Global Hydrogen Sensor Market Overview

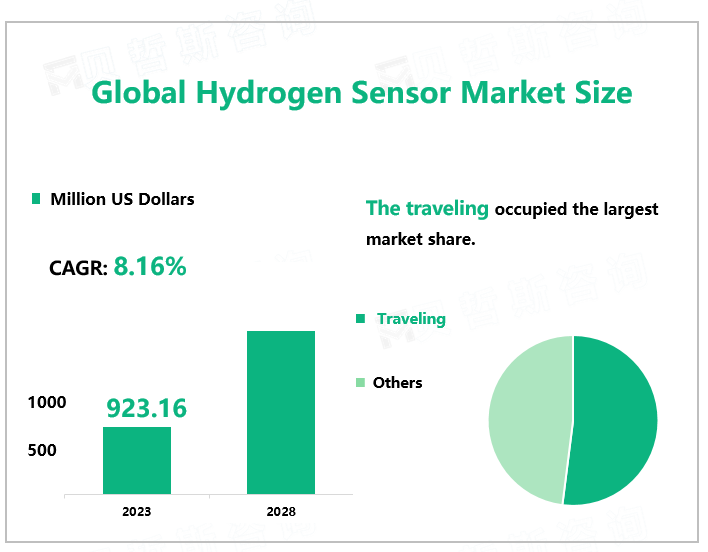

According to Global Market Monitor, the global hydrogen sensors market size is expected to grow to $129.38 million by 2028 with a CAGR of 5.3% from 2023 to 2028.

The most commonly available hydrogen sensors include electrochemical, MEMS, and chemochromic sensors. Each type has its advantages and disadvantages in terms of performance. Hydrogen sensors are widely deployed in industries that either produce or consume hydrogen gas such as automotive, oil and gas, aerospace and defense, healthcare, mining, and power plants among others.

The Wide Application of Fuel Cell Drives the Demand for Hydrogen Sensors.

As fuel cell adoption grows, the demand for hydrogen detection equipment is expected to rise significantly. This trend is particularly evident in the transportation industry, where hydrogen fuel cell vehicles are gaining popularity as a clean alternative to traditional gasoline-powered vehicles. FCVs offer several advantages compared to traditional gasoline-powered vehicles, including lower greenhouse gas emissions, higher fuel efficiency, and quieter operation. In this context, hydrogen detection is crucial to ensuring hydrogen fuel cell vehicles' reliable and safe operation. Thus, the expanding use of fuel cells is driving the market for hydrogen detection equipment, as it plays an indispensable role in guaranteeing the safe and efficient operation of fuel cells and the broader hydrogen-based energy economy.

Market Competition Status

Asia Pacific accounted for the largest market share in 2022. The presence of a high number of refineries in major countries such as China and India has driven the utilization of hydrogen generation. Furthermore, governments in some Asia Pacific countries such as Japan and Australia are evaluating greener and cleaner technologies for hydrogen generation.

The major hydrogen detection equipment providers include City Technology Ltd, Figaro Engineering, Nissha FIS, Hanwei, and so on. These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position. The hydrogen generation industry is competitive with key participants involved in R&D and constant innovation done by vendors has become one of the most important factors for companies to perform in this industry. City Technology Ltd is one of the major players operating in the hydrogen sensor market, holding a share of 16.04% in 2022.

|

Company Name |

City Technology Ltd |

|

Website |

www.citytech.com |

|

Established Time |

1977 |

|

Plants Distribution |

Europe, America |

|

Sales Region |

Worldwide |

|

Business Overview |

City Technology is a leading global provider of life-saving gas sensing solutions. From the pioneering origins of university laboratories to the forefront of safety-critical environments, we are committed to improving the quality of gas detection through innovative technologies. City Technology has more than 300 products that can detect 28 different gases. |

We provide more professional and intelligent market reports to complement your business decisions.