Sportswear

or active wear is clothing, including footwear, worn for sport or physical

exercise. Sport-specific clothing is worn for most sports and physical

exercise, for practical, comfort or safety reasons.

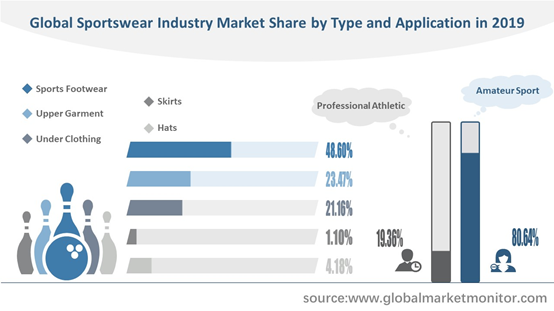

Common

sportswear mainly includes sports footwear, upper garment, under clothing,

skirts and hats. Sports footwear are shoes primarily designed

for sports or other forms of physical exercise but that are now also widely

used for everyday casual wear, occupying most of the market with 48.60% in

2019. Upper garment is tops, typically made of lightweight stretchable

fabric, worn for sport or informal wear. Under clothing are a casual

variety of soft trousers. Skirts for sports is a pair of shorts with a

fabric panel resembling a skirt covering the front, or a skirt with a pair of

integral shorts hidden underneath. Beanies are common in winter

sports such as skiing and snowboarding to help with warmth. Baseball caps are

mainstays in popular summer sporting activities like golf, tennis and of course

baseball, as they shade the eyes and head of players from the sun and the rays.

Sportswear is often designed separately for professional sports and amateur sports. Professional athletes are people with natural talent, stamina, and competitive drive, as well as excellent reflexes and coordination. They are paid according to the time of the game and training, but amateur sports are sports in which participants engage largely or entirely without remuneration. Due to the wide range and large number of amateur sports, the market shares of sportswear used for amateur sports is as high as 80.64% in 2019.

Sports have always been valued by the public, so in the clothing industry, sportswear also occupies a broad market. In recent years, with the promotion of national policies, the increase of human leisure time and the enhancement of health awareness, the global sportswear industry market will further expand.

Prospect Analysis of Sportswear Industry in Various Regions

With mature economic development and strong national health awareness, developed countries in North America, mainly the United States and Canada, have become the largest revenue market, with market shares of 38.86% and 37.23% in 2015 and 2019 respectively. The market value of sportswear in Asia-Pacific region is second only to North America, with a market share of 30.81% in 2019, an increase of 3.36% compared with 2015. The European market has gradually matured, ranking third with a market share of 23.96%. In the future, the Asia-Pacific region is expected to become the fastest growing region in sportswear market.

Get the Complete Sample, Please Click: https://www.globalmarketmonitor.com/reports/763074-sportswear-market-report.html

Although in 2020, due to the strong impact of the new coronavirus, the stock market fell sharply, and the economies around the world, including North America and Europe, were severely damaged. The cancellation of sports and cultural activities also had a serious impact on the sportswear market.

The upper, middle and lower reaches of the sportswear industry have formed leaders, and the leading position of top brands has continued to deepen. The top three companies are Nike, Adidas and V.F Corporation, which accounted for 39.29% of the market in 2019, 20.45%, 13.42% and 5.42% respectively. Under the double blow of the new crown epidemic and national protests, the American sports brand giant Nike posted its first quarterly loss in two years. In the fourth quarter of fiscal 2020, operating income of Nike reached 6.313 billion U.S. dollars, lower than the expected 7.38 billion U.S. dollars, down 38.14% year-on-year. The sportswear industry has both opportunities and challenges during the epidemic.

With the increase of human health awareness in developing regions and the guidance of national policies, more and more people join the ranks of physical exercise. In these areas, the number of professional sports has increased, and the number of marathon participants has increased rapidly; the number of daily exercise and fitness groups has increased, and downloads of fitness software and fitness videos have also increased. The rise of the sports crowd directly drives the growth of demand for sportswear. China current sports population is currently about 430 million people. China sports industry accounts for approximately 1.9% of GDP. According to the national plan, it is to increase to 3%. Therefore, the sports crowd and the scale of the sports industry have great potential for growth.

The Market Demand of Sportswear Industry Continues to Increase, with Great Development Potential

For the larger sportswear companies in the industry, capacity reduction is the biggest problem in the development of the epidemic. For the smaller sportswear companies in the industry, they face the problem of inventory backlog during the epidemic.

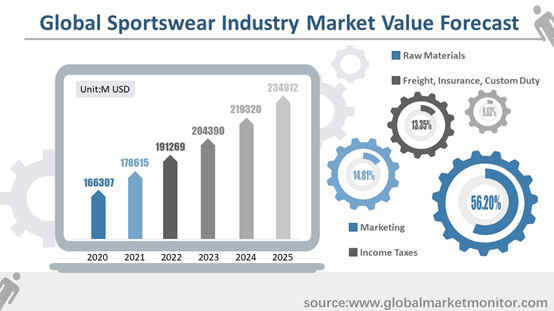

As far as the manufacture cost of the sportswear industry is concerned, expenditures on raw materials, freight, marketing and income tax accounted for 56.20%, 13.35%, 14.81% and 8.63% respectively. It can be seen that its development is mainly restricted by raw materials. As factories need to protect workers and help curb the spread of the COVID-19 virus, as the factory closes elsewhere, the damage to the production supply chain is expected to intensify further, such as shortages of raw materials and increased raw material price fluctuations. Although the current shutdown is disruptive, some demand for Sportswear will appear later this year.

The biggest opportunity COVID-19 has brought to the sports industry is the shift in health concepts of consumers. The mass sports consumption habits and kinetic energy activated by the epidemic will benefit the Sportswear industry in the future. Consumers are expected to increase their health awareness after the epidemic, pay more attention to the improvement of their physical fitness and immunity, and increase physical exercise and other activities, which will benefit the sales of Sportswear products.

According

to the survey, the global sportswear industry market value was $126019 million

in 2015, rising to $166307 million in 2020. We forecast that the global

sportswear market will be worth $234.912 million by 2025.

With the

extension of the depth and breadth of national sports and the upgrading of the

consumer market, consumers have higher requirements for the professionalism and

functionality of products, paying more attention to the design beauty and

fashion components of clothing, making the application fields of sportswear

products more extensive and daily. Sportswear companies continue to expand

downstream regions and markets, add fashion elements to their products, form

new consumer trends, and drive the development of the sportswear industry.

We provide more professional and intelligent market reports to complement your business decisions.