Managed Security

Service Providers (MSSPs) are platforms that provide customers with continuous

and efficient security monitoring and operation management services. Managed security

services can quickly respond to various security risk events of security

products such as hosts, networks, applications and data, use security

orchestration automation and response technology for intelligent classification

and efficient operation and disposal, and conduct continuous risk monitoring

and leakage monitoring for cloud assets. At the same time, it provides an

emergency guard team for all-weather security guarantees to improve user

operation efficiency.

With the

development of the Internet, more and more companies need to outsource the

security operation and maintenance of their business systems to external

professional security service providers to obtain comprehensive and secure

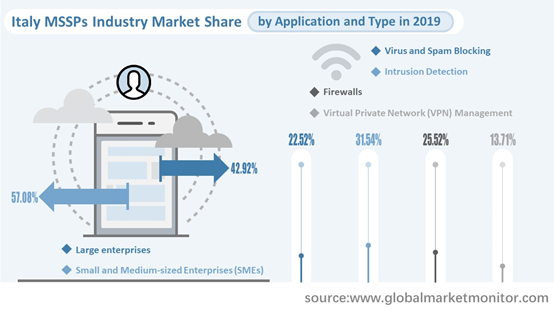

protection. The service can be divided into virus and spam blocking, intrusion

detection, firewalls, virtual private network management and others, according

to different needs. Among them, intrusion detection accounted for the widest

market, with a market share of 31.54% in 2019.

Whether it is a small or medium-sized enterprise, or a large enterprise, they choose a managed security service provider. In Europe, SMEs are defined as companies with fewer than 250 employees and an annual turnover of not more than 50 million euros, or companies with a total balance sheet not exceeding 43 million euros. Large companies usually employ more than 250 people, with multiple offices at home and abroad. Some multinational companies, such as Wal-Mart, Apple, Amazon, etc., are large companies. Large companies usually have considerable profits, a certain industry position, and relatively large local or international influence. Despite the higher turnover of large companies, there are more SMEs with more total market share, accounting for 57.08% in 2019 in the managed security service provider industry.

After a period of development, the industry is at a growing stage. With the continuous upgrading of products and the development of technology and economy, the market continues to expand. Italy MSSPs has become primarily a competitive market. Some large multinational companies have stepped into the Italian market one after another, using their capital advantages, technical strength and brand effect to strengthen the competitive landscape.

Analysis on the Current situation of MSSPs Industry in Various Regions of Italy

Italy MSSPs companies are mainly from USA; the industry concentrate rate is moderate. The market share of the top five companies in 2019 was 28.08%. The top three companies are IBM, Kaspersky, DXC Technology with the revenue market share of 7.51%, 5.87% and 5.58% in 2019.

Get the Complete Sample, Please Click: https://www.globalmarketmonitor.com/reports/763084-managed-security-services-providers-(mssps)-market-report.html

Northern Italy is the most developed and productive region of the country, and one of the regions with the highest GDP per capita in Europe. The leading economic cities such as Milan, Turin and Genoa are all in the north, with outstanding economic advantages and a wide market. Therefore, northern Italy has become the largest revenue market with a market share of 58.49% in 2015 and 57.89% in 2019, with a decrease of 0.60%. However, the economy of central and southern Italy is largely dependent on tourism with a small market. In 2019, they only accounted for 26.14% and 15.97% of the market share in the MSSPs industry, ranking second and third.

The continuous development of cloud computing, social media, wireless connectivity, e-commerce, and big data poses a greater threat to the security of information systems. The protection of the physical and operational layers is no longer sufficient to solve vulnerabilities and attacks. Cyber threats continue to rise, driving the demand for managed security services. In addition, Italian government proposed the first National Cyber Security Framework (NCSF) in 2015, which indirectly encourages companies to actively explore appropriate managed security services.

During the epidemic, due to the rapid development of the Internet, global communication was not greatly affected. Therefore, the COVID-19 outbreak has little impact on the Italian MSSPs industry.

High Market Demand and Wide Prospects for Italy MSSPs

The growth of the Italy MSSPs market is driven by the downstream demand market. The ongoing cybercrime incidents of this country have led large corporations to invest aggressively in cybersecurity services to better address potential threats.

Italian

rapidly growing economy, increasing population, and growing market demand are

playing a positive role in the expansion of the Italy MSSPs market. According

to our research, the Italy MSSPs market has a total revenue of 284.68 M USD

back in 2015, and increased to 498.16 M USD in 2019. We made the prediction

that the value of Italy MSSPs markets can be 1155.40 M USD by 2027. The CAGR of

Italy Managed Security Services Providers is 10.71% from 2019 to 2027.

Maintenance

and operation costs, R&D and labor costs, marketing costs, and equipment

costs in this industry account for 34.41%, 23.79%, 14.98%, and 18.71% of the

cost structure of companies, respectively. This shows the importance of science

and technology for managed security services in Italy, hence technological

innovation advancements will boost the provider market. The production of

higher quality and more affordable products by companies will be one of the

opportunities to expand the market share in the future. At the same time,

competition in new regions is likely to become more intense, which could be a

factor hindering the growth of the market.

We provide more professional and intelligent market reports to complement your business decisions.