Coaxial

cable is one of the most common transmission media in the LAN. It refers to the

cable with two concentric conductors, and the conductor and the shield layer

share the same axis. The most common

type of coaxial cable consists of a copper conductor separated by an insulating

material. Outside the inner layer of insulation is another ring conductor and

its insulator, and then the entire cable is covered by a sheath of polyvinyl

chloride or Teflon. Coaxial cables are

designed to prevent external electromagnetic waves from interfering with the

transmission of abnormal signals.

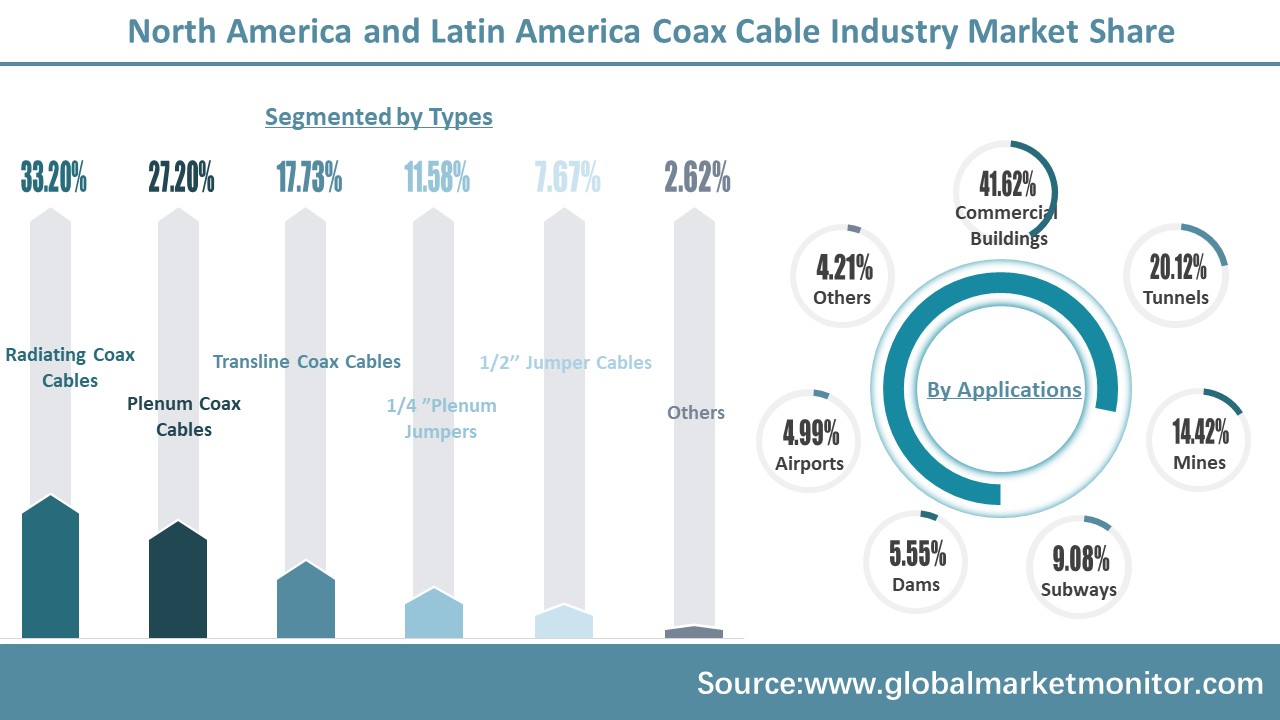

