Global PPR Pipe Market Overview

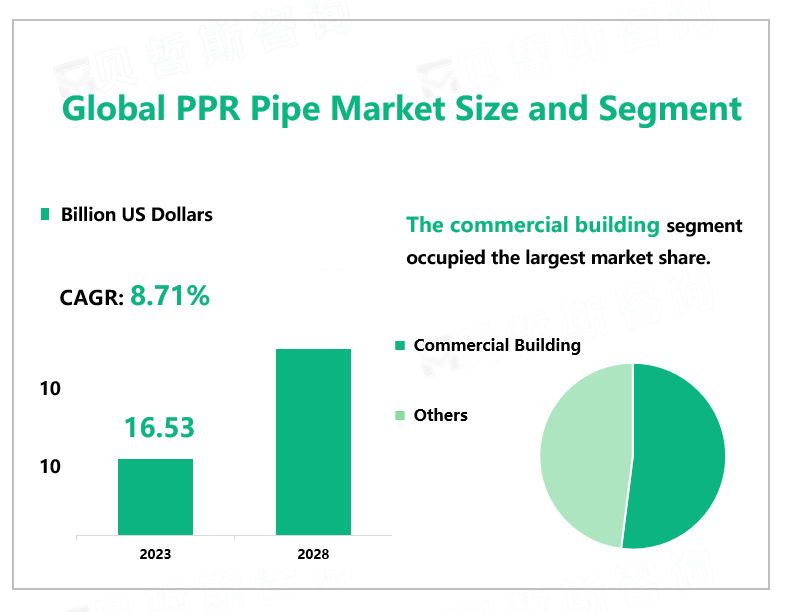

According to Global Market Monitor, the global PPR pipe market size will reach $16.53 billion in 2023 with a CAGR of 8.71% from 2023 to 2028.The PPR pipe is designed for the transportation of portable hot and cold water distribution systems. Compared with traditional pipes such as cast iron pipes, galvanized steel pipes, and cement pipes, PPR pipes have the advantages of energy-saving, environmental protection, lightweight and high strength, corrosion resistance, smooth and non-scaling inner walls, easy construction and maintenance, and long service life.

Global PPR Pipe Market Status

As a new type of water pipe material, the PPR pipe has unique advantages. It can be used as both a cold water pipe and a hot water pipe. Because of its non-toxicity, lightweight, pressure resistance, and corrosion resistance, it is becoming a popular material that is known for never scaling, never rusting, never leaking, and green high-grade water supply material. PPR pipe is widely used in construction and municipal fields including construction water supply and drainage, urban and rural water supply and drainage, urban gas, power and fiber optic cable jackets, industrial fluid transportation, and agricultural irrigation. In recent years, with the increasing market demand in the global construction industry, municipal engineering, water conservancy engineering, agriculture, and industry, the PPR pipe industry has shown a rapid development trend. By applications, the commercial building segment occupied the largest market share with 46.75% in 2022.

Regional PPR Pipe Market Status

China occupies the main market of PPR pipes with a market share of 36.71% in 2022. According to the data of the Ministry of Housing and Urban-Rural Development, the fixed asset investment of China's water supply and drainage industry in 2022 was 71.33 billion yuan and 190.51 billion yuan respectively, and the length of the water supply and drainage pipeline in 2022 was 1103 thousand kilometers and 914 thousand kilometers. The length of China's water supply and drainage pipeline continues to increase, and the market demand for plastic pipes continues to improve. In recent years, developed countries in Europe and the United States, Japan, and South Korea, Australia have rarely used PPR pipes in water supply and heating. The PEX, aluminum-plastic composite, stainless steel, copper, and other materials are more commonly used, and the growth rate of the global PPR pipe market has declined.

|

By type |

Composite PPR Pipe |

|

Hot and Cold Water PPR Pipe |

|

|

Other |

|

|

Hot and cold water PPR pipes contributed the largest market share in 2022. |

|

|

By application |

Commercial Building |

|

Residential Building |

|

|

Other |

|

|

The commercial building occupied the largest market share with 46.75% in 2022. |

|

|

USA |

China dominated the market with a market share of 36.71% in 2022. |

|

China |

|

|

Eastern Europe |

|

|

Latin America |

|

|

Middle East |

|

|

Africa |

|

|

Russia |

PPR Pipe Market Trends

PPR pipe has the attributes of environmental protection, energy saving, and low carbon, in line with national policy guidance, and replacing steel with plastic is still a long-term development trend. The intensive introduction of policies related to residential industrialization, prefabricated buildings, prefabricated decoration, and full decoration will promote the adjustment of product structure and bring great changes to the industrial structure of the plastic pipe industry. There will be more opportunities and challenges for the PPR pipe industry.

We provide more professional and intelligent market reports to complement your business decisions.