Asia Aluminum Beverage Cans Market Overview

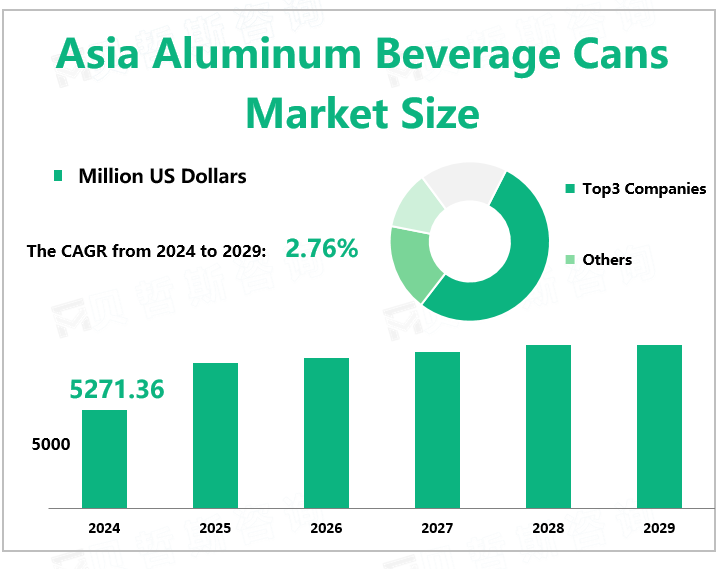

According to Global Market Monitor, the Asia aluminum beverage cans market size will reach $5271.36 million in 2024 with a CAGR of 2.76% from 2024 to 2029.

Aluminum beverage cans are valued for their convenience and portability. They also offer a powerful barrier against light and oxygen, which can affect a drink’s flavor and freshness. Plus, aluminum beverage cans chill faster than other materials, so customers will enjoy their drink that much sooner.

Potential Problems with May Hinder Market Development.

The aluminum can manufacturer is lined with a thin layer of plastic inside the can to prevent aluminum from penetrating the food. Unfortunately, one side effect of including plastic liners in aluminum cans is that consumers may be exposed to BPA toxic levels.Besides, after a person opens an aluminum can, the interior poses an injury because of its sharp edges--a risk not found in other types of food packaging material. The injuries sustained from opening aluminum cans may cause the need for stitches, sterile dressing, and antibiotics. This risk affects children, as well as adults.

Drinks sold in aluminum cans avoiding the use of plastic is a trend in Asia, but aluminum cans are not without harm. Aluminum cans are not completely environmentally friendly. The production of aluminum consumes a lot of electricity and also produces some chemical emissions of greenhouse gases. Smelting aluminum emits greenhouse gases and toxins, including carbon dioxide, fluoride, sulfur dioxide, dust, polycyclic aromatic hydrocarbons, and toxic wastewater.

Drivers of the Aluminum Beverage Cans Market

In recent years, a wave of negative publicity and strong consumer opposition to disposable plastic products, especially plastic bottles, has emerged. Images of bottles overflowing the landfill and adversely affecting the ecosystem make consumers feel uncomfortable. Because aluminum cans have a higher recycling rate and more recycled content than competing products, they are gradually recognized as the best alternative.

More and more Asian countries and companies use practical actions to show their concern for environmental protection. For example, in India, Hindalco Industries Ltd, Ball Beverage Packaging (India), And Can-Pack India co-founded India’s first association of Aluminum Beverage Can, named Aluminium Beverages Can Association Of India-'ABCAI'; in Vietnam, the beverage company Winking Seal Bia Co. and TBC-Ball Vietnam Beverage Co., Ltd. and Ball Asia Pacific Co., Ltd. have jointly launched beWater, a bottled water product. The product is packaged in aluminum cans.Thus, the deepening understanding of the dangers of plastics in Asia is one of the important drivers.

Opportunities of Aluminum Beverage Cans Market

Japan and Southeast Asia are the two regions with the largest proportion of aluminum can market shares. Japan has advanced environmental awareness and attaches great importance to environmental protection. The recycling rate of aluminum cans has always been at the forefront of the world. However, due to Japan's aging population and the cost pressure of using aluminum cans, downstream demand has decreased. Therefore, in recent years, the sales of aluminum cans in Japan have been on a downward trend, and some companies have had to reduce the production of aluminum cans (for example, Showa Denko), resulting in a decrease in market share. On the contrary, the market share of the Southeast Asian region is increasing due to the increase in investment by multinational enterprises. With economic development and population growth, the region is expected to become the next growth market and bring opportunities to the market. Second, India currently has a small market share. However, the emergence of the single-use plastic ban has become policy support for aluminum cans. This forces companies that want to enter the Indian market to move in a more appropriate direction. Therefore, India's future aluminum market has great potential.

|

Southeast Asia |

Main Market |

|

South Korea |

Relatively small market |

|

Japan |

Main Market |

|

India |

Potential market |

We provide more professional and intelligent market reports to complement your business decisions.