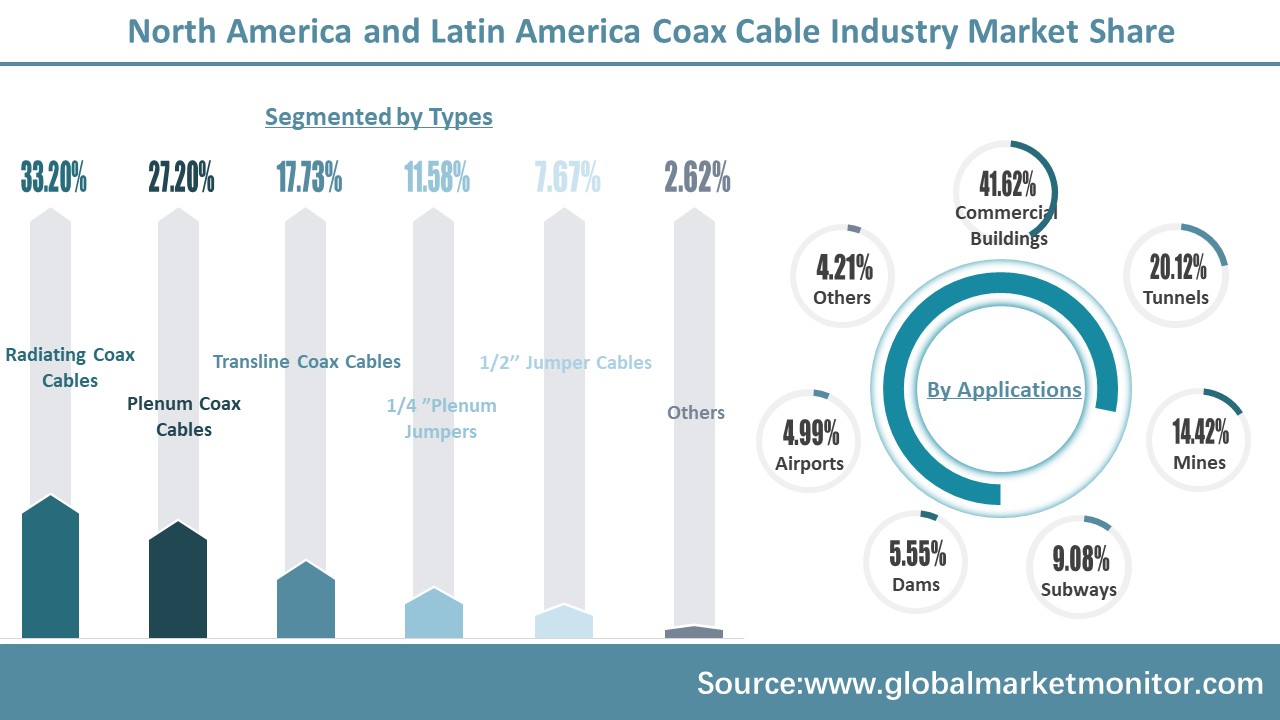

Common

coaxial cables include radiating coaxial cables, plenum coaxial cables, transline

coaxial cables, 1/4 "plenum jumpers, and 1/2" jumper cables. Among them, the market share of radiating

coaxial cable is the highest, and its market revenue share was 33.20% in

2020. Followed by plenum coaxial cable,

the market revenue accounted for 27.20%.

From the perspective of downstream application field, coaxial cable is

the most widely used in commercial buildings, and the market revenue share of

coaxial cable used in commercial buildings in 2020 was 41.62%.

