Dibutyl Fumarate (DBF) is a kind of solvent with strong ability,

is also very important raw materials of chemical industry, comonomer and organic

synthesis intermediates, which can be made of fumaric acid from n-butyl alcohol

by esterification reaction was prepared, its molecular formula is C12H20O4,

molecular weight of 228.2848 and it is a colorless transparent liquid, with the

characteristics of micro relish, slightly soluble in water.

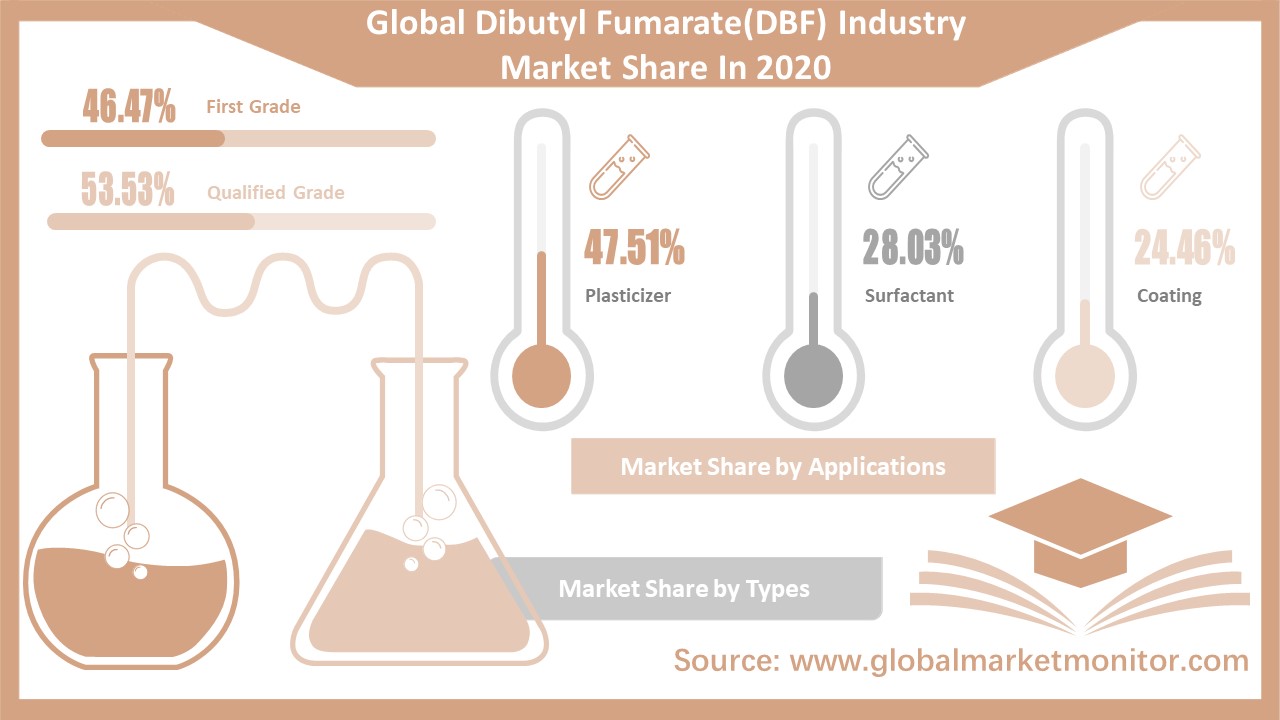

Dibutyl Fumarate (DBF) is commonly used as plasticizer,

surfactant and coating in different application fields. DBF is very difficult

to self-polymerize, as an internal plasticizer, it copolymerizes with various monomers such as vinyl acetate, styrene,

vinyl chloride, acrylate,etc.. The copolymer can be used to enhance the

plasticity of the object; Surfactant is

a compound used to reduce the surface tension (interfacial tension) between two

liquids, between gases and liquids, or between liquids and solids. It can be

used as detergents, wetting agents, emulsifiers, foaming agents, and

dispersants. Coating is a viscous liquid made from resins, oils or emulsions,

organic solvents or water, which is applied to the surface of an object for decoration

or protection and forms a continuous film that adheres to the object to be

coated. Among the three applications,

dibutyl fumarate was the most common used as plasticizer, accounting for 47.51%

of the market in 2020, compared with 28.03% for surfactants and 24.46% for coatings.

The Asia-Pacific region is the largest revenue market for the

global dibutyl fumarate industry, accounting for more than half of the global

market. In 2020, Asia Pacific accounted for 53.75% of the market share in the

industry, and its market share is expected to increase over the forecast period

to 57.60% by 2025. In March 2020, manufacturing PMI in Asia rebounded 5.9% points

from February to 48.8%, showing a significant month-on-month increase.The manufacturing PMI of China rebounded significantly due to the effective containment of

the epidemic in China and the release of the effects of policies related to the

resumption of production, leading to a rebound in the Asian manufacturing PMI,

which remained below 50%. The impact of COVID-19 has been more pronounced in

other Asian countries. Manufacturing

PMIs in South Korea, Japan and Singapore fell by more than 3% points. PMI

declines were more pronounced in Vietnam, the Philippines and Myanmar; Indian manufacturing PMI fell by less than 3% points and remained above 50%. It is

expected that the impact of the epidemic on The Asian economy will continue to

be felt in the later period, especially in developing countries in Asia, where

the economic foundation is relatively weak and the internal and external impact

of the epidemic will be relatively large. The economic recovery in China is the key

to manufacturing recovery of Asia.

Europe and North America ranked second and third with 21.01%

and 18.76% market share respectively, while South America, the Middle East and

Africa had a very low market share of 3.58% and 2.91%.

The top 3 enterprises in the industry are Polynt, HANERCHEM and Liaoning Yingkou Xinghuo Chemical CO.,Ltd. Polynt is from Italy and HANERCHEM and Liaoning Yingkou Xinghuo Chemical CO.,Ltd are both from China. Polynt has been engaged in the production, marketing, research and development of organic anhydride and it has derived for more than 60 years. It has expanded to four continents through its manufacturing and commercial structure to provide innovative, sustainable solutions to its customers; HANERCHEM is a professional manufacturer of chemical products and is a scientific and technological enterprise integrating scientific research, production and sales both at home and abroad. The company has senior experts, experienced operation and technical personnel and excellent after-sales service team. Products are widely used in coatings, ink, adhesives, resin synthesis, polymer modification, washing, electroplating and other industries; Liaoning Yingkou Xinghuo Chemical CO.,Ltd., founded in 1993, is a fine Chemical enterprise integrating research and development, production and sales. After years of efforts, the company has formed 5 series of more than 50 varieties of products. In 2020, the market share of these three companies in the global dibutyl fumarate industry was 24.27%, 19.27% and 13.09%. As the top three companies account for more than half of the global market, the industry is highly concentrated.

Get the complete sample, please click: https://www.globalmarketmonitor.com/reports/762628-dibutyl-fumarate-market-report.html

Research data show that the global market value of dibutyl

fumarate industry was $134.99 million in 2015, and then began to decline

sharply, from $76.30 million in 2016 to $11.48 million in 2020. Based on this

data, and combined with the industry development law, we carried out a series

of function operations, scientific derivation of the next five years of data. Finally,

it is predicted that the total market value of the global dibutyl fumarate

industry will decrease year by year from 2021 to 2025, and only reach $3.32

million in 2025.

A Number of Enterprises Have Stopped the

Mass production of Dibutyl Fumarate, Industry Development Space Has Become Smaller

From the end of 2019 to the beginning of 2020, due to the

outbreak of the novel coronavirus, factories and enterprises of all sizes have

delayed the resumption of work under the requirements of national policies due

to the high infectiousness of the coronavirus, and a large number of

enterprises cannot operate normally. The deterioration of the global economy

will inevitably affect various industries and have a huge impact on downstream

enterprises. The downstream plasticizer industry chain is one of the main

applications of dibutyl fumarate. On August 18, 2020, our analyst team called

the sales manager of Hangzhou Qianyang Technology CO.,Ltd for a telephone

interview and learned that the company had stopped producing dibutyl fumarate

products in the first half of 2020. At present, the products sold on the market

are historical inventory products. On the same day, the analyst team called the

sales manager of Hangzhou Hairui Chemical Co., Ltd. and learned that the

company had stopped the mass production of dibutyl fumarate products in 2018. These

two companies are the industry leaders, among the top six companies in the

industry, and their reduction of dibutyl fumarate production has undoubtedly

slowed the development of the industry.

Get the complete sample, please click: https://www.globalmarketmonitor.com/reports/762628-dibutyl-fumarate-market-report.html

We provide more professional and intelligent market reports to complement your business decisions.