There are many kinds of water treatment chemicals, and the scale inhibitor market accounts for the highest proportion Common water treatment chemicals include flocculants, coagulants, corrosion inhibitors, scale inhibitors and water treatment fungicides. Flocculant is one of the most widely used chemical agents in wastewater treatment. Flocculant process is an indispensable key link in wastewater treatment. According to its chemical composition, it can be divided into inorganic salt flocculant, organic polymer flocculant and microbial flocculant. In wastewater treatment, the addition of coagulants can eliminate or reduce the mutual repulsion between colloidal particles in water, so that the colloidal particles in water are easy to collide with each other, forming larger particles or flocs, and then separated from the water; A corrosion inhibitor is a compound that, when added to a liquid, reduces the rate of corrosion of a material (usually a metal or alloy) in contact with the liquid; Scale inhibitor is a kind of chemical that can disperse insoluble inorganic salts in water, prevent or interfere with the precipitation of insoluble inorganic salts on the metal surface, and maintain good heat transfer of metal equipment; Water treatment fungicides, also known as bactericides, sludge removal agents, or mud resistants, are a class of chemicals that inhibit the growth of bacteria, algae, and microorganisms in water to prevent the formation of microbial slime that is harmful to the system.

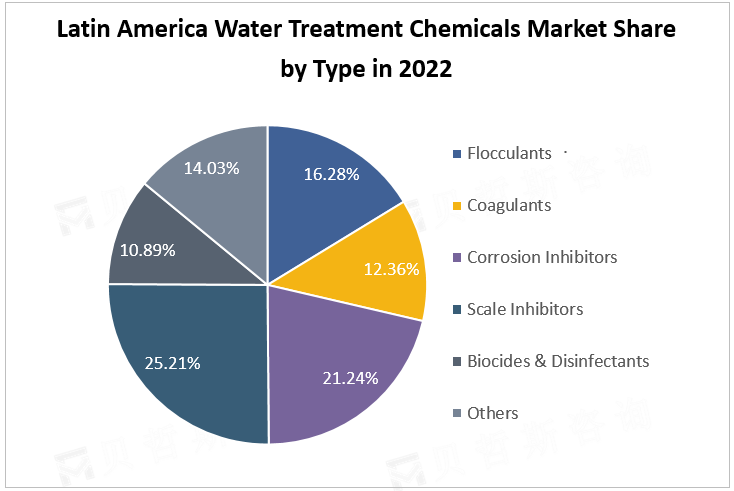

Data show that in the Latin American water treatment chemicals market in 2022, the scale inhibitor market accounted for the highest proportion, 25.21%; Followed by corrosion inhibitors, the market share was 21.24%; In addition, the market size of flocculants, coagulants and water treatment fungicides accounted for 16.28%, 12.36% and 10.89%, respectively.

Latin America Water Treatment Chemicals Market Share by Type in 2022

Source: www.globalmarketmonitor.com

Brazil is the largest market by revenue

The study shows that Brazil is the largest revenue market for the water treatment chemicals industry in Latin America, with a market size of $1.502 billion in 2022, an increase of 3.53% from 2021, and a market share of 43.83%. In 2022, Mexico won 25.27% of the market with a market size of $866 million, ranking second.

Market size, growth rate and proportion of water treatment chemicals in major Latin American countries in 2022

|

Countries |

Market Size(M USD) |

Growth Rate(%) |

Market Share(%) |

|

Mexico |

866 |

3.29 |

25.27 |

|

Brazil |

1502 |

3.53 |

43.83 |

|

Columbia |

292 |

2.97 |

8.52 |

|

Chile |

175 |

2.68 |

7.82 |

|

Argentia |

416 |

3.16 |

12.14 |

Source: www.globalmarketmonitor.com

Market development opportunity analysis

The products are developing in the direction of high efficiency, low toxicity, no pollution and environmental protection

Advanced water treatment chemicals show the development trend of high efficiency, low toxicity, no pollution, multi-function and compound environmental protection industry. The environmental friendliness of water treatment chemicals not only includes the environmental friendliness of water and wastewater treatment chemicals themselves, but also includes the environmental friendliness of raw materials for the production of water and wastewater treatment chemicals, conversion reagents, reaction methods, reaction conditions, and improved water treatment agent production processes.

Production and sales capacity in Latin America will be further improved

The Latin American region has an important position in the global market. It is expected that the market in Latin America will further expand and the production capacity will further increase. Because in economies such as Mexico and Brazil, the increase in economic development and agricultural development needs has led to the development and improvement of chemical industry, chemical equipment technology and has also promoted the development of water treatment chemical industry. The Latin American region\'s large population base, high demand for water resources and water resources, and growing concern about environmental issues will further drive the production and marketing of water treatment chemicals.

We provide more professional and intelligent market reports to complement your business decisions.