Global Refrigerant Market Overview

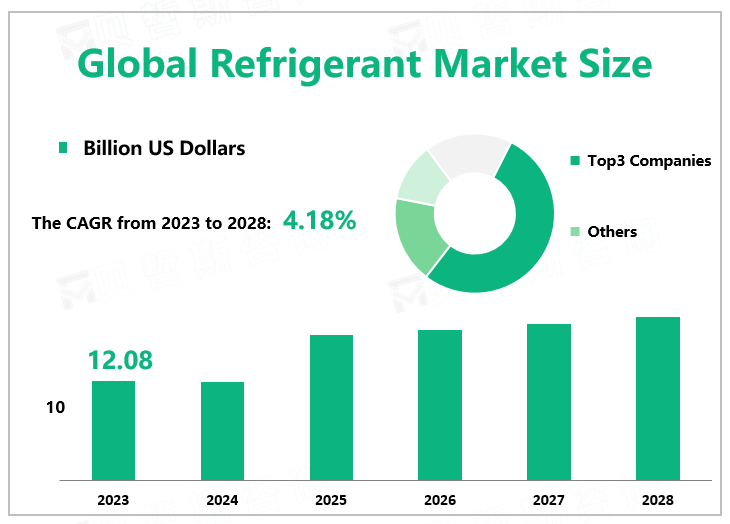

According to Global Market Monitor, the global refrigerant market size was $12.08 billion in 2023 with a CAGR of 4.18% from 2023 to 2029.

A refrigerant is a substance or mixture. Fluorocarbons, especially chlorofluorocarbons, became commonplace in the 20th century but are being phased out because of their ozone depletion effects. Other common refrigerants used in various applications are ammonia, sulfur dioxide, and non-halogenated hydrocarbons such as propane.

Market Trends

Due to the continuous discharge of CFCs and other chemical wastes, the oxygen ions in the atmosphere gradually decrease, causing the ozone layer to be destroyed. It will increase the amount of ultraviolet radiation reaching the earth by 5% to 10%, causing direct damage to humans, animals, and plants. At the same time, CFCs, HCFCs, and HFC refrigerants are considered greenhouse gases. The US Environmental Protection Agency (EPA) has introduced regulations to phase out certain HFC refrigerants in many applications. Some rules have been formally implemented, and more rules will be fully implemented in the next few years. The industry is continuing to study safety equipment using new refrigerants.

Honeywell, Chemours, Linde, Zhejiang Juhua, and Arkema are the five key players in the global Refrigerant market. These companies have shown consistent revenue growth, larger sales volumes, and a prominent presence in terms of share in the global Refrigerant market.

The Explosion of Construction Drives Market Development.

According to the International Energy Agency, the global stock of air conditioners in buildings is anticipated to grow up to 5.6 billion by 2050, up from 1.6 billion in 2022, which amounts to 10 new ACs sold every second for the next 30 years, which in turn positively impacts the growth in demand for refrigerants. According to a report by the Civil Aviation Administration of China (CAAC), the Chinese mainland built six new cargo airports and 29 new multipurpose airports in 2022, bringing the total number of airports in both categories to 254 and 399, respectively, by the end of the year. The growing infrastructure development activities, such as office complexes, airports, and metro rail systems, contribute to the increasing requirement for commercial AC.The growing investments in construction activities are driving the demand for ACs, which, in turn, may drive the refrigerants market over the forecast period.

The Change of Lifestyles Stimulates Market Growth.

Consumers prefer health and wellness foods like organic foods that require cold storage, including peas, corn, etc. Packaged frozen foods especially dairy, baby food, and confectionery products are also increasingly popular. Many consumers consider refrigeration appliances as household necessities owing to the increasing usage of ready-to-eat packaged food, which paves the way for appliances to penetrate the market, further strengthening the growth of the refrigeration market.

|

By Type |

HCFC |

|

HFC |

|

|

HFO |

|

|

Others |

|

|

The HFC contributes the largest market share. |

|

|

By Application |

Air Condition |

|

Chillers |

|

|

Refrigerator |

|

|

Others |

|

|

The air condition segment occupies the biggest share. |

We provide more professional and intelligent market reports to complement your business decisions.