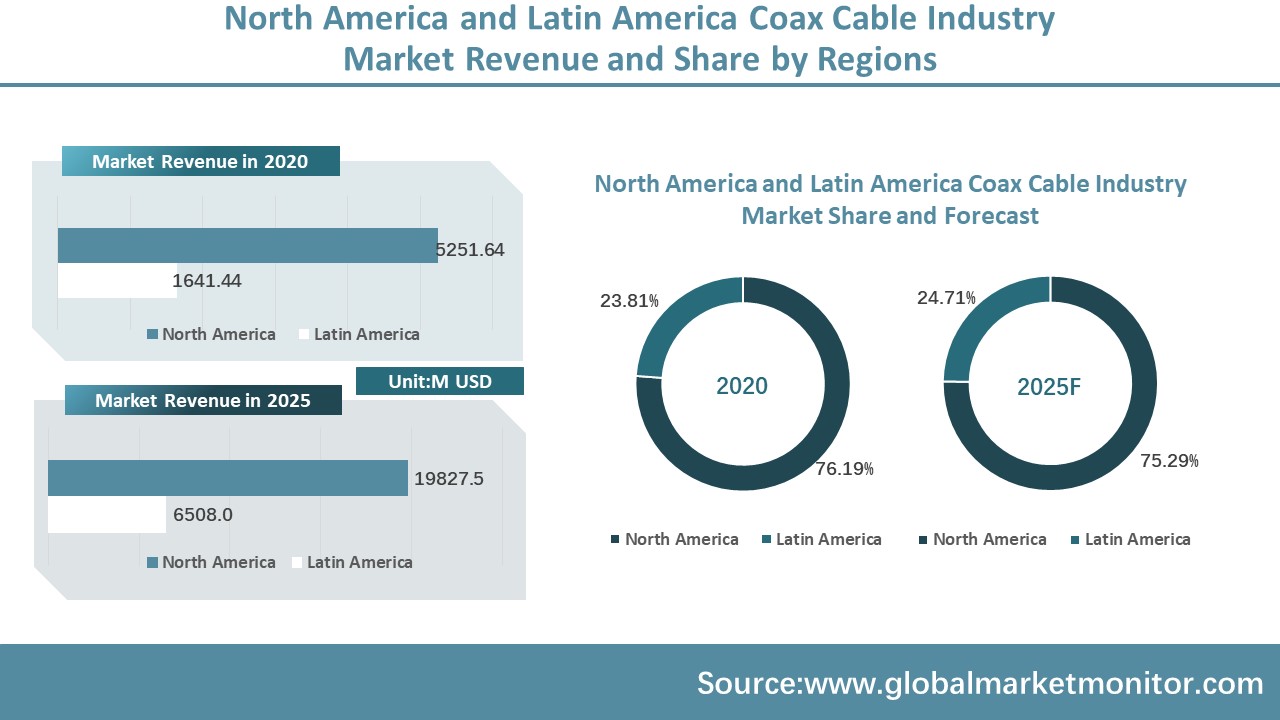

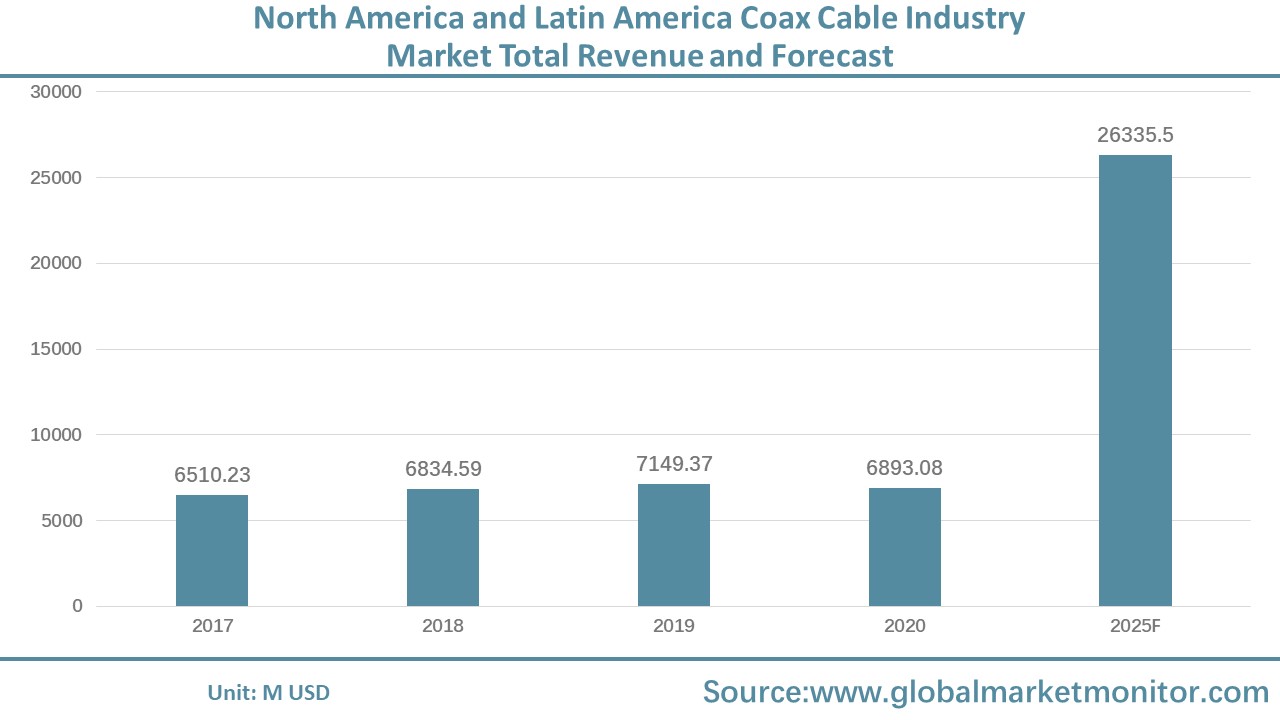

The total market revenue was $6893.08 million in 2020 and is expected to increase to $26,335.5 million in 2025

Research shows that in the large market of coaxial cable in North America and Latin America, North America occupies the majority share. In 2020, the North American coaxial cable market revenue reached $5251.64 million, accounting for 76.19%; The Latin American coaxial cable market revenue was $1641.44 million, with a market share of 23.81%.

