Cocoa butter equivalent is a natural cocoa butter substitute oil extracted by distillation from natural vegetable oil. The triglyceride content and fatty acid composition of cocoa butter equivalents are very similar to those of cocoa butter, and their physical and chemical properties are also similar. They are similar in taste, flavor, hardness, and other aspects to cocoa butter.

In the production of chocolate industry, the content of cocoa butter substituted by cocoa butter equivalent fluctuates between 5% and 20%. The products made from cocoa butter equivalents are very similar to cocoa butter in terms of viscosity, hardness, brittleness, expansion and contraction, and flowability, and can greatly reduce production costs. Meanwhile, compared to cocoa butter substitutes, cocoa butter equivalents are extracted from natural vegetable oils through fractionation without undergoing hydrogenation and do not produce a large amount of trans fatty acids.

There is a wide range of plant species used to produce cocoa butter equivalents, including shea butter, palm fruit, mango, etc. Therefore, according to the different sources, cocoa butter can be divided into several categories: shea butter cocoa butter equivalent, palm kernel oil cocoa butter equivalent, mango oil cocoa butter equivalent, and mango oil cocoa butter equivalent. Among them, palm kernel oil cocoa butter equivalent is the most mainstream product in the market, and its market sales volume is expected to reach 168125 tons in 2023, with an estimated market revenue of $533 million, accounting for 48.24% of the market.

From the perspective of downstream applications, the confectionery industry is the largest downstream application market for cocoa butter equivalents. According to our research data, the market sales volume of cocoa butter equivalents in the confectionery industry is estimated to be 182103 tons in 2023, with an estimated sales revenue of $589 million and an expected market share of 53.35%.

Global Cocoa Butter Equivalent Market Sales, Revenue, and Share Forecast by

Type and Application in 2023

|

|

Sales Volume (Tons)

|

Market Revenue (M USD)

|

Market Share

|

|

Cocoa butterequivalent

|

344344

|

1104

|

/

|

|

Segmented by Type

|

|

Shea butter cocoa butter equivalent

|

95692

|

305

|

27.65%

|

|

Palm kernel oil cocoa butter equivalent

|

168125

|

533

|

48.24%

|

|

Mangosteen oil cocoa butter equivalent

|

36389

|

119

|

10.75%

|

|

Mango oil cocoa butter equivalent

|

25453

|

86

|

7.75%

|

|

Others

|

18685

|

62

|

5.62%

|

|

Segmented by Application

|

|

Confectionery

|

182103

|

589

|

53.35%

|

|

Food & Beverage

|

123053

|

387

|

35.05%

|

|

Cosmetics

|

24559

|

81

|

7.34%

|

|

Others

|

14629

|

47

|

4.26%

|

Source: www.globalmarketmonitor.com

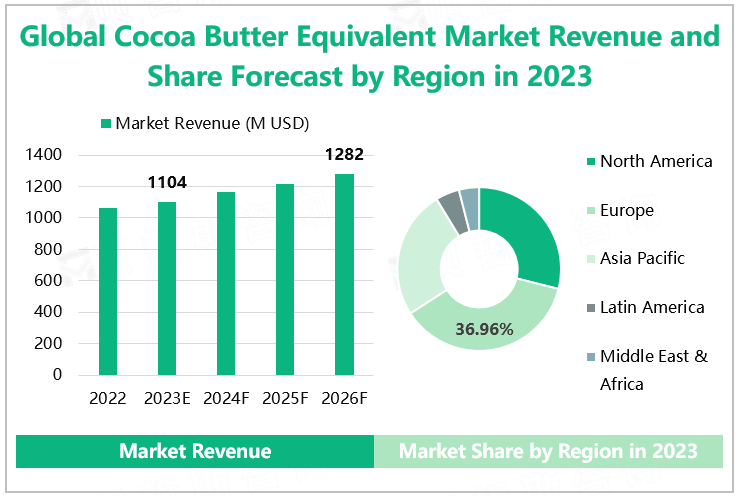

Research shows that Europe is the largest revenue market for the global cocoa butter equivalent industry. In 2023, the total revenue of the global cocoa butter market is expected to reach $1104 million, among which the estimated revenue in the European market is $408 million, and the market share is expected to reach 36.96%; North America and the Asia-Pacific region are expected to rank second and third with market shares of 28.89% and 25.36% respectively.

The Asia-Pacific region has a large population base, rapid economic development, and a continuous increase in consumer disposable income. In addition, the rapid development of the food and beverage industry in the region provides rich opportunities for the development of the cocoa butter market equivalent. Although there are traditional alternatives to candies, with changes in consumer consumption and dietary habits in the Asia-Pacific region, the consumption of cocoa butter equivalent will continue to increase. Therefore, it is expected that the Asia-Pacific region will become the fastest-growing region in the cocoa butter equivalent market in the coming years.

Global Cocoa Butter Equivalent Market Revenue and Share Forecast by Region in 2023

Source: www.globalmarketmonitor.com

In the future, as people\'s demands for food taste and health continue to increase, the demand for cocoa butter equivalent will continue to increase. On the other hand, due to the increasing attention of consumers to healthy foods, the cocoa butter equivalent market will develop towards a healthier and more natural direction. At the same time, due to globalization and the development of logistics technology, the globalization trend of the cocoa butter equivalent market will also become increasingly evident.