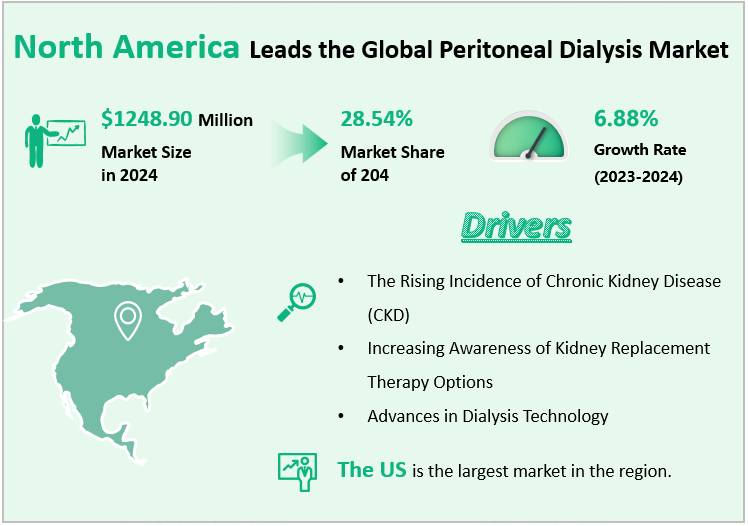

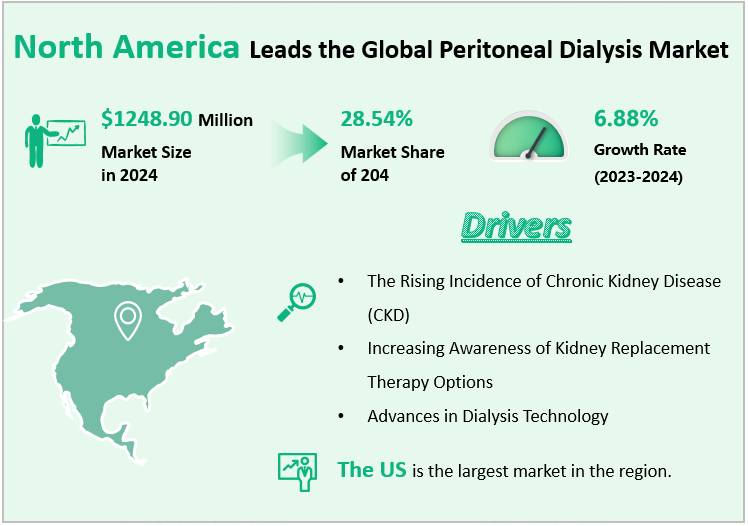

North America Leads the Market.

The North American peritoneal dialysis market is mature and holds a significant position globally, reaching 28.54% in 2024. Drivers include the rising incidence of chronic kidney disease (CKD), increasing awareness of kidney replacement therapy options, and advances in dialysis technology.

As the population ages and lifestyle factors contribute to kidney diseases such as diabetes and high blood pressure, the demand for dialysis therapy continues to grow. Increasing awareness of kidney health and the benefits of PD over hemodialysis have further fueled this trend. Furthermore, with the increasing prevalence of end-stage renal disease (ESRD) and the increasing shift to home dialysis therapy, the peritoneal dialysis market in North America is showing steady growth. At the same time, as more patients and healthcare providers realize the benefits of PD, the market is expected to continue to expand in the coming years.

