Finance lease is a credit method with financing as its direct purpose. The usual method of it is that the lessee intends to lease the leased items and the lessor is willing to lease them to the lessee after assessing the risk of the leased project. To obtain the leased object, the lessor first purchases the leased object selected by the lessee with full financing, and collects the rent according to the fixed interest rate and lease period. During the entire lease period, the lessee has no ownership but has the right to use, which is responsible for repairing and maintaining the leased items.

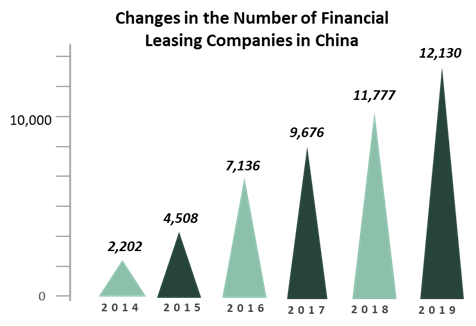

Financial leasing which has become the second-largest financing method after bank credit is one of the three major financial instruments including bank credit and securities in developed countries in Europe and the United States. The capital scale and market scale of the financial leasing industry in China have also developed rapidly in recent years and the number of domestic financial leasing companies has been increasing, from 1,026 in 2013 to 12,130 in 2019, including 70 financial leasing companies, 403 domestic leasing companies, and 11,657 foreign leasing companies.

Environmental protection companies in China are mainly small and medium-sized enterprises, with a shortage of funds, high equipment and technology requirements, and large financing needs, which are common characteristics of most environmental protection projects. Financing difficulties have become one of the most difficult problems in the growth process of environmental protection companies.

Leasehold and cash flow are the key to financial leasing. And energy conservation and environmental protection is a capital-intensive industry with sufficient leased items. At the same time, projects generally have stable and predictable cash flows, which are highly compatible with the financial leasing model.

Financing leases are financed using financing, which can meet the needs of environmental protection companies for equipment renewal and purchase. The flexible payment method of financial leasing and the longer lease term can also adapt to the characteristics of the long income cycle of environmental protection enterprises. The separation of the right of use and ownership will help solve the problem that SMEs with insufficient credit have demand for machinery and equipment. It can be said that financial leasing can help solve the financing dilemma of the environmental protection industry, ensure the normal operation of projects, and promote the healthy development of the industry.

After experiencing rapid development and scale expansion, the domestic financial leasing industry has moved from a rapid growth stage to a new stage of transformation that emphasizes quality and service. In this context, leasing companies also need to strengthen business innovation and cooperation to enhance their sustainable development capabilities. If the leasing company only regards the leased property as a prop, the competitiveness and living space of the leasing company will be small.

Green Concept Has Become A New Point for Leasing Companies

After experiencing rapid development and scale expansion, the domestic financial leasing industry has moved from a rapid growth stage to a new stage of transformation that emphasizes quality and service. In this context, leasing companies also need to strengthen business innovation and cooperation to enhance their sustainable development capabilities. If the leasing company only regards the leased property as a prop, the competitiveness and living space of the leasing company will be small.

As the construction of ecological civilization is placed in an increasingly prominent position, leasing companies should also increase the investment of green leasing to assist entities in the green fields such as energy-saving and emission reduction, clean energy, and environmental transportation. At the same time, through deep cultivating green leasing, leasing companies create differentiated brand characteristics of leasing companies to find a focus for realizing their transformation and upgrading.

Large Potential Demand for Financial Leasing in the Green Environmental Protection Industry

The State Council Development Research Center reported that the annual demand for green investment from 2015 to 2020 can reach 2.9 trillion yuan, of which about 2 trillion yuan will require green finance to provide leasing support. At present, the participation of the leasing industry in the green finance market needs to be improved, and the potential financing scale provides it with development space.

The Scale of Financial Leasing Green Bonds Has Increased, But Still at A Low Level

The issuance of green bonds provides financial leasing companies with new financing channels, which can reduce the operating costs of financial leasing companies to a certain extent and effectively improve their financial expense structure.

Financial leasing companies can be divided into two types of financial leasing and commercial leasing, both of which are all supervised by the China Banking and Insurance Regulatory Commission after May 2018. Bond issuers in the leasing industry are mainly financial leasing companies, and commercial leasing companies issue fewer.

In 2019, the participation of the financial leasing industry in the green bond market has increased, with the number and scale of issuance reaching a record high, but the proportion of total green bond issuance is still low.

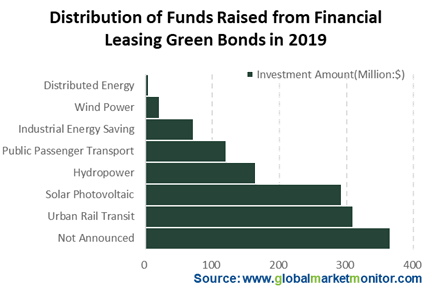

In 2019, 3 financial leasing companies and 2 commercial leasing companies issued a total of 10 green bonds, with a scale of 10.3 billion yuan, of which the actual green investment amounted to 9.46 billion yuan, and green investment accounted for 91.8%. Compared with the 2.58billion yuan issuance of green bonds issued by only three commercial financial leasing companies in 2018, a substantial increase has been achieved in2019. However, the issuance of financial leasing green bonds accounted for only 4.19% of the total issuance of labeled green bonds in the whole year, with a low level.

From the perspective of the investment distribution of the raised funds, 2.168 billion yuan was invested in urban rail transit, 2.051 billion yuan in solar photovoltaic power generation, and 1.15 billion yuan in hydropower generation and the remaining investment was less than 1 billion yuan, which can be seen is that the issuance of green bonds by financial leasing companies focuses on investing in urban infrastructure and renewable energy, matching their own main business.

The construction of ecological civilization must be the permanent theme of social development, in which the environmental protection industry that needs support at this stage must also be the focus in the future. The environmental protection industry cannot be fully developed under the support of the government, while it needs the participation of the market to realize the healthy development of the industry. Financial leasing has a natural fit with the environmental protection industry in terms of the financing period and the leasing subject matter. Good financing will help promote the clearing of the old production capacity and support the development of environmental protection and clean industries, which has become a new driving force for the environmental protection industry. At the same time, the environmental protection industry in return is also a new force in the financial leasing industry, in which the two promote each other and develop together.

Custom Reporting

https://www.globalmarketmonitor.com/request.php?type=9&rid=0

We provide more professional and intelligent market reports to complement your business decisions.