As a part

of a soft damping suspension system, air springs have ideal non-linear elastic

characteristics. It provides both softness and damping characteristics by

utilizing the compressibility and flow resistance of air, used as secondary

suspension systems between the bogie and the wagon in railway vehicles like

trains, bullet trains, metros, light rail systems. After the height adjustment

device is installed, the vehicle height does not change with the increase or

decrease of the load.

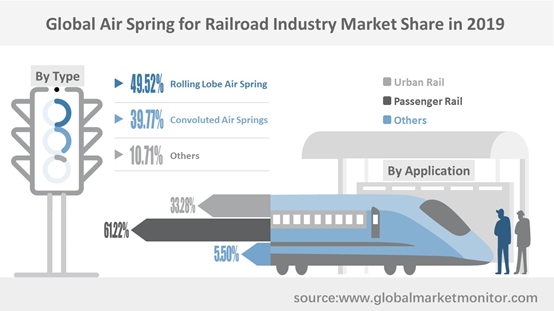

Air

springs can be divided into convoluted air springs and rolling lobe air springs

according to the structure type. The convoluted air spring uses one

to three shorter bellows, with the multiple units being reinforced by a girdle

hoop. Convoluted air springs are capable of several times the force of a

rolling lobe version and longer life cycle rating, but have the less usable stroke

to work with. The rolling lobe air spring uses a single rubber bladder, which folds

inward and rolls outward, depending on how far and in which direction it is

moved. The rolling lobe air spring is available with very high usable stroke

length—but it is limited in strength because of its tendency to bulge, and

therefore, has limited force capacity.

Passenger rails running between cities usually use air springs for railroad to ease the interaction between wheels and rails, improve the stability and comfort of vehicle operation, and extend the service life of vehicle parts and rails. In addition, air springs for railroad are commonly applied in various local rail systems that provide passenger transport services in and around cities or suburbs, such as trams, light rails, rapid transit, monorails, and commuter rails. The air spring suspension system has many advantages that steel coil springs do not have, which is more and more widely used as a secondary suspension device to significantly improve the operational stability of the vehicle system, greatly simplify the bogie structure, and make the bogie lightweight and easy to maintain.

As an important part of the urban transportation system, urban rail is also one of the main ways to solve the diseases of big cities, which is constantly developing in the direction of high speed, light weight and low noise. The global intercity high-speed rail and urban rail transit are still in the stage of continuous expansion, which will drive the demand for air springs for railroad. With the continuous development of the global economy, the strengthening of regional economic links, and the expansion of urban agglomerations, the rail transit industry will face long-term demand, which also means that the market demand for air springs for railroad will continue.

Prospect Analysis of Air Spring for Railroad Industry in Various Regions

After a period of development, Air Spring for Railroad industry have entered a mature period, with relatively high concentrate rate. the top three companies, Continental, Zhuzhou Times and Bridgestone, accounted for 30.59% of the market share, 11.36%, 10.23% and 9.01% respectively.

Europe was the largest revenue market with a market share of 34.31% in 2015 and 33.48% in 2020 with a decrease of 0.83%. China ranked the second market with the market share of 22.78% in 2019. Development of economy, increase downstream demand, technology innovation progress in emerging economies such as China have led to an increase in demand.

Get the Complete Sample, Please Click: https://www.globalmarketmonitor.com/reports/763063-air-spring-for-railroad-market-report.html

Asia and Europe are the two continents with the largest market share of air springs for railroad. Rail transit infrastructure projects will become key investment areas of governments, especially inter-city high-speed rail and inter-city rail transit. COVID-19 is having an impact on the air springs of the European railway industry. This impact will continue, increasing the instability and vulnerability of European economic development. As of 2018, the global high-speed rail operating mileage is about 38,000 kilometers, of which China high-speed rail operating mileage is 25,000 kilometers, accounting for 66.3% of the global high-speed rail total, much higher than other countries in the world. In 2019, new high-speed rail mileage of China exceeded 4,000 kilometers, still maintaining a rapid growth rate. At the same time, the new infrastructure proposed by the Chinese government focuses on rail transit and 5G, which will stimulate the Chinese market demand for air springs for railroad. The United States is the country most severely affected by the epidemic. Affected by the decline in supply and demand, the US manufacturing industry has slowed down significantly and market prices have fallen.

Air Spring for Railroad Market Development Forecast

During the epidemic, the slowdown in manufacturing activities, the weak rail transit market, and the interruption of the supply chain had a negative impact on air springs for railroad and limited its development. However, as the disaster situation is gradually brought under control and market sentiment returns to stability, in the long run, the development of urban rail transit will have a continuous demand for railway air springs.

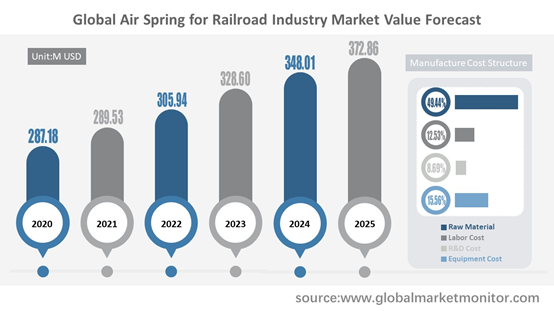

According to the research, the global Air Spring for Railroad market has a total Production value of 233.39 M USD back in 2015, and increased to 287.18 M USD in 2020. Thanks to the development of the rail transit industry and the excellent characteristics of air springs for railroad, as well as the government support for infrastructure, it is expected that the global air spring for railroad market will experience moderate growth. We made the prediction that the value of Air Spring for Railroad markets can be 372.86 M USD by 2025. The CAGR of Air Spring for Railroad is 5.36% from 2020 to 2025.

In the manufacture

structure of air springs for railroad, raw materials, labor costs, R&D

costs and equipment costs accounted for 49.44%, 12.53%, 8.69% and 15.56%

respectively. It can be seen that its output is mainly restricted by raw

materials, of which rubber accounts for about 70% of raw materials, and metal

parts account for about 25% of raw materials. We can foresee that price of raw

materials of air spring for railroad will continue to rise in the future, which

brings challenges to enterprises in the industry.

In

addition, air springs for railroad, as the upstream industry of railways and

other infrastructures, are facing continuous demand and will develop towards

intelligence and digitization. The application of continuously updated chip

technology in air springs has brought development opportunities to

manufacturers. At the same time, manufacturers should also focus on improving

quality to ensure the safety of the railway industry.

We provide more professional and intelligent market reports to complement your business decisions.