US Electrical and Lighting Service Market Overview

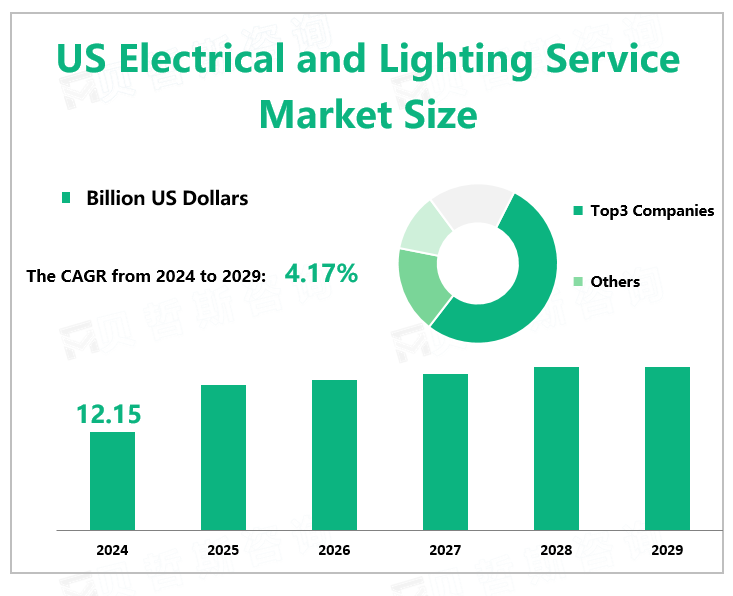

According to Global Market Monitor, the US electrical and lighting service market size will reach $12.15 billion in 2024 with a CAGR of 4.17% from 2024 to 2029. The lighting service is charged on a subscription basis, rather than through a one-time payment, and it is managed by a third party.

Market Competition pattern

The top three companies are ABM Industries, Facility Solutions Group, and OSRAM Sylvania Inc., with a market share of 20%. ABM is a leading provider of facility solutions. ABM’s comprehensive capabilities include janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, mission critical solutions, and parking, provided through stand-alone or integrated solutions. ABM provides custom facility solutions in urban, suburban, and rural areas to properties of all sizes – from schools and commercial buildings to hospitals, data centers, manufacturing plants, and airports.

Market News

In May 2024, U.S. Electrical Services completed its acquisition of Askco Electric Supply, which serves the residential, commercial, and industrial markets. Askco will be integrated into USESI's electrical wholesaler and HZ power supply area while retaining its existing operating identity.

Market Trends

The push for sustainability and reducing the carbon footprint is driving the integration of renewable energy sources such as solar and wind into the grid. Electrical service providers are involved in the installation, maintenance, and integration of these renewable energy systems, including battery storage solutions. This trend is supported by government incentives and mandates aimed at increasing renewable energy capacity. While the electrical services industry is transitioning to digitalization, which includes the adoption of smart grid technologies, IoT (Internet of Things) integration for monitoring and control, and advanced analytics for predictive maintenance, government policies, regulations, and incentives aimed at promoting energy efficiency, renewable energy deployment, and grid modernization provide a favorable environment for utility investments.

Limitations

Due to the economic downturn and high salaries offered by other related industries, some skilled workers have left the industry. There is a severe shortage of skilled electrical contractors in the United States. In addition, the company providing certain electrical installations requires certain qualifications. The increasing use of electrical smart devices and energy management systems requires electrical contractor professionals to provide new skills because they are reluctant to change due to insufficient training. With the progress of the Sino-U.S. trade war, tariffs have increased, and the cost of imported equipment has continued to increase, which has affected consumers to reduce the need to replace electrical appliances, therefore limiting the development of the American Electrical and lighting service industry.The increase in the best interest rate limits the flow of funds and undermines the spending plans of businesses and consumers. Construction projects are usually suspended, which reduces demand for industrial products and electrical and lighting services.

|

By Type |

Consulting & Designing |

|

Installation |

|

|

Other Services |

|

|

By Application |

Commercial |

|

Industrial |

|

|

Municipal |

We provide more professional and intelligent market reports to complement your business decisions.