Global Strontium Carbonate Market Overview

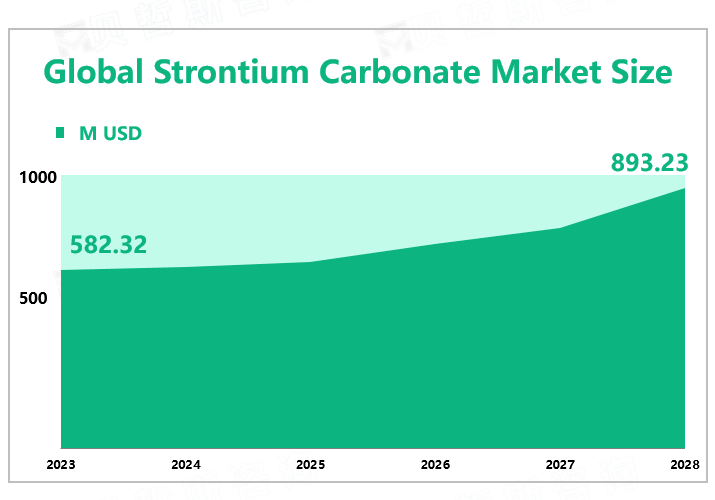

According to Global Market Monitor, the global strontium carbonate market value will reach $582.32 million in 2023 and is expected to grow to $893.23 million by 2028. Strontium ferrite magnets are used in magneto-optic mediums, tiny electric motors, recording mediums, microwave devices, and the electronics and communication industries.

The Strontium Carbonate Industry has a Wide Range of Applications.

Strontium carbonate has a wide range of uses in production, and strontium carbonate particles are used in the production of display glass and other glass.Strontium carbonate particles can also be used in metallurgy, such as the smelting of zinc. Strontium carbonate is a common alternative to barium carbonate, especially when the desired effect is a color-sensitive matte. In addition, it is also used in the preparation of iridescent glass, luminescent coatings, strontium oxide and strontium salts, refined sugars, and certain drugs. By application, the magnetic materials segment occupied the biggest share in 2022. North America dominated the strontium carbonate market in 2022, with a market share of 34.32%.

Development Status of the Strontium Carbonate Industry in China

At present, the main raw material for the production of strontium carbonate is celestite. China is one of the countries with rich azurite reserves, accounting for about a quarter of the world\'s total reserves, ranking second in the world. Strontium ore resources are mainly distributed in Qinghai, Hubei, Shaanxi, and other seven provinces and regions, among which Qinghai Province has the largest identified resource reserves, accounting for about 50% of the national reserves, but its grade is low and the transport facilities are backward, which is not conducive to transport. Data from the Ministry of Natural Resources in 2020 showed that China\'s strontium ore reserves were 15.8 million tons.

Import and Export Analysis of China Strontium Carbonate Industry

Most strontium ores are processed by industrial chemical production methods that are expensive and have no recycling value, thus also causing a large amount of wasted sulfur loss from the lapis lazuli ore resource, and manufacturers are in urgent need of more advanced production processes. In the production process, environmental protection will be a challenge for enterprises and society. Focused actions on environmental protection inspections, haze remediation, and enterprise rectification have led to the shutdown and production restriction of strontium carbonate production centers and many larger manufacturers, resulting in a decline in China\'s strontium carbonate exports and a continued growth in imports. According to China Customs, China\'s strontium carbonate exports have declined since 2015. Since 2020, China\'s strontium carbonate exports began to pick up, exports were 0.03 million tons and 0.046 million tons respectively in 2021 and 2022. In 2022, the international trade block was blocked and other impacts affected the cost. Imports fell to 14,400 tons.In October 2022, the Indian Finance Ministry eliminated the existing anti-dumping tariff on Chinese imports of Barium Carbonate, an inorganic chemical in the form of white powder or granules. The tax department\'s action came more than a month after the Directorate General of Trade Remedies (DGTR) advised the "rapid cessation" of anti-dumping duties on Chinese imports of barium carbonate.

|

|

Import(Tons) |

Export(Tons) |

|

2015 |

172 |

6399 |

|

2016 |

465 |

7858 |

|

2017 |

4754 |

6167 |

|

2018 |

15836 |

3164 |

|

2019 |

20993 |

2878 |

|

2020 |

21633.5 |

1936.7 |

|

2021 |

23339.1 |

3969.9 |

We provide more professional and intelligent market reports to complement your business decisions.