Global Medical Aesthetics Device Market Overview

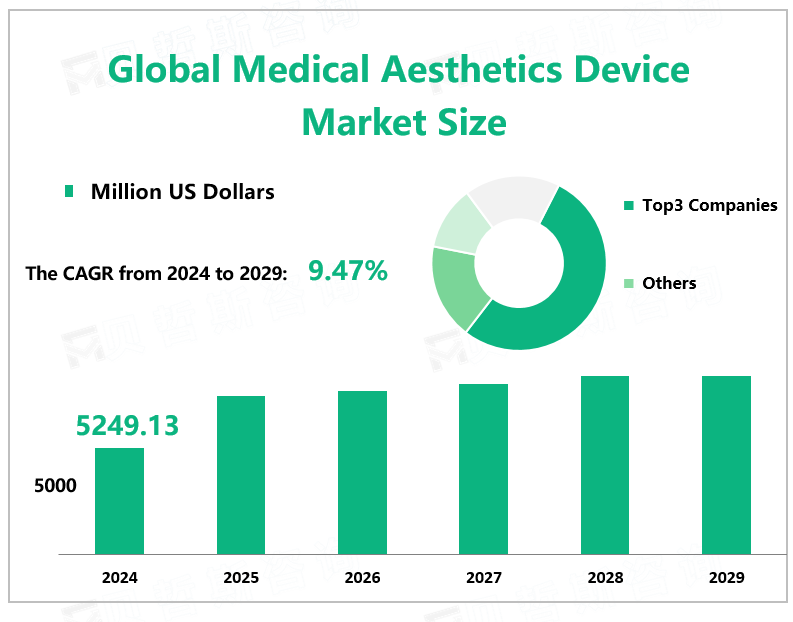

According to Global Market Monitor, the global medical aesthetics device market size will reach $5249.13 million in 2024 with a CAGR of 9.47% from 2024 to 2029.

Medical aesthetics device refers to medical equipment that repairs and remodels the appearance of a person and the shape of various parts of the human body. Medical aesthetics device is used to treat imperfections related to the aesthetic appearance of a person, such as acting on the skin, removing stains, birthmarks, red blood, hair removal, etc.

Market Drivers

Many occupations have higher requirements on appearance, such as "Internet celebrities" and celebrities. "Internet celebrity culture" is developing rapidly, and the public is paying more attention to appearance. "Internet celebrities" have higher and subtler requirements for a beautiful appearance. Medical aesthetics devices are favored by "Internet celebrities" because they can achieve freckle removal, wrinkle removal, and skin-firming effects. Film and television stars use medical aesthetic devices to enhance their appearance, thereby gaining more resources and attention. For ordinary people, many occupations also need a good image, such as sales, public relations, and so on. A good external image can bring convenience to work and increase the priority of selection.

Medical aesthetics devices do not require surgery and are highly safe, dispelling the worries of many consumers who want to look beautiful but are afraid of surgery. In addition, medical aesthetics devices are non-invasive or minimally invasive, and the recovery time is short, which will not affect the normal work and life of consumers, prompting more people to choose to use medical aesthetics devices, and its demand is expected to further increase.

Analysis of Industrial Chain

The upstream industry of medical devices is mainly spare parts manufacturing enterprises. On the whole, the cost of electronic devices is relatively high in the raw materials of medical devices and equipment in the medical industry, and the core components are the key to the upstream supply chain of medical devices and equipment in the medical industry. Most of the manufacturers of medical devices and equipment in the medical industry in China do not have the independent research and development capability of core components. All kinds of parts rely on outsourcing and then realize the integration of the whole machine. The number of Chinese local manufacturers producing core components is small, and the main supply depends on imports, resulting in the upstream core component suppliers having a high bargaining power for medical equipment manufacturers in the Chinese medical industry. China's local production of beauty instruments is the representative of the enterprise, compared with the international giants, the overall product bias is low-end production, resulting in a low overall gross profit margin, in the industry competition in a relatively inferior position.

Consumer Group Analysis

Medical beauty industry Medical device downstream industries such as medical beauty institutions and hospitals. Due to the improvement of the technical level of medical beauty products and instruments and the popularization of medical beauty knowledge, people's concept of plastic surgery and cosmetology is changing to a positive attitude and has shown a change from acceptance to enthusiasm. The consumer groups of medical devices in the medical industry are constantly expanding. The expansion of the target consumer group is first reflected in age, the medical beauty industry's customer group has expanded from 35 to 45 years old to 20 to 55 years old, secondly, it is also reflected in gender, although the main customers are still female, but male customers are significantly increased. With the continuous improvement of social recognition, the consumer group has expanded from high-end consumers to mass consumers.

|

By Type |

Laser Skin Resurfacing Devices |

|

Body Contouring Devices |

|

|

Others |

|

|

Laser skin resurfacing devices segment contributes the largest market share. |

|

|

By Application |

Hospitals |

|

Clinics |

|

|

The clinics segment occupies the biggest share. |

We provide more professional and intelligent market reports to complement your business decisions.