The process of treating deactivated or partially deactivated catalysts to partially restore their catalytic activity and selectivity is called catalyst regeneration. The regeneration process does not involve the disintegration of the overall structure of the catalyst, but the removal of the factors leading to catalytic degradation by appropriate means, such as the removal of toxins on the catalyst, dust covering the catalyst surface, and sediments formed on the surface of the catalyst or inside the pores due to side reactions, etc. Not all deactivated catalysts can regenerate, depending on the cause of their inactivation.

At present, there are two methods of

catalyst regeneration treatment after deactivation: on-site regeneration and

factory regeneration (off-site regeneration). This process is the same as that

experienced in Europe and the US at the beginning, but the US has no longer

adopted the on-site regeneration method since 2005 because it’s extremely

dangerous, easy to cause on-site environment and water pollution and the total

cost is too high, and more and more countries have adopted the off-site regeneration

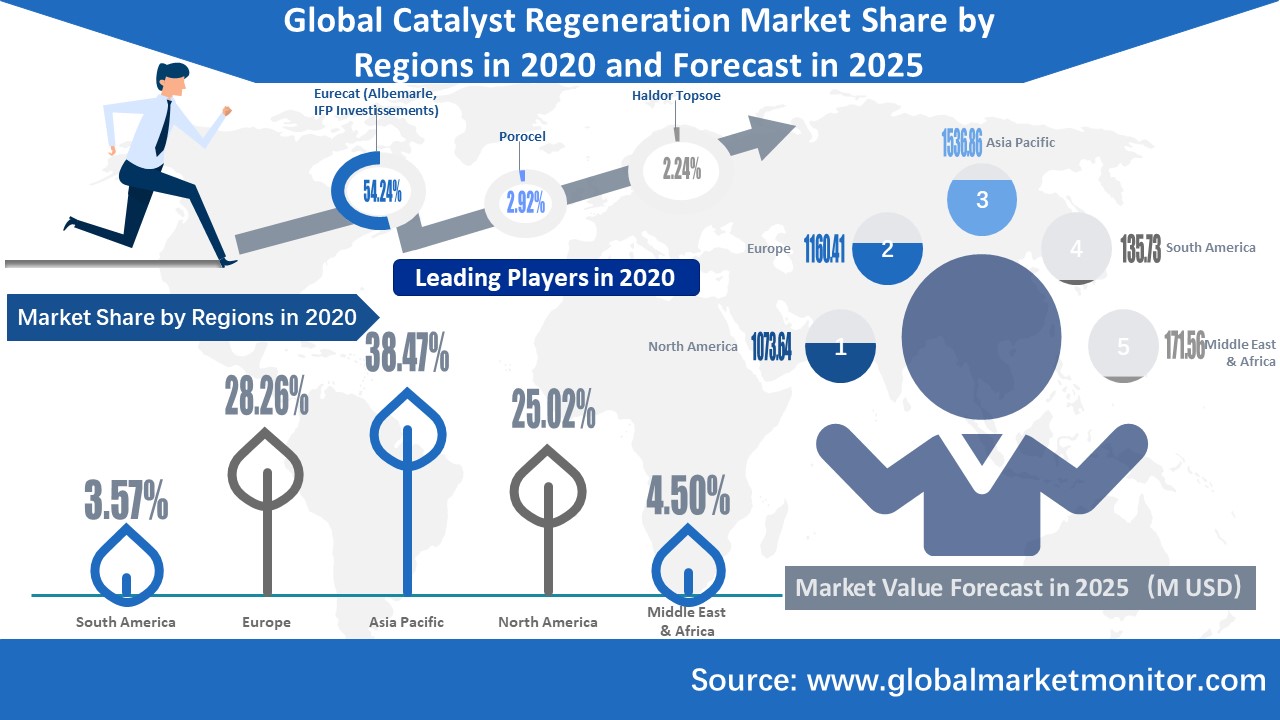

method. In 2020, the global market share of catalyst off-site regeneration was

up to 84.94%

Global Catalyst Regeneration Market Status Analysis and

Prospect Forecast

The global catalyst regeneration market was valued at $2.462 billion in 2015 and will increase to $3.056 billion by 2020. The annual growth rate between 2015 and 2016 was 6.28%; In 2019-2020, it fell to -1.51%. Based on this, we perform a series of functional calculations and derive the data for the next five years using a scientific model. Finally, we predict that the global catalyst regeneration market will reach $4.078 billion by 2025.

The

Catalyst market in Asia Pacific was valued at $1.106 billion in 2020, making it

the industry's largest market by revenue with a market share of 38.47%. Europe

and North America ranked second and third with 28.26% and 25.02% market share

respectively. The industry's leaders, the top five companies in the world, are

all from Europe and the US. Among them,

Eurecat (Albemarle, IFP Investissements) from France ranks the first in the

catalyst regeneration industry in the world in 2020 with a market value of

$1.699 billion, accounting for more than half of the global market share

--54.24%. Porocel from the US and Haldor Topsoe from Denmark occupy the second

and third positions in the market respectively.

Asia Pacific and Europe are the two largest markets in this industry. Europe is a gathering place of developed industrial countries and is the origin of the industrial revolution. Technology and R&D ability are at the forefront of the world. In recent years, the aging population has restricted the development of the European market; while the Asia-Pacific region has benefited from the economic strength of emerging economies such as China, industrial construction, urbanization and manufacturing development have all result in high demand of catalysts. In addition, the Asia-Pacific is also a densely populated region. Relatively speaking, with the development of the economy, the potential consumption power will become stronger and stronger, making it one of the world's major consumer markets. According to data from the European Union, the number of middle-class in the Asia-Pacific region will exceed that of North America and Europe. Therefore, the region is expected to bring development opportunities for the industry.

Get the complete sample, please click:https://www.globalmarketmonitor.com/reports/762454-catalyst-regeneration-market-report.html

The Impact of COVID-19 on the Global Catalyst Regeneration

Industry

The

impact of the pandemic on the industry was mainly due to the negative impact on

downstream operations, resulting in delays in production. Some measures have

been taken to control the traffic in areas with severe epidemics. The

inconvenience of transportation has also led to the delay in the delivery of

raw materials. Even in areas where the outbreak was relatively mild and normal

operations could be carried out, companies faced shortages of raw materials and

below-normal capacity utilization. Disruptions to the production supply chain,

such as shortages of raw materials, increased volatility in raw material

prices, and Labor shortages, are expected to intensify as factories are closed

elsewhere due to the need to protect workers and help contain the spread of

Novel Coronavirus. In addition, sales of catalyst regeneration have been

affected due to movement restrictions. The expected drop in demand may cause

some catalyst regeneration manufacturers to adjust production throughout the

year. All in all, various negative effects may cause the industry growth rate

to decline in the short term.

While

the current shutdown is disruptive, there will be some need for catalyst regeneration

later this year. However, in the long term, because COVID-19 is so contagious,

there is a high likelihood of another outbreak. If the epidemic breaks out

again, it will increase the financial risk of enterprises or trigger

corresponding default risk and financial risk of enterprises. Therefore, the

ultimate impact of the epidemic on the industry will depend on how the epidemic

develops.

We provide more professional and intelligent market reports to complement your business decisions.