Data shows that the coaxial cable market revenue in North America and Latin America totaled $6,510.23 million in 2017, and has increased for two consecutive years to $7,149.37 million in 2019. In 2020, due to the impact of the pandemic, the market revenue decreased to $6893.08 million. Based on the data base and development rules, we conducted a series of functional operations and derived the data for the next 5 years with a scientific model. Finally, it is predicted that by 2025, the total revenue of coaxial cable industry in North America and Latin America will reach $26335.5 million. Among them, the revenue of North America market is $19827.5 million accounting for 75.29%; Latin America will account for 24.71% of $6508.0 million in revenue. It can be seen that the market share of North America will decrease during the forecast period, while the market share of Latin America will increase to some extent.

To get complete sample,please click:https://www.globalmarketmonitor.com/reports/1506386.html

With obvious technological changes, coaxial cable faces the threat of being replaced

As the world becomes more connected, the need for secure data transmission increases, leading to a rising demand for coaxial cable. Because of the reliability and security of coaxial cable, individuals and organizations use it to participate in a large amount of data exchange, creating a strong market demand. In addition, the increasing demand for consumer and industrial electronics is also one of the major factors driving the growth of the coaxial cable market. Miniature coaxial cables are widely used by manufacturers of consumer and industrial electronic equipment. These cables are very small in size and very flexible, so they are used in medical applications, consumer applications and industrial applications. In addition, they are used in high-end and advanced audio systems for studios and Musical Instruments.

In addition, many cable manufacturing companies are increasing their production capacity for fireproof cables to keep up with the growing demand from the construction industry. Fireproof cables are often required during emergency operations of critical circuits to reduce the spread of fire and ensure the highest level of safety. This cable is designed for wiring large residential, industrial and manufacturing buildings. For example, in 2019, some of the major companies selling fire-resistant cables included Prysmian Group, Nexans, TPC Wire & Cable, Cavicel, and Cleveland Cable. Cable manufacturers will consider increasing production of fire-resistant cables to meet the growing demand for these cables from construction companies.

On the other hand, the global defence sector is expanding rapidly due to increased investment and expanding budgets. Increased security concerns, deteriorating geopolitical relations among major industrial economies, and increased terrorist activities are influencing major economies to revise budget allocations and increase defense investments to provide better protection. The increase in defense spending in North America and Latin America will be one of the important coaxial cable market trends that will gain traction during the forecast period. And, with increased investment, communication-related infrastructure is being put on a sound footing. In addition, demand generated by the broadband and broadcasting industries is also driving upward growth.

However, coaxial cable itself has an obvious drawback: the failure of a single cable can bring down an entire network. In addition, the braided shield used by highly flexible coaxial cable is not a smooth surface, bending will cause changes in the actual electrical characteristics of the cable, and the sharp bending or even kinking of the shield will seriously affect the transmission power and integrity, the same result also happens for the twisted inner conductor bending. The shortcomings of coaxial cable itself dissuade some consumers and hinder the rise of consumption, which is not conducive to the development of the industry. On the other hand, rapid changes in technology have led to the constant development of alternatives such as fiber optic or wireless technology. The increasing use of fiber optic cables is expected to limit the growth of the coaxial cable market.

In addition, fierce market competition and relatively old technology will also reduce the use of coaxial cable. The intensity of competition within the coaxial cable industry has increased as the major manufacturers and suppliers of the coaxial cable industry compete in North America and Latin America. Suppliers adopt strategies such as price premium to remain competitive in the market. At the same time, these multinationals are pricing their products in stiff competition with local coaxial cable suppliers in North and Latin America. Fierce competition is not conducive to the sustainable development of the industry. At the same time, entering the coaxial cable business does not require significant capital or investment, so many small companies or retailers are entering the business. This will lead to the proliferation of substandard or duplicate products, which in turn breaks the existing competitive landscape in the market, and the established coaxial cable manufacturers are forced to lower the prices of their products, which ultimately affects their profit margins and sales volumes.

On the other hand, labor costs for manufacturers of coaxial cable in North and Latin America are high and rising. For example, in the fourth quarter of 2019, unit labor costs in the U.S. non-farm business sector increased at an annual rate of 0.9%, hourly earnings rose 2.1%, and productivity increased 1.2%. Labor costs rose 1.7 percent in 2019, reflecting a 3.6 percent increase in hourly wages and a 1.9 percent increase in productivity. The increase of labor cost leads to the increase of operating cost of coaxial cable manufacturers, which is not conducive to the development of the industry.

To get complete sample,please click:https://www.globalmarketmonitor.com/reports/1506386.html