Energy drinks are a special purpose beverage primarily designed to supplement the energy needed by the human body. The principle of supplementing energy is that after drinking energy drinks, the vitamins (usually B-class vitamins) and sugars (usually white sugar) in the drink interact with each other to convert into the energy needed by the human body, in order to supplement physical strength and relieve fatigue.

Overview of Market Development

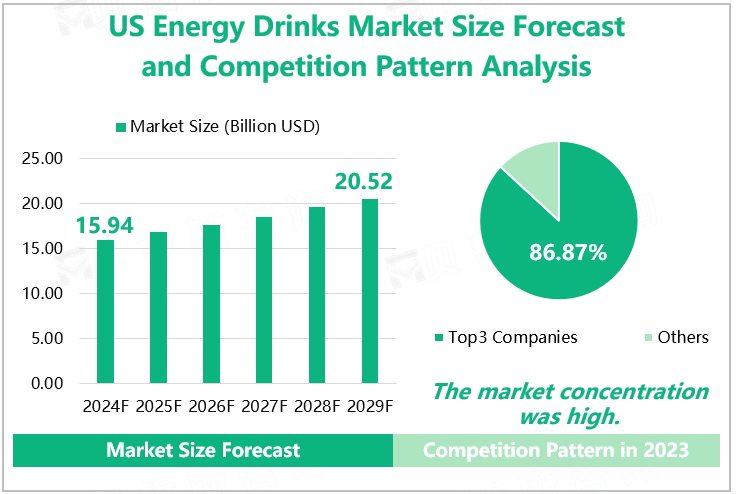

In recent years, the US energy drink market has shown a steady growth trend. According to our research data, the US energy drinks market size is expected to reach $15.94 billion in 2024, an increase of 4.97% compared to 2023. It is expected that the US energy drink market will continue to maintain a growth trend in the coming years, and the market size is expected to increase to $20.52 billion by 2029.

Analysis of Market Competition Pattern

From the perspective of market competition, the concentration of the US energy drinks market is extremely high. According to the data, the total revenue of the energy drink market for the top 3 companies in the industry in 2023 was 13.19 billion, with a total revenue share of 86.87%. The top three companies were Red Bull GmbH, Monster Energy, and Bang Energy. In 2023, these three companies accounted for 41.56%, 37.15%, and 8.16% of the energy drink market revenue in the US market, respectively.

Red Bull energy drink originated in Thailand and has a marketing history of over 40 years. With outstanding quality and functionality, the product is sold in more than 70 countries and regions around the world. With strong strength and reputation, Red Bull has created extraordinary performance and become the world's best-selling functional beverage.

Monster Energy is a high-energy drink produced by Hansen Corporation in California, officially launched in 2002. Hansen Company competes with Red Bull to capture the global market by producing high-energy beverages containing high caffeine, targeting young men as customers. The product features a black substrate with green or blue M-shaped monster paw prints.

US Energy Drinks Market Size Forecast and Competition Pattern Analysis

Source: www.globalmarketmonitor.com

Segmented Market Analysis

From the perspective of product types, energy drinks can be divided into three categories: organic, non-organic, and natural energy drinks. Organic energy drinks are made from natural ingredients and do not contain chemicals, artificial additives, synthetic coloring agents, or preservatives; Non organic energy drinks contain less than 70% organic ingredients; Non organic energy drinks refer to products that use synthetic chemicals; Natural energy drinks are typically considered minimally processed beverages that do not contain any hormones, antibiotics, or artificial flavors. Research shows that non-organic energy drinks dominate the market, with an expected market share of 73.75% by 2024.

US Energy Drinks Segment Market Size and Market Share Forecast in 2024

|

Types

|

Market Size (Billion USD)

|

Market Share

|

|

Organic Energy Drinks

|

0.70

|

4.40%

|

|

Non-Organic Energy Drinks

|

11.76

|

73.75%

|

|

Natural Energy Drinks

|

3.48

|

21.85%

|

|

Total

|

15.94

|

100.00%

|

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "2023 Global Energy Drinks Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".