Xylitol is an organic compound originating from Finland. It is a natural sweetener extracted from plant materials such as birch, oak, corn cob, and sugarcane bagasse. It is also the sweetest sweetener among polyols, with a sweetness that can reach 1.2 times that of sugar. Xylitol is metabolized slower than sucrose and will not cause blood sugar to rise, so it is often used to make sweet food for diabetes patients.

Overview of Global Xylitol Market Development and Analysis of Segmented Markets

Xylitol, as one of the most mainstream functional sugar alcohol products in the market, is mainly used in the production of popular foods such as chewing gum and ice cream to replace sucrose or other sweeteners. Although xylitol is priced higher than sucrose, it is widely popular among consumers worldwide due to its various characteristics such as low-calorie intake, non-caries, and hypoglycemic reactions, resulting in a huge demand in the market.

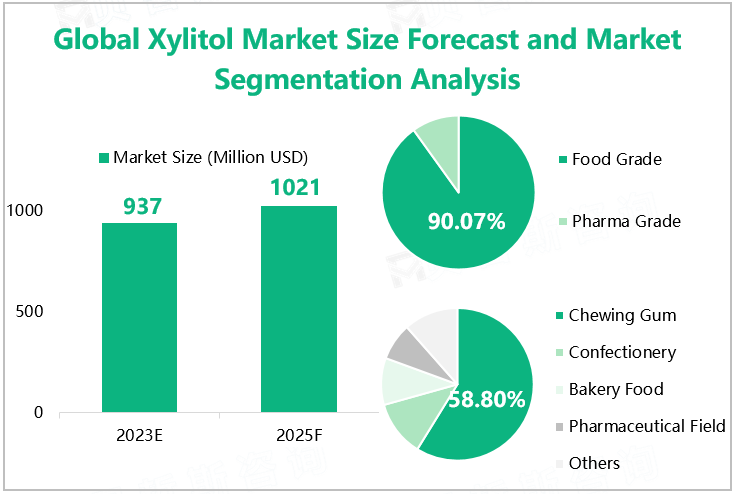

According to our research data, the global xylitol market is expected to reach $937 million in 2023, among which the food-grade xylitol segment market dominates, with an estimated market size of $844 million in 2023 and a market share of 90.07%. In terms of downstream applications, the chewing gum industry is the largest downstream application market for xylitol. According to our data, the estimated global market size for xylitol used in chewing gum production in 2023 is $551 million, with an estimated market share of 58.80%.

Global Xylitol Market Size Forecast and Market Segmentation Analysis

Source: www.globalmarketmonitor.com

Global Xylitol Market Competition Pattern Analysis

From the perspective of market competition, the concentration of the global xylitol market is moderate. Based on our data, the total production of xylitol by the top 3 enterprises in the industry in 2020 was 121.7k tons, with a total production value of $334 million and a total share of 45.32%. The top three companies were Danisco (DuPont), Futaste Co., Ltd., and Zhejiang Huakang. In 2020, these three companies accounted for 118.86%, 13.30%, and 13.16% of the global total output value of xylitol, respectively.

Xylitol Production, Production Value, and Share of Main Enterprises in 2020

|

Enterprises

|

Production (K tons)

|

Production Value (Million USD)

|

Share

|

|

Danisco (DuPont)

|

43.8

|

139

|

18.86%

|

|

Futaste Co., Ltd

|

39.4

|

98

|

13.30%

|

|

Zhejiang Huakang

|

38.5

|

97

|

13.16%

|

|

Top3

|

121.7

|

334

|

45.32%

|

Source: www.globalmarketmonitor.com

Development Prospects Analysis of the Global Xylitol Market

In the coming years, as consumer demand for healthy

foods increases, the market demand for xylitol as a natural sweetener will

continue to grow. Meanwhile, with the development of technology, the production

process of xylitol will also be further optimized and improved, thereby

reducing production costs and improving market competitiveness. In addition,

with the development of the global economy and the expansion of trade, the

export market for xylitol will also further expand. Meanwhile, as a major

producer and consumer of xylitol, China's market potential cannot be ignored.

For more industry information, please refer to our latest released "2023 Global Xylitol Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".