Public

works software refers to software that is not copyrighted. It is a special case

of non-copylefted free software, meaning that some copies or modifications are

no longer free. Public works software helps oversee the organization\'s

management of public works data, assets, maintenance schedules, regulatory

compliance, labor and material costs, and more.

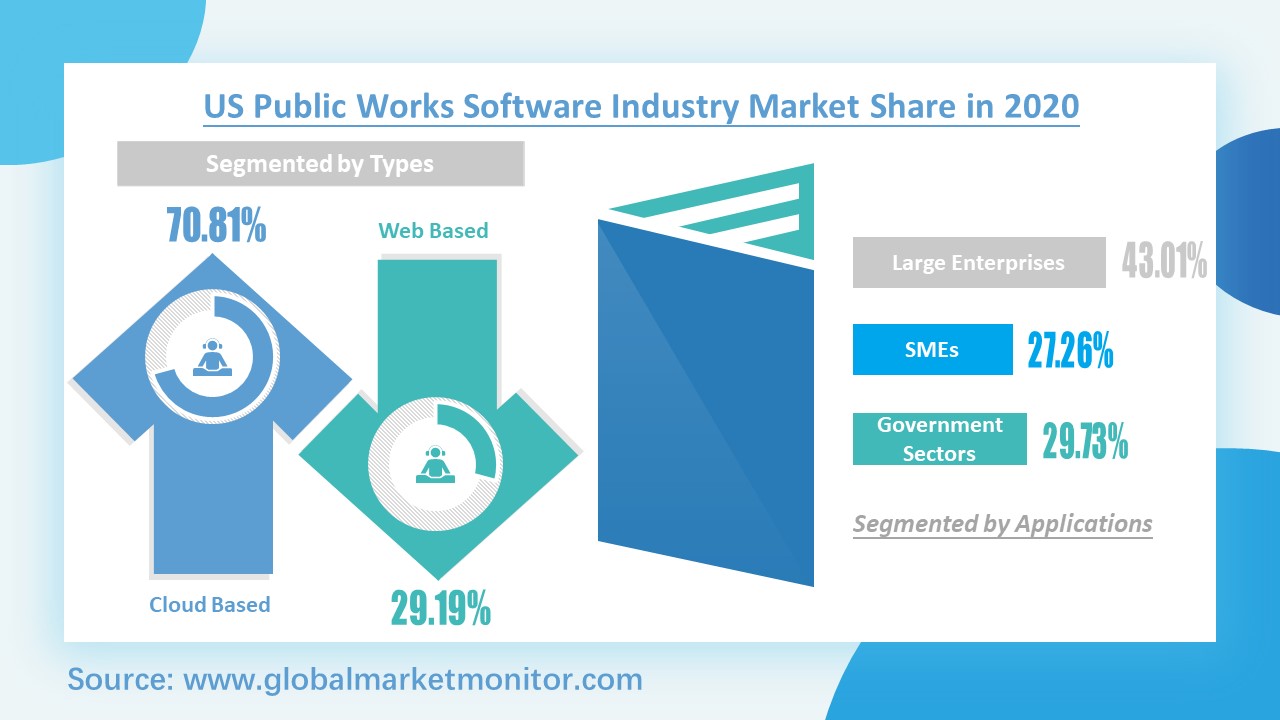

Public

works software can be divided into cloud - based software and network - based

software. Cloud-based public software is similar to a Web application that

accesses an online service over the Internet, but it never relies on a Web

browser to run, instead running on cloud data that can be operated in offline

mode. Web-based public software uses HTTP (Hyper Text Transfer Protocol) as its

primary communication Protocol and only operates when there is an active

Internet connection. In addition, such applications are primarily designed to

be accessed through a Web browser. Among

the two categories, cloud-based public software is widely used. In 2020, it

accounted for 70.81% of the market in the US public works software industry,

much higher than the market share of web-based public software.

