Global Home Textile Market Overview

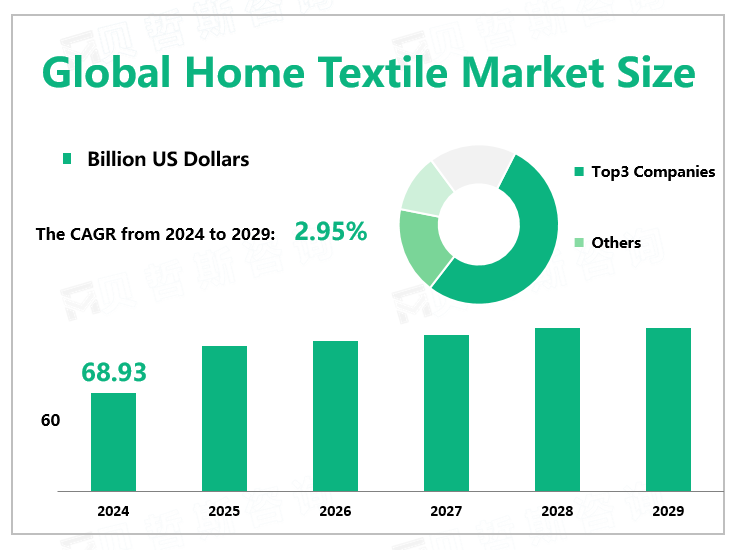

According to Global Market Monitor, the global home textile market size will reach $68.93 billion in 2024 with a CAGR of 2.95% from 2024 to 2029.

Market Drivers and Opportunities

The surge in demand for household products and increased consumer awareness have made home textiles a lucrative business field in the global textile industry. Various growth drivers are pushing this demand to record highs. One of the main factors driving growth is the booming home textile market in Asian economies (such as China, India, Thailand, etc.). Although there are still major consumer groups in the US and European markets, the growth trend of household purchases is also obvious. These Asian economies have been affected by the booming housing market and the rapid growth of the middle class.

As fast fashion not only the apparel market but also the home furnishing market, people's fashion sensitivity to home decoration has increased. As consumers' awareness of high-quality life increases, family fashion has become a separate market segment. The number of retailers of home textiles is also increasing. From IKEA to H&M Home, big brands are entering the booming market and using the current environment to promote the development of the home textile market.

The Asia-Pacific region is home to around 60% of the global population and is a significant hub for producing and exporting home textiles. Countries like India, China, and Pakistan are among the region's largest home textiles markets. Growth in the global home textiles market is driven by factors such as the housing boom in Asia-Pacific, evolving fashion trends in home textiles, and demand recovery from Western economies. The robust growth of the Asia-Pacific region can be attributed to factors like rising per capita spending, a large pool of potential consumers, increased investments by key regional players, and the improving lifestyles of consumers. These factors are also fueling the demand for home textiles. The growth of e-commerce has further boosted home textile sales worldwide as consumers increasingly turn to online platforms to purchase from the comfort of their homes.

Market Dynamics

December 2023: Ralph Lauren Corporation recently unveiled a significant and enduring partnership with Haworth Lifestyle Design, a renowned industry frontrunner in luxury furniture design, production, and distribution. This collaboration will empower Ralph Lauren to extend further and enhance its home business, solidifying its market position.

March 2023: Welspun Group has successfully finalized the purchase of Sintex BAPL, a plastics products manufacturer that private equity firm KKR previously supported. By acquiring Sintex BAPL, Welspun Group, known for its expertise in home textiles and line pipes, will be able to enhance its plastic business-to-consumer operations.

|

By Type |

Bed Linen & Bed Spread |

|

Bath & Toilet Linen |

|

|

Kitchen Linen |

|

|

Upholstery |

|

|

Rugs & Carpets |

|

|

The bed linen & bedspread segment contributes the largest market share. |

|

|

By Application |

Online Channels |

|

Offline Channels |

|

|

The offline channels segment occupies the biggest share. |

We provide more professional and intelligent market reports to complement your business decisions.