Global Brominated Flame Retardants Market Overview

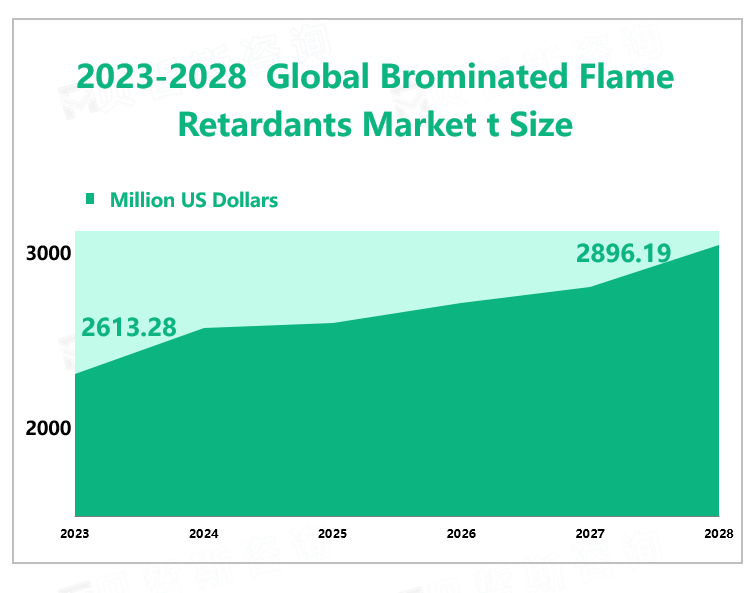

According to Global Market Monitor, the brominated flame retardants market size will reach $2613.28 million in 2023 and is expected to grow to $2896.19 million by 2028. Brominated flame retardants (BFRs) are organ bromine compounds that have an inhibitory effect on combustion chemistry and tend to reduce the flammability of products. Brominated flame retardants are one of the widely used flame retardants.

The Increasing Demand Promotes Market Development.

Brominated flame retardants are widely used in electronic castings, printed circuit boards (PCBs), circuit treatments, and other electrical components to help overcome overheating and avoid fire hazards. Therefore, high demand in the electrical and electronics industries is considered to be the main factor driving the growth of the brominated flame retardant market. In addition, flame-retardant chemicals are added to plastics and polymeric resins to retard the burning of fire. As a result, there is a growing demand for plastics in some end-user industries, such as electronics housing, building materials, and textiles. The increase in infrastructure activities, the improvement of building structure safety standards, and the growth of consumer electrical and electronic product manufacturing will promote the development of the brominated flame retardant industry in the next few years.

Environmental and Health Concerns Limit Market Growth.

However, some brominated flame retardants have been identified as persistent, bio-accumulative, and toxic to humans and the environment, and are suspected of causing neurobehavioral and endocrine disturbances. Considering the current status of global waste treatment, BFRs may be released into the environment. With concerns about environmental and health issues, it is expected that the development of the industry will be limited.

China Dominates the Industry.

Brominated flame retardants originated in developed countries in Europe and the United States. The world's largest brominated flame retardant suppliers are currently concentrated in Europe, North America, and Asia, and these are also the main consumption markets. The brominated flame retardants industry in China started relatively late, but now it has become the largest consumption market. The overall consumption volume of China has exceeded North America and Europe, with a market share of 30.26% in 2022.

The world’s largest electronic production base is in China. While meeting the domestic demand for electronic products, China also exports electronic products to other countries. In 2022, the construction industry accounted for about 6.9% of the GDP of China and according to China's Ministry of Housing and Urban-Rural Development, the construction industry is scheduled to remain at 6% of the GDP during the 14th Five-Year Plan period (2021-2025) until 2025. The rapid development of the electronics industry and construction industry has provided a huge market for brominated flame retardants.

|

North America |

Major markets Reduced consumption |

|

Europe |

Major markets Reduced consumption |

|

China |

Largest market increased consumption |

|

Japan |

Smaller markets consumption drop |

|

Middle East & Africa |

Potential market |

|

India |

Potential market with faster growth |

|

South America |

Potential market with faster growth |

We provide more professional and intelligent market reports to complement your business decisions.