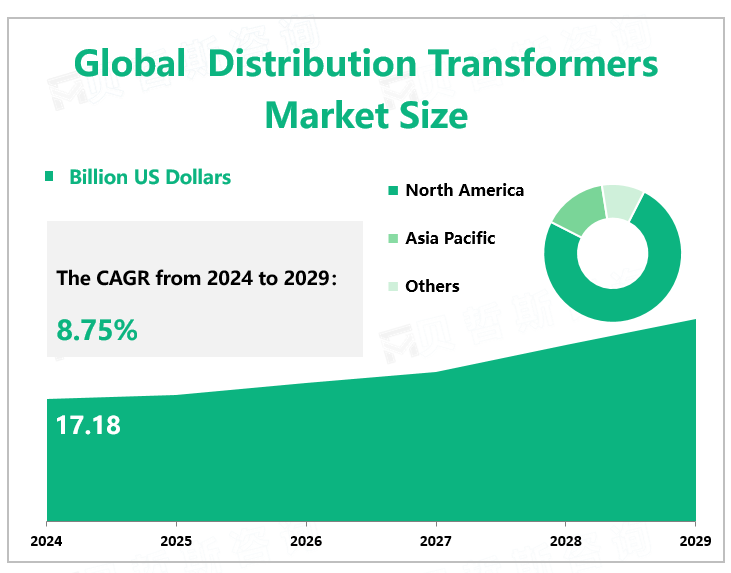

Global Distribution Transformers Market Overview

According to Global Market Monitor, the global distribution transformers market size will be $17.18 billion in 2024 with a CAGR of 8.75% from 2024 to 2029.

The main function of the distribution transformer is to convert high voltage to normal voltage, which is composed of various types of transformers, such as single-phase and three-phase transformers and can be installed underground, on the pad and the pole.

Market News

April 2024: The U.S. DOE completed energy efficiency standards for distribution transformers, supporting grid resiliency, creating jobs, and saving USD 824 million annually.

April 2024: Hitachi Energy upgraded its Varennes transformer factory and other Montreal support, investing over USD 100 million with Quebec's help to meet North America's sustainable energy demands.

April 2024: Hitachi Industrial Equipment Systems Co., Ltd. and Mitsubishi Electric Corporation announced a merger of their distribution transformer businesses by transferring Mitsubishi Electric's Nagoya Works to Hitachi.

March 2024: Siemens Energy allocated USD 49.8 million to build its inaugural U.S. power transformer factory in Charlotte, North Carolina, enhancing operations and generating 600 jobs.

The power transformer industry is an investment-driven industry that has a close correlation with power investment and new power generation installed capacity. Many developing countries are still in the middle of industrialization, and industrialization and urbanization will continue to grow in the next 10 years. With the rapid development of the social economy, the electricity demand will continue to be released, leading to further growth in the power transformer industry.

China Distribution Transformers Market Status

As electricity generation grows, so does the number of power stations, which will require new distribution transformers to supply power to consumers. To decarbonize the power sector, China is investing heavily in renewable energy, creating plenty of opportunities for distribution transformers to expand the market in the country. Due to the rapidly accelerating urbanization and industrialization process, China is expanding its existing transmission and distribution system by laying new transmission lines and installing new substations to fill the gap between energy supply and demand.

Electricity production was stable, and breakthroughs were made in renewable energy generation. In 2023, China's planned industrial power generation was 8.9 trillion KWH, an increase of 5.2 percent over the previous year. Among them, thermal power generation was 6.2 trillion KWH, an increase of 6.1 percent over the previous year; Clean energy sources such as hydropower, nuclear power, wind power, and solar power generated 270 million KWH of electricity, an increase of 3.1 percent over the previous year. The installed capacity of renewable energy such as hydropower, wind power, and solar power reached a new high, exceeding 1.4 billion kilowatts, accounting for more than half of the total.

|

Drivers |

Developing countries expect a steady increase in demand |

|

Dry-type transformers are relatively stable in scale and profitable |

|

|

Challenges |

Overseas market is difficult to occupy |

|

Intense market competition |

|

|

Trade protection |

We provide more professional and intelligent market reports to complement your business decisions.