Diketone is a chemical substance that typically refers to compounds with two carbonyl groups in their molecules. According to their different structures and properties, diketone can usually be subdivided into turmeric diketone, alpha diketone, and beta diketone.

Overview of Market Development

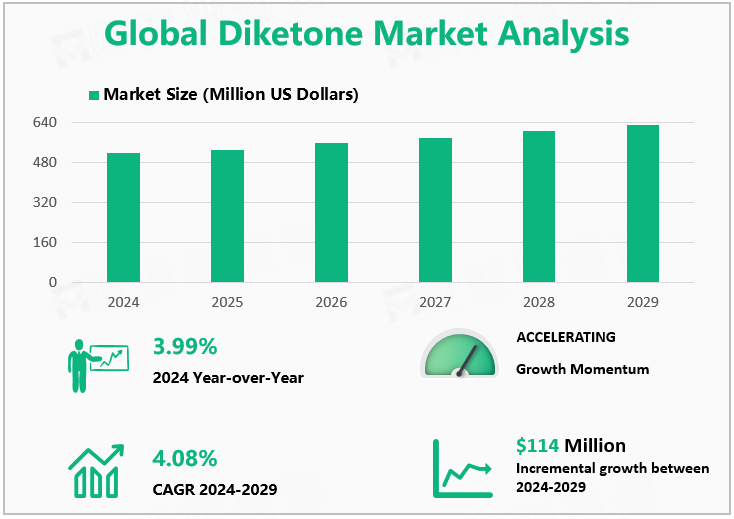

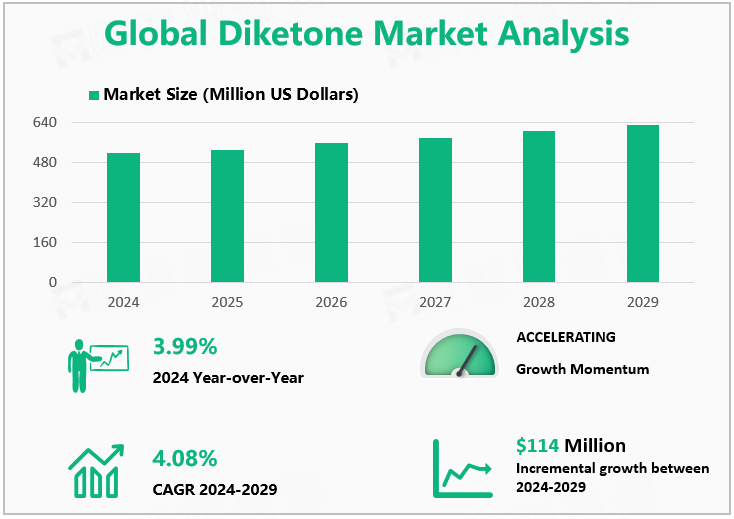

According to our research data, the estimated global diketone market size in 2024 is $515 million, an increase of 3.99% compared to 2023. In the next few years, with the continuous development of downstream fields such as food, medicine, and biotechnology, marketization is expected to continue to expand. It is expected that by 2029, the global diketone market size will increase to $629 million. The CAGR for 2024-2029 is estimated to be 4.08%.

Market Competition Pattern

From the perspective of market competition, the concentration of the global diketone market is moderate. The data shows that the total revenue share of diketone for the top 3 companies in 2023 was 33.46%. The top three companies were Lonza Group, Sito Bio, and Anhui Jiaxian Functional Auxiliary Co., Ltd. In 2023, these three companies accounted for 15.61%, 14.15%, and 3.70% of the global market revenue in the diketone market, respectively.

Global Diketone Market Analysis

Source: www.globalmarketmonitor.com

Segmented Market Analysis

From the perspective of downstream application patterns, diketone is mainly used in fields such as food, pharmaceuticals, and biotechnology. Among them, the pharmaceutical industry is the largest downstream application market. Data shows that the estimated consumption of diketone in the pharmaceutical industry in 2024 is 8282.1 tons, accounting for an estimated 40.13% of total sales.

From a regional perspective, the global diketone market is mainly concentrated in North America, Europe, and the Asia Pacific region. Among them, the Asia Pacific region is the largest consumer market. From a national perspective, China is the largest consumer country. Data shows that the estimated consumption of diketone in the Chinese market in 2024 is 5828.2 tons, which is expected to account for 28.24% of the global total consumption.

Global Diketone Consumption and Proportion by Application and Region/Country Forecast in 2024

|

|

Consumption (Tons)

|

Proportion

|

|

Segmented by Application

|

|

Food

|

1042.2

|

5.05%

|

|

pharmaceuticals

|

8282.1

|

40.13%

|

|

biotechnology.

|

6820.9

|

33.05%

|

|

Others

|

4492.9

|

21.88%

|

|

Segmented by Region/Country

|

|

US

|

4629.1

|

22.43%

|

|

Europe

|

4934.6

|

23.91%

|

|

China

|

5828.2

|

28.24%

|

|

Japan

|

1900.8

|

9.21%

|

|

India

|

891.6

|

4.32%

|

|

Southeast Asia

|

738.8

|

3.58%

|

|

Latin America

|

641.8

|

3.11%

|

|

Middle East & Africa

|

447.8

|

2.17%

|

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "2023 Global Diketone Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".