In

biochemistry, kinases are a class of enzymes that transfer phosphate groups

from high-energy donor molecules to specific target molecules. The largest

group of kinases are protein kinases. Kinase inhibitor is an enzyme inhibitor

that can block the action of kinase. Kinases add phosphate groups to specific

target molecules during phosphorylation, which affects their activity and

functional levels. Protein kinase inhibitors can be subdivided according to the

amino acids (such as serine, threonine or tyrosine) on the phosphoprotein to

inhibit the phosphorylation of amino acids. Phosphorylation is usually a

necessary step in the development of certain cancers and inflammatory diseases,

so inhibiting the enzymes that trigger phosphorylation can provide a way to

treat these diseases. In the past 30 years, kinase inhibitor drugs have made

great progress. So far, a total of 38 kinase inhibitor drugs have been approved

for marketing.

There are

four main types of kinase inhibitors: tyrosine kinase inhibitors (TKI),

multi-kinase inhibitors, threonine kinase inhibitors, and MTOR kinase

inhibitors. The most commonly used in the market is tyrosine kinase inhibitor

(TKI), with a market share of 63.58% in 2020. It is a drug that inhibits

tyrosine kinase. Tyrosine kinases are enzymes responsible for activating many

proteins through the signal transduction cascade. This process is the step of

TKI (anticancer drug) inhibition. The market share of threonine kinase

inhibitors in 2020 is 19.86, ranking second. Threonine kinase is an enzyme that

can catalyze the phosphorylation of threonine residues on a variety of

substrate proteins, which can regulate the cell cycle through protein

phosphorylation and dephosphorylation, causing tumor cell growth. Studies have

shown that blocking the expression of threonine protein kinase can destroy the

signal pathway of tumor cells, thereby achieving the purpose of anti-tumor.

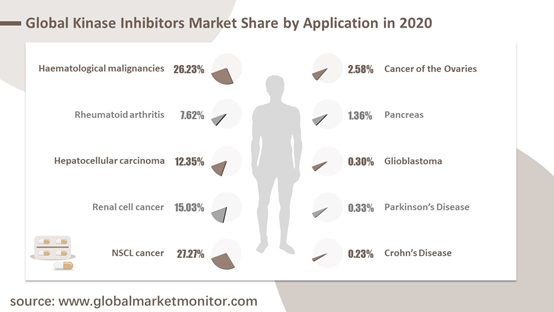

Kinase

inhibitors have a wide range of applications, generally in the development of

anti-cancer drugs, mainly for NSCL cancer and hematological malignancies, and

their market shares in 2020 will account for 27.27% and 26.23%, respectively.

Other application areas include rheumatoid arthritis, hepatocellular carcinoma,

renal cell cancer, cancer of the ovaries, pancreatitis, glioblastoma, Parkinson

disease, Crohn disease, etc. By 2026, the market share of the two fields of

hepatocellular carcinoma and renal cell carcinoma will significantly expand.

Analysis of Kinase Inhibitor Industry in Various Regions

Companies in the industry are mainly from Europe, with pretty high market concentration. The top three companies are Pfizer, Novartis and AstraZeneca, with revenue market shares of 24.75%, 19.51% and 10.14% in 2019.

North America is the largest revenue market, with a market share of 41.67% in 2015 and 38.76% in 2020, a drop of 2.91%. Europe ranked second with a market share of 32.17% in 2019. In addition, the economic development, increased downstream demand, and technological innovation and progress of China, India, Brazil and other emerging economies will promote the increase in the demand for kinase inhibitors. The Asia-Pacific, Middle East, and African markets are expected to become the fastest growing markets in the industry.

Get the Complete Sample, Please Click: https://www.globalmarketmonitor.com/reports/763155-kinase-inhibitors-market-report.html

The Surge in the Cancer Population is Still the Main Factor Driving the Development of the Kinase Inhibitor Industry

Cancer is the second leading cause of death in the world, with an estimated 9.6 million deaths from cancer in 2018. According to United Nations data, on a global scale, the population of 65 and over is growing faster than all other age groups. Aging is the most important risk factor for overall cancer and many individual cancer types. According to statistics from NCI surveillance, epidemiology, and final results program, the median age of cancer diagnosis is 66 years, and many common cancer types have similar patterns. Therefore, as populations around the world become increasingly aging, the demand for cancer treatments will increase, which will also lead to an increase in the demand for kinase inhibitors.

2017 and 2018 ushered in explosive growth in the approval of targeted small molecule kinase inhibitors. As of January 1, 2020, the FDA has approved a total of 52 small molecule kinase inhibitors (SMKI). In the past 20 years, protein kinase has become the most important disease intervention target, accounting for about a quarter of the R&D resources of pharmaceutical companies. Small molecule drugs targeting kinases are easy to use and relatively inexpensive, and will become an important part of drug development. With the increase in the number of kinase inhibitors approved, the huge market potential allows R&D companies to increase their R&D efforts and promote the development of the kinase inhibitor market.

According

to research, the total sales of the global kinase inhibitor market in 2015 was

US$20,081.05 million, and by 2020 it will increase to US$39981.72 million. Due to

the prevalence of cancer and the increase in the number of patients, the global

kinase inhibitor market is expected to experience moderate growth during the

forecast period. Therefore, we predict that by 2026, the market value of kinase

inhibitors can reach US$85,428.08 million, with a compound annual growth rate

of 13.49% from 2020 to 2026.

Although

kinase inhibitors have been widely used in cancer and other diseases, their

development still faces many challenges. Drug resistance is a major obstacle to

the development of these drugs. When a new generation of drugs plugs the

loopholes in the previous generation of gene mutations, new drug resistance

mutations will always appear. Another challenge is to improve selectivity. In

addition, the development cost of kinase inhibitors is high, the development

cycle is long, the time required for complicated approval and marketing, and

the possible risks are also costs that companies need to bear. Therefore, the

huge cost from drug development to successful commercialization is also one of

the limiting factors in the kinase inhibitor market.

We provide more professional and intelligent market reports to complement your business decisions.