1,3-hexafluorobutadiene can be classified into different types based on its chemical structure and properties. For example, according to its synthesis method and structural characteristics, it can be divided into two types: polymerized and non-polymerized. Polymerized 1,3-hexafluorobutadiene can be used to synthesize polymers, while non polymerized 1,3-hexafluorobutadiene is mainly used as a dry etching gas in the electronics industry.

Overview of Market Development

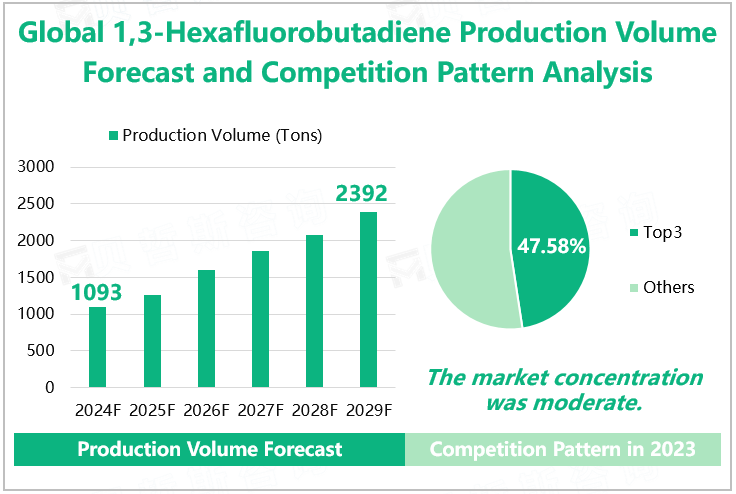

In recent years, driven by multiple factors such as increasing demand in the electronics and chemical industries, as well as technological progress, the global 1,3-hexafluorobutadiene market has shown a steady growth trend.According to our research data, the global production of 1,3-hexafluorobutadiene is expected to reach 1093 tons in 2024, an increase of 14.98% compared to 2023; The estimated production value is $410 million. It is expected that global production of 1,3-hexafluorobutadiene will continue to increase to 2392 tons by 2029.

Analysis of Market Competition Pattern

From the perspective of market competition,the concentration of the global 1,3-hexafluorobutadiene market is moderate.According to the data,the top 3 companies in the industry achieved a total output value of $167 million for 1,3-hexafluorobutadiene in 2023, with a total share of 47.58%.The top three companies are Foosung, AppFolio, and RealPage. In 2023, these three companies accounted for 25.21%, 12.51%, and 9.86% of the global market share for 1,3-hexafluorobutadiene production.

Global 1,3-Hexafluorobutadiene Production Volume Forecast and Competition Pattern Analysis

Source: www.globalmarketmonitor.com

Segmented Market Analysis

From an application perspective, due to its good chemical stability and high purity requirements, 1,3-hexafluorobutadiene has become a key material in semiconductor manufacturing processes. In addition, 1,3-hexafluorobutadiene also plays an important role in the chemical industry, used in the production of high-performance polymers and chemicals.Research has shown that the semiconductor industry is the largest downstream application market for 1,3-hexafluorobutadiene, with an expected application share of 98.22% in 2024.

From a regional perspective,the global 1,3-hexafluorobutadiene market is concentrated in three major regions: North America, Europe, and the Asia Pacific region.Among them,the Asia Pacific region is the largest consumer market.From a national perspective, Japan is the largest consumer country. Data shows that the estimated consumption of 1,3-hexafluorobutadiene in Japan in 2024 is 429 tons, accounting for an estimated 39.29% of the global total consumption.

Global 1,3-Hexafluorobutadiene Consumption and Proportion Forecast by Application and Region/Country in 2024

|

|

Consumption (Tons) |

Proportion |

|

Segmented by Application |

||

|

Semiconductor |

1074 |

98.22% |

|

Chemical Synthesis |

19 |

1.78% |

|

Segmented by Region/Country |

||

|

US |

137 |

12.52% |

|

Europe |

118 |

10.81% |

|

China |

90 |

8.26% |

|

Japan |

429 |

39.29% |

|

Others |

318 |

29.12% |

Source: www.globalmarketmonitor.com

We provide more professional and intelligent market reports to complement your business decisions.