Global Aluminum Cans Market Overview

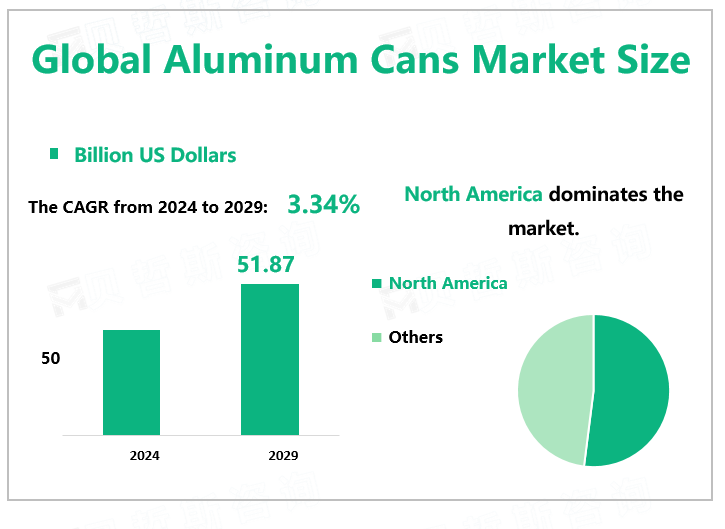

According to Global Market Monitor, the global aluminum cans market size is expected to grow to $51.87 billion by 2029 with a CAGR of 3.34% from 2024 to 2029.

An aluminum can is a container for packaging made primarily of aluminum. It is commonly used for foods and beverages such as milk and soup but also for products such as oil, chemicals, and other liquids.

Environmental Protection

Aluminum cans have long-term food quality maintenance advantages. Aluminum cans provide nearly 100% protection against light, oxygen, moisture, and other contaminants. Aluminum cans do not rust are resistant to corrosion, and have the longest shelf life considering any packaging. The growing use of aluminum cans in the food and beverage industry can be attributed to their protective properties, sustainability benefits, and consumer convenience.

Remanufacturing aluminum in aluminum can consume 71% less energy than aluminum, reducing air pollution by 95%. Many countries, especially developed countries, attach great importance to the recycling and utilization of used aluminum cans after use, and the recycling rate is also increasing. The recycling of recycled aluminum cans has greatly reduced production costs and energy consumption and is, therefore, one of the reasons for the market growth.

Market Challenges

The aluminum can manufacturer is lined with a thin layer of plastic inside the can to prevent aluminum from penetrating the food. Unfortunately, one side effect of including plastic liners in aluminum cans is that consumers may be exposed to BPA toxic levels. Besides, after a person opens an aluminum can, the interior poses an injury because of its sharp edges--a risk not found in other types of food packaging material. The "British Medical Journal" notes that injuries sustained from opening aluminum cans may cause the need for stitches, sterile dressing, and antibiotics. This risk affects children, as well as adults.

Market News

In February 2024, UAE Global Aluminium (EGA) in partnership with beverage can manufacturers Crown and CANPACK, launched the "Every Can Count" innovative campaign aimed at promoting the recycling of used aluminum beverage cans. The initiative, launched during COP28, is a key step in promoting a circular economy in the United Arab Emirates.

In February 2024, Freudenberg High-Performance Materials (Freudenberg) launched a new line of fully synthetic wet nonwovens manufactured in Germany.

Based on the application, beverages account for a significant share of the aluminum can market. The growing consumer preference for canned beverages is driving the demand for aluminum cans for packaging beverages such as carbonated soft drinks, coffee, and juices. The recyclability provided by aluminum cans as well as the ease of use are some of the main factors contributing to their demand. In addition, leading beverage manufacturers utilize designer labels to reach more consumers and increase product coverage.

|

By Type |

One-Piece Cans |

|

Two-piece Cans |

|

|

The two-piece cans segment contributes the largest market share. |

|

|

By Application |

Chemicals |

|

Beverage |

|

|

Food |

|

|

Pharmaceuticals |

|

|

The beverage segment occupies the biggest share. |

For more industry information, please refer to our latest released "2023 Global Aluminum Cans Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".

We provide more professional and intelligent market reports to complement your business decisions.