Global Senior Care Market Overview

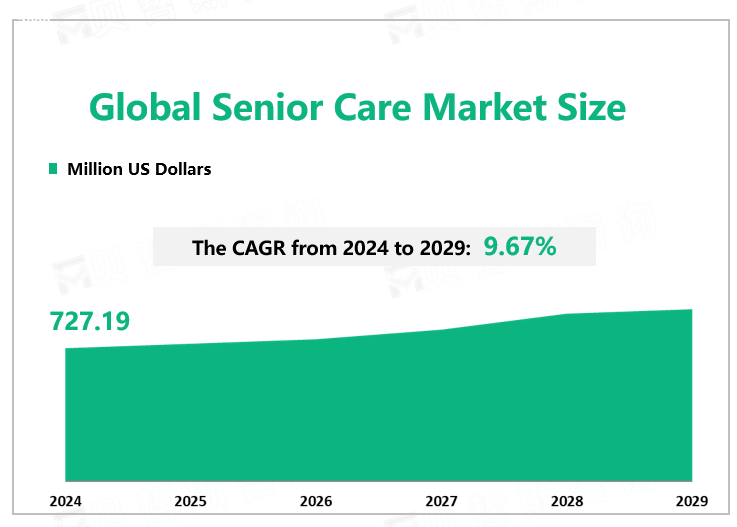

According to Global Market Monitor, the global senior care market size will reach $727.19 million in 2024 with a CAGR of 9.67% from 2024 to 2029.

There is a higher burden of diseases, including dementia, fatal illnesses, and other significant disabilities, among the growing elderly population. In low- and middle-income nations, there is a shift towards choosing senior care facilities over home healthcare settings due to the necessity to manage chronic conditions and prevent diseases in the elderly. Seniors in emerging nations may access healthcare services as healthcare infrastructure advances, frequently leading to better disease diagnosis and treatment. The demand for senior care products that improve quality of life and support aging in place may be influenced by this increasing awareness and accessibility to healthcare.

China Senior Care Market Status

Since entering the aging society in 2000, the aging degree of the Chinese population has continued to deepen. In 2021, there were 267.36 million people aged 60 or above in China, accounting for 18.9% of the country's population. It is expected that during the "14th Five-Year Plan" period, the total number of elderly people aged 60 and above will exceed 300 million, accounting for more than 20%, and enter the stage of moderate aging. Around 2035, the elderly population aged 60 and above will exceed 400 million, accounting for more than 30% of the total population, entering the stage of severe aging.

China follows a ’90-7-3’ senior care model (90% at home, 7% in intermediate facilities, and 3% in nursing homes). This approach is driving demand for both professional nursing and rehabilitation services and smart products and solutions. On October 20, 2021, the Government of China published its five-year Development Action Plan for the Smart Elder Care Industry (2021-2025), which identifies the smart products and services particularly needed for elderly care, including but not limited to wearable devices and self-service health testing equipment for testing blood pressure, rehab training equipment such as exoskeleton robots and rehab training assessment devices, smart care products, telemedicine solutions, and health management solutions.

Market Trends

With the development of the global economy, people have higher wage requirements, the company's operating costs increase, and patients need to bear expensive service costs, which will limit the development of the senior care market to a certain extent.

Certain assisted living and home care facilities are turning into smart homes to aid the aging population. Voice assistants, such as Amazon Echo (aka Alexa) and Google Home, are helping older people remember their schedules, such as when to eat, take medicine, or see a doctor. Smart kits help with dose control and medication timing. Even some smart outfits are already helping doctors monitor patient movements to check if their gait is irregular or to alert the care team when they fall. In addition, motion detectors, smart mattresses, and even personal robots can make the assisted living experience more enjoyable. Therefore, increasing R&D investment in hardware and software will help companies to increase their competitiveness.

|

By Type |

Software |

|

Hardware |

|

|

Services |

|

|

The services segment contributes the largest market share. |

|

|

By Application |

Public Expenditure |

|

Private Source |

|

|

Out-of-Pocket Spending |

|

|

The market's largest segment by application is public expenditure, with a market share of 57.32% in 2023. |

We provide more professional and intelligent market reports to complement your business decisions.