Peritoneal Dialysis Market Competition

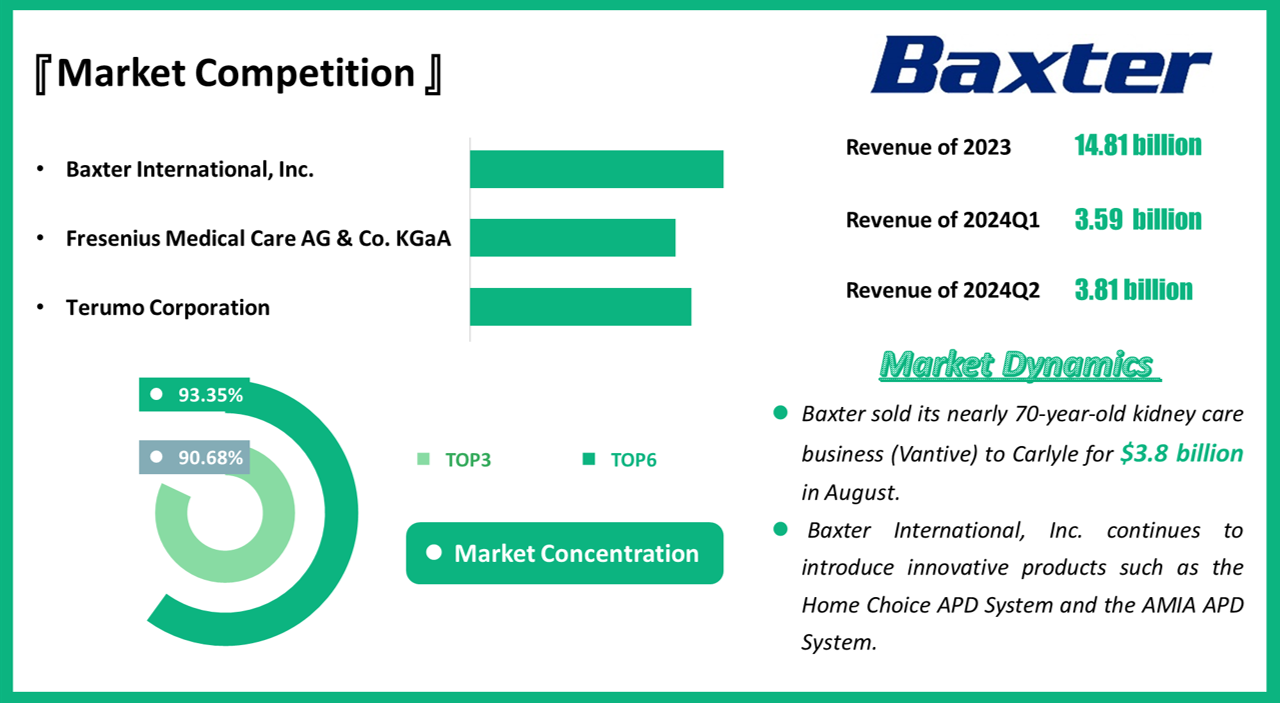

The global dialysis market concentration is high. The TOP3 companies are Baxter International, Inc., Fresenius Medical Care AG & Co. KGaA, and Terumo Corporation, holding a market share of 90.68% in 2024. Baxter International, Inc. takes the lead in terms of market share, technological innovation, marketing, localization strategy, cooperation and project support, and quality and service.

Baxter International, Inc., founded in 1931, is a provider of critical care, nutritional, renal, hospital, and surgical products focused on products for the treatment of kidney diseases, as well as other diseases. In 1960, Baxter International introduced the first peritoneal dialysis (PD) solution. At the same time, Baxter International has vigorously promoted peritoneal dialysis therapy and peritoneal dialysis products around the world, and its marketing intensity and depth have significant advantages in the industry. Baxter International, Inc. continues to introduce innovative products such as the Home Choice APD System and the AMIA APD System, automated peritoneal dialysis devices that improve treatment comfort and compliance while equipped with a remote patient management system. Help doctors monitor patients' treatment in real-time.

Baxter International, Inc. Market Performance and News

Baxter International Inc. reported results for the first quarter of 2024 on May 2, 2024. First-quarter sales from continuing operations of $3.59 billion. It reported results for the second quarter of 2024 on August 6, 2024. Second-quarter sales from continuing operations of $3.81 billion, exceeding the company's previously issued guidance and delivering constant currency growth across all segments. Baxter increased its full-year sales guidance and now expects sales growth of approximately 3% on both a reported and constant currency basis.

Baxter International Inc. will host a conference call to discuss its third-quarter 2024 financial results on November 8, 2024.

In August 2024, Carlyle agreed with Baxter's takeover of its Kidney Care segment (Vantive) for $3.8 billion. With these alterations, Baxter is focusing on hospital solutions and connected care. It is trying to make the business model streamlined through an aligned strategy that positions toward innovation and ultimately delivers value to the stakeholders. Following the completion of the Kidney Care divestiture, Baxter is committed to achieving operating sales growth of 4% to 5% on an annualized basis through innovation and continued market expansion strategies. For 2025, Baxter expects an adjusted operating margin of approximately 16.5% on a continuing operating basis.