A remittance is a transfer of money by a foreign

worker to an individual in their home country. Money sent home by migrants

competes with international aid as one of the largest financial inflows to

developing countries. Digital remittance is using digital channel to realize

the remittance process, which is referred to as the transfer of money by

foreign migrants to their native countries by using digital transfer networks

such as easy-to-use mobile applications, digital wallets, and others. Numerous

benefits of using digital remittance such as convenience, speed, lower cost,

elimination of the need for tedious form-filling processes, agents, and codes

and others, have shifted the focus of consumers toward digital transactions for

money remittance.

The high popularity of digitalization and mobile

technology has brought convenient and efficient experience, driving the

continuous growth of the global digital remittance industry. Over the past few

years, digital remittances have become the main method of cross-border

transfers.

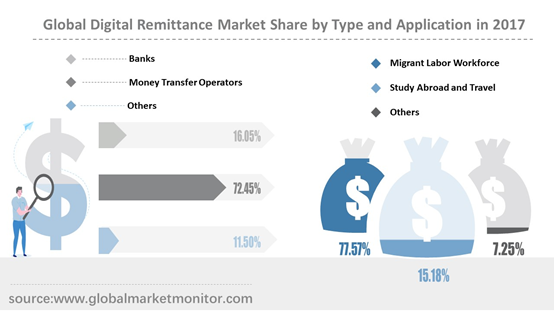

By remittance channel, Asia-Pacific digital

remittance market can be classified into banks, money transfer operators

(MTOs), and others. Although banks are widely distributed, money transfer operators

have the highest demand due to their convenience and low fees, and have been

the biggest contributor to market growth, accounting for the majority of the

market. In terms of volume, money transfer operators are expected to remain

dominant in the global digital remittance market. In addition, commercial banks

have the highest fees among remittance service providers, but the information

is the opaquest, while money transfer operators are the most transparent.

In general, it is mainly migrant labor workforce who use digital remittances to transfer money. In addition, a small number of people studying and traveling abroad also use digital remittances.

Prospect Analysis of Digital Remittance Industry in Various Regions

North America, Europe, Asia-Pacific, South America, Middle East and Africa are the key regions that are included in this report. In 2017, North America, Europe, Asia-Pacific, South America, Middle East and Africa accounted for 32.96%, 25.04%, 27.59%, 5.38% and 9.03% of the global digital remittance revenue market.

Get the Complete Sample, Please Click: https://www.globalmarketmonitor.com/reports/763137-digital-remittance-market-report.html

It can be seen that North America was the largest revenue market with a market share of 34.01% in 2013 and 32.70% in 2018 with a decrease of 1.31%. Asia-Pacific ranked the second market with the market share of 27.59% in 2017. Also, the Asia Pacific, Middle East, South America markets for Digital Remittance are expected to be the market with the most promising growth rate. Development of economy, increase downstream demand, technology innovation progress in emerging economies such as China, India, Philippines, Thailand, Brazil, Saudi Araba and Vietnam has led to an increase in demand.

Asia-Pacific is the dominant market in the global digital remittance market in terms of value. The Asia-Pacific digital remittance market was estimated to be valued at 843.62 M USD in 2018 and is expected to expand at a robust rate over 20% in terms of revenue over the forecast period due to the steadily increasing consumption in this region. Among these, China was the major revenue contributor to the market. The market players of China are focusing on the launch of electronic cross-boundary remittance services, so remittance business has grown substantially.

People of different countries are increasingly engaging with their overseas counterparts for business, leisure, education, medical, entertainment-related activities. Compounded by increase in cross-border transactions and move towards cashless, mobile banking, and mobile-based payment solutions dominate payment trends, which also drives the digital remittance market growth. Furthermore, increase of the remittance industry in the developing counties is expected to fuel the growth of the digital remittance market.

Digital remittance companies are mainly from US, UK; the industry concentrate rate is high. The top three companies are Western Union, MoneyGram, Xoom with the revenue market share of 26.63%, 15.49%, and 14.06% in 2017.

The Digital Remittance Industry Develops Steadily, with a Broad Market

In recent years, the digital remittance market has shown steady growth. The growth of the digital remittance market is driven by rise in digitization and automation, reduced remittance cost and transfer time, and growth in adoption of banking and financial services. Furthermore, regulatory initiatives that encourage all financial institutions to become more transparent and nurture richer ecosystems of data and partners supplement the market growth. Rise in internet usage offer growth opportunities for the market.

However, one of the major challenges for the digital remittance market is the changes in downstream consumer demand. lack of awareness and guidance is an important factor that restrains people from opting for digital remittance transfer mode. Other challenges like technology risks, government policy and keen international competition also seriously affects the development of the digital remittance industry.

According to our research, the global digital remittance

market has a total sales value of 553.58 M USD back in 2013, and increased to

1954.51 M USD in 2018. We made the prediction that the value of digital remittance

markets can be 6403.49 M USD by 2023. The CAGR of digital remittance is 27.72%

from 2017 to 2023.

Although the sales of digital remittance have

brought many opportunities (especially in the emerging countries), the research

group does not recommend new entrants to enter into the digital remittance

market if they are not equipped with industry chain advantages and accurate

positioning of the downstream segments. What is more, the company in this

industry should pay attention to R&D and innovation, and keep on developing

new product functions, improving customer experience in order to get the

competitive advantages and larger market share.

We provide more professional and intelligent market reports to complement your business decisions.