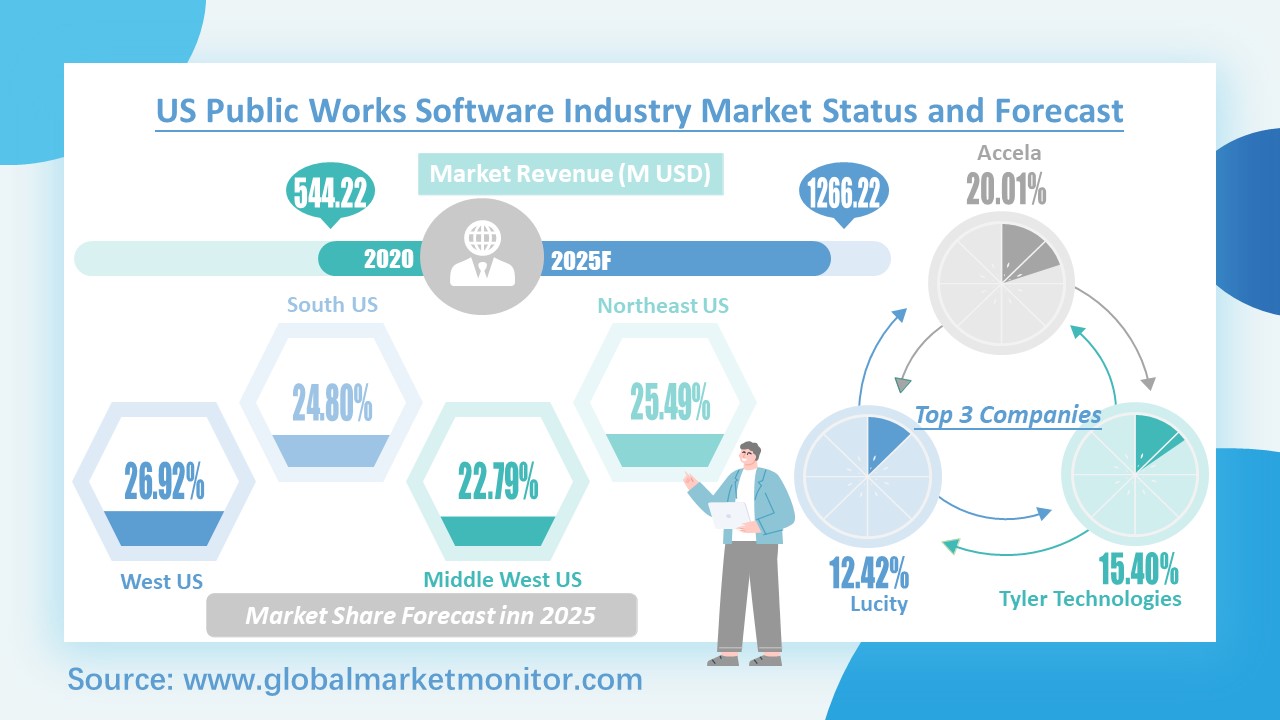

In

terms of market share of each region, resources of the public engineering

software industry in the United States are evenly distributed, and there is no

centralized distribution in a certain region. The western region is the

industry\'s largest revenue market, with a market share of 27.29% in 2015 and a

slight decline to 26.99% in 2020. In 2020, the Northeast ranked second with

$139.79 million in market revenue, accounting for 25.69% of the market. In

addition, the Midwest will be the fastest-growing market in the industry, with

its market share expected to increase to 22.79% by 2025, while all other

regions will lose market share. The

middle east US owns Chicago, the third largest city and is located in the Great

Lakes region of North America. According to the data of the US Bureau of

Economic Analysis in 2018, the per capita PEC and economic development level of

the central and western regions are relatively high, which can provide a good

economic foundation for the development of the public works software

industry.

The

top three companies of U.S. public works software industry are Accela, Tyler

Technologies and Lucity, with the market shares of 20.01%, 15.40% and 12.42%,

respectively,in 2020.

In-depth research report on ${Public Works Software} market: https://www.globalmarketmonitor.com/reports/762770-public-works-software-market-report.html

Accela

provides a market-leading SaaS solution platform that enables state and local

governments to build thriving communities, attract and grow businesses, and

protect citizens. From planning, construction and licensing, to asset and

service request management, finance, environmental health and more, the SaaS of Accela offerings level the playing field for small and medium governments and

enable small organizations to use the same software as large cities. Supported

by Microsoft Azure, its open and flexible technology can help

organizations address specific needs today, while ensuring they are prepared

for any emerging or complex challenges in the future.And its solutions serve

more than 80% of the largest metropolitan areas in the United States.

Tyler

Technologies, a leading provider of End-To-End information

management solutions and services for local governments, works with customers

to empower the public sector -- cities, counties, schools and other government

entities -- to be more efficient, convenient and responsive to the needs of

their constituents. Supporting the enterprise asset and maintenance management

needs of hundreds of municipalities and thousands of users across the country.

Lucity

provides enterprise asset and maintenance management services to hundreds of

municipalities and thousands of users across the country, providing integrated,

flexible and scalable GIS and web-enabled Office-To-Mobile software

solutions for local governments and public works.

According

to our research, the market value of the US public works software industry was

$222.29 million in 2015 and grew to $544.22 million by 2020. Based on this, we

did a series of functional calculations and derived the data for the next five

years with a scientific model. Finally, we predict that the market value of the

US public works software industry will reach $1.27billion by 2025. From 2020 to

2025, the US public works software industry market will grow at a CAGR of

18.40%. The industry will develop rapidly during the forecast period.

Digital Twin Model Brings Development Opportunity to Public

Works Software Industry

The

digital Twin model aims to build a new collaborative digital workflow that

better serves planners, engineers, and urban stakeholders in public works,

utilities, asset management, and development. For example, digital urban

planning can use digital twin models to achieve more efficient city and

regional operations. Digital Twin Model Cloud services fully integrate the

digital environment, digital components and information of the digital age to

provide an intuitive, immersive 4D environment, creating a continuously updated

digital twin model of the infrastructure for the entire life cycle of the

asset. For infrastructure professionals, the 4D digital twin model can

effectively facilitate the development of BIM and GIS.

In-depth research report on ${Public Works Software} market: https://www.globalmarketmonitor.com/reports/762770-public-works-software-market-report.html

We provide more professional and intelligent market reports to complement your business decisions.