Global Casino and Gaming Market Overview

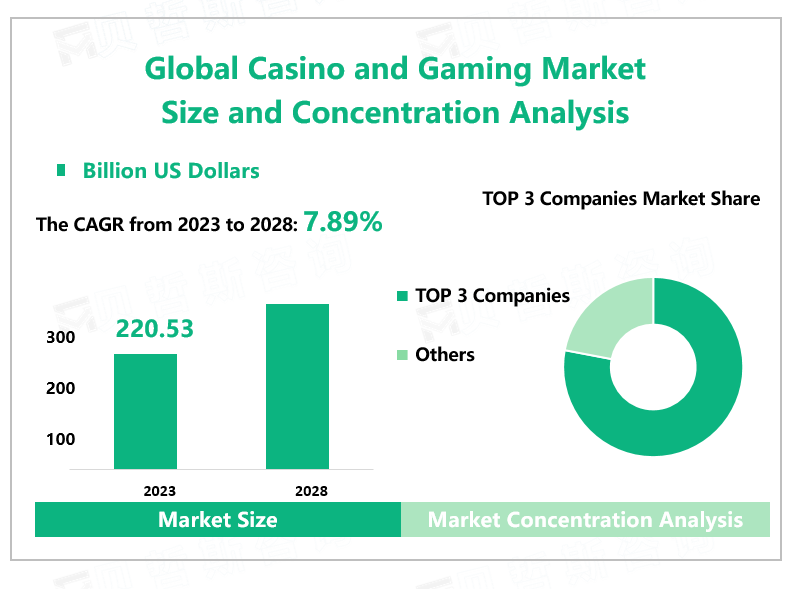

According to Global Market Monitor, the global casino and gaming market size will reach $220.53 billion in 2023 with a CAGR of 7.89% from 2023 to 2028.

The casino and gaming industry consists of establishments primarily engaged in the operation of gambling that offer table wagering games and other gambling activities. Common gambling games include slot machines, blackjack, roulette, baccarat, sic bo, fantan, etc. The casino also offers a variety of leisure facilities, including dining, entertainment, swimming pools, and meeting rooms.

Consumers’ Increasing Spending Power Drives the Market

The growth in the spending power of consumers is significantly driving the growth of the casino games market, increasing the affordability and purchasing power of customers in developed countries for high-end services such as casino games. Hectic lifestyles lead to an increased demand for leisure time among modern consumers, and gambling tourism is gaining popularity. In recent years, tour companies have offered casino tours as part of their packages, and the vibrant new casinos, buzzing vibes, and luxurious resorts have drawn many tourists to the casinos as vacation destinations. In general, the growth of consumer spending power and the pursuit of leisure and entertainment have driven the development of the casino and gaming industry.

RegionalCasino and Gaming Market Status

The Asia-Pacific sports gaming market is expanding rapidly due to the increase in betting on cricket, basketball, hockey, and football matches and the licensing of the activity by countries such as India and Australia. The growth of the industry can be attributed to the increase in Internet penetration and the expansion of the middle-class income group. China and Australia are the two major players in Asia-Pacific, and by 2023 Macau China casino and gaming industry has achieved a rapid recovery, and the total gaming revenue is expected to become normal in 2024, returning to 78% of 2019. In 2022, the casino and gaming market share in the Asia-Pacific region was 47.44%.

Factors such as liberalized gambling laws in various European countries, strict security standards for offline betting, and popular sporting events such as football and horse racing have also stimulated the demand for betting in the European region, leading to a significant advantage over other countries.

|

S |

The casino has highly skilled staff with successful training and mature learning programs. |

|

Strong Customer Network |

|

|

Good Returns on Capital Expenditure |

|

|

Strong Free Cash Flow |

|

|

W |

The industry's leading companies are too competitive. |

|

This is a buyer's market. Customers have high bargaining power and high arbitrariness in choosing companies. |

|

|

The company was unable to cope with the challenges faced by new entrants in the market segment and lost a small market share in the niche market. |

|

|

O |

The entire era has the supremacy of entertainment, and the entertainment industry has gradually become a very important industry in various countries. |

|

After COVID-19, many countries will introduce a large number of new tax policies. |

|

|

New technologies like big data provide casinos with the opportunity to implement differentiated pricing strategies in new markets. |

|

|

T |

Liability laws vary from country to country, and casinos may face various liability claims in light of policy changes in these markets. |

|

Most offline casinos are located in developed countries, and high wages in these areas may bring serious pressure on the profitability of the casino. |

|

|

The United States occupies a large proportion of the casino industry, and the US economy is increasingly biased towards isolationism. |

We provide more professional and intelligent market reports to complement your